Understanding NJ Manufacturers Insurance Home: A Comprehensive Guide

With the Garden State's unique regulatory environment and diverse manufacturing landscape, securing appropriate coverage is crucial for protecting both your residential property and business assets. This comprehensive guide will explore the intricate world of manufacturers insurance, specifically tailored for New Jersey homeowners who operate manufacturing businesses from their residences. We'll delve into the various coverage options, regulatory requirements, and practical considerations that can help safeguard your business while maintaining compliance with state regulations. The manufacturing sector in New Jersey has evolved significantly, with many small-scale operations now thriving in home-based settings. From artisanal food production to specialized component manufacturing, these businesses face unique insurance challenges that traditional homeowner policies simply can't address. The intersection of residential and commercial risks creates a complex landscape that demands specialized insurance solutions. As manufacturing technologies advance and home-based operations become increasingly sophisticated, understanding the specific insurance requirements becomes paramount for business owners who want to protect their investments while ensuring regulatory compliance. To address these challenges effectively, it's essential to understand how NJ manufacturers insurance home policies differ from standard homeowner or commercial insurance products. These specialized policies must account for both residential living spaces and manufacturing operations, including equipment coverage, product liability, and workplace safety considerations. This guide will walk you through the essential aspects of manufacturers insurance, helping you make informed decisions about protecting your home-based manufacturing business while maintaining peace of mind regarding your personal property.

Table of Contents

- What Are the Essential Coverage Options for NJ Manufacturers Insurance Home?

- How Does Regulatory Compliance Impact Your Insurance Needs?

- Why Is Risk Assessment Crucial for Your Manufacturing Operation?

- Understanding the Cost Factors of NJ Manufacturers Insurance Home

- Customizing Your Policy to Fit Your Business Needs

- What Are the Common Exclusions in Manufacturers Insurance?

- How Can You Optimize Your Insurance Coverage?

- The Claims Process for NJ Manufacturers Insurance Home

What Are the Essential Coverage Options for NJ Manufacturers Insurance Home?

When evaluating insurance options for your home-based manufacturing business, several critical coverage components must be considered.

Property Protection: Beyond Basic Homeowner Coverage

Unlike standard homeowner policies, NJ manufacturers insurance home solutions must account for specialized manufacturing equipment, inventory storage, and potential structural modifications to your residence. This includes coverage for:

Read also:How To Secure Iot Devices With Ssh Server Remote Access And Firewall Protection

- Manufacturing equipment and machinery

- Raw materials and finished product inventory

- Structural alterations for business purposes

- Business interruption protection

These elements require careful valuation and assessment to ensure adequate coverage limits.

Liability Coverage: Addressing Dual Risks

The liability aspect of NJ manufacturers insurance home policies must address both residential and commercial exposures. This comprehensive coverage typically includes:

- Product liability protection

- Third-party bodily injury coverage

- Professional liability insurance

- Workers' compensation (if applicable)

Understanding these liability components is crucial, as manufacturing operations often involve higher risk factors than traditional home-based businesses.

Additional Coverage Considerations

Beyond basic property and liability protection, several specialized coverage options should be evaluated:

- Cyber liability protection for digital operations

- Environmental liability coverage

- Transportation insurance for product delivery

- Equipment breakdown protection

These additional coverages help create a comprehensive safety net for your manufacturing business while maintaining residential protection.

How Does Regulatory Compliance Impact Your Insurance Needs?

Navigating the regulatory landscape is a critical aspect of managing a home-based manufacturing business in New Jersey.

Read also:How To Set Up Raspberry Pi Remote Access For Free A Complete Guide

State-Specific Requirements for Manufacturers

The New Jersey Department of Environmental Protection (NJDEP) mandates specific compliance measures that directly affect insurance requirements. These include:

- Air pollution control regulations

- Hazardous waste management protocols

- Water usage and discharge limitations

Failure to meet these requirements can result in significant fines and potential insurance coverage gaps.

Zoning and Land Use Considerations

Local municipal regulations often dictate how manufacturing operations can be conducted in residential areas. These zoning requirements impact insurance coverage in several ways:

- Operational hour restrictions

- Noise and emission limitations

- Parking and traffic considerations

- Employee presence regulations

Understanding these local ordinances is crucial for securing appropriate NJ manufacturers insurance home coverage that aligns with legal requirements.

Industry-Specific Compliance Factors

Different manufacturing sectors face unique regulatory challenges that affect insurance needs:

- Food manufacturers must comply with FDA and state health department regulations

- Chemical producers face strict environmental and safety standards

- Electronics manufacturers must adhere to waste disposal protocols

These industry-specific requirements necessitate tailored insurance solutions that address both regulatory compliance and operational risks.

Why Is Risk Assessment Crucial for Your Manufacturing Operation?

Conducting thorough risk assessments forms the foundation of effective NJ manufacturers insurance home coverage.

Identifying Potential Hazards

A comprehensive risk assessment should evaluate multiple factors:

- Equipment safety and maintenance protocols

- Fire and explosion risks

- Chemical storage and handling procedures

- Electrical system capacity and safety

These assessments help insurance providers accurately evaluate risk exposure and determine appropriate coverage levels.

Implementing Risk Mitigation Strategies

Proactive risk management can significantly impact insurance premiums and coverage options:

- Installing fire suppression systems

- Implementing safety training programs

- Maintaining proper ventilation systems

- Developing emergency response protocols

These measures demonstrate responsible business practices to insurance providers while enhancing overall safety.

Regular Risk Review and Updates

As manufacturing operations evolve, regular risk assessments become essential:

- Quarterly safety audits

- Annual equipment inspections

- Biannual emergency drill exercises

- Continuous employee training programs

Maintaining up-to-date risk management practices ensures insurance coverage remains relevant and adequate.

Understanding the Cost Factors of NJ Manufacturers Insurance Home

Several key elements influence the cost of NJ manufacturers insurance home policies.

Premium Determinants

Insurance providers consider multiple factors when calculating premiums:

- Business size and revenue

- Type of manufacturing operation

- Equipment value and complexity

- Historical claims data

These factors help insurers assess risk levels and determine appropriate pricing structures.

Cost Optimization Strategies

While maintaining adequate coverage, businesses can implement cost-saving measures:

- Bundling multiple coverage types

- Maintaining excellent safety records

- Implementing loss prevention programs

- Negotiating multi-year policies

These strategies can help reduce premium costs while maintaining comprehensive protection.

Hidden Costs to Consider

Beyond basic premiums, businesses should account for additional expenses:

- Deductible amounts

- Policy endorsements

- Administrative fees

- Annual inflation adjustments

Understanding these potential costs helps in budgeting and financial planning.

Customizing Your Policy to Fit Your Business Needs

Tailoring your NJ manufacturers insurance home policy ensures optimal protection.

Industry-Specific Customizations

Different manufacturing sectors require specialized coverage:

- Food producers need product recall insurance

- Chemical manufacturers require environmental liability coverage

- Electronics manufacturers need technology protection

These customizations address unique risks associated with specific manufacturing types.

Scalable Coverage Options

As businesses grow, policies should adapt accordingly:

- Increased equipment coverage

- Expanded liability limits

- Additional employee coverage

- Enhanced business interruption protection

Flexible policy structures allow for seamless scaling without coverage gaps.

Specialized Endorsements

Additional policy enhancements can provide extra protection:

- Cybersecurity coverage

- Supply chain disruption protection

- International shipping insurance

- Product warranty coverage

These endorsements address modern manufacturing challenges and risks.

What Are the Common Exclusions in Manufacturers Insurance?

Understanding policy exclusions is crucial for comprehensive coverage.

Standard Exclusion Categories

Most NJ manufacturers insurance home policies exclude:

- Wear and tear of equipment

- Intentional damage or fraud

- Acts of war or terrorism

- Natural disasters (unless specifically covered)

These exclusions help maintain reasonable premium costs while managing risk exposure.

Manufacturing-Specific Exclusions

Industry-related exclusions often include:

- Product recall costs

- Environmental cleanup expenses

- Patent infringement claims

- Trade secret violations

Understanding these limitations helps businesses secure appropriate additional coverage.

Addressing Exclusion Gaps

Strategies for managing exclusions include:

- Purchasing additional endorsements

- Maintaining separate specialized policies

- Implementing risk mitigation measures

- Regular policy reviews and updates

Proactive management helps minimize coverage gaps and potential financial exposure.

How Can You Optimize Your Insurance Coverage?

Maximizing the value of your NJ manufacturers insurance home policy requires strategic planning.

Annual Policy Reviews

Regular evaluations ensure coverage remains relevant:

- Assessing business growth and changes

- Reviewing new equipment purchases

- Evaluating emerging risks

- Adjusting coverage limits accordingly

These reviews help maintain optimal protection levels while managing costs effectively.

Building Strong Insurance Relationships

Developing partnerships with insurance providers offers multiple benefits:

- Access to specialized expertise

- Customized policy solutions

- Priority claims handling

- Competitive pricing structures

Strong relationships help ensure better service and more responsive coverage.

Technology Integration for Better Management

Modern tools can enhance insurance management:

- Digital policy management platforms

- Real-time risk monitoring systems

- Automated renewal reminders

- Claims tracking applications

These technological solutions improve efficiency and ensure timely coverage adjustments.

The Claims Process for NJ Manufacturers Insurance Home

Understanding the claims process ensures smooth operations during challenging times.

Initial Reporting Procedures

Prompt and accurate reporting is crucial:

- Immediate incident documentation

- Photographic evidence collection

- Witness statements gathering

- Notifying the insurance provider within specified timeframes

These steps help establish a strong foundation for successful claims resolution.

Documentation Requirements

Comprehensive documentation supports claims processing:

- Detailed inventory lists

- Equipment maintenance records

- Financial impact assessments

- Repair estimates and quotes

Maintaining organized records expedites the claims process and ensures fair settlements.

Claims Resolution and Follow-Up

Effective claims management involves:

- Regular communication with adjusters

- Monitoring claim progress

- Reviewing settlement offers carefully

- Appealing decisions when necessary

Proactive management helps achieve satisfactory outcomes and maintains business continuity.

Frequently Asked Questions

What types of manufacturing operations qualify for NJ manufacturers insurance home policies?

Was Greg Gutfeld's Baby Adopted? Unveiling The Truth Behind The Media Buzz

Discovering Elijah Hewson's Height: A Comprehensive Guide

Alexis Bledel Kids: A Deep Dive Into The Actress's Family Life And Parenting Journey

NJ Manufacturers Insurance Comprehensive Coverage for Your Insurance

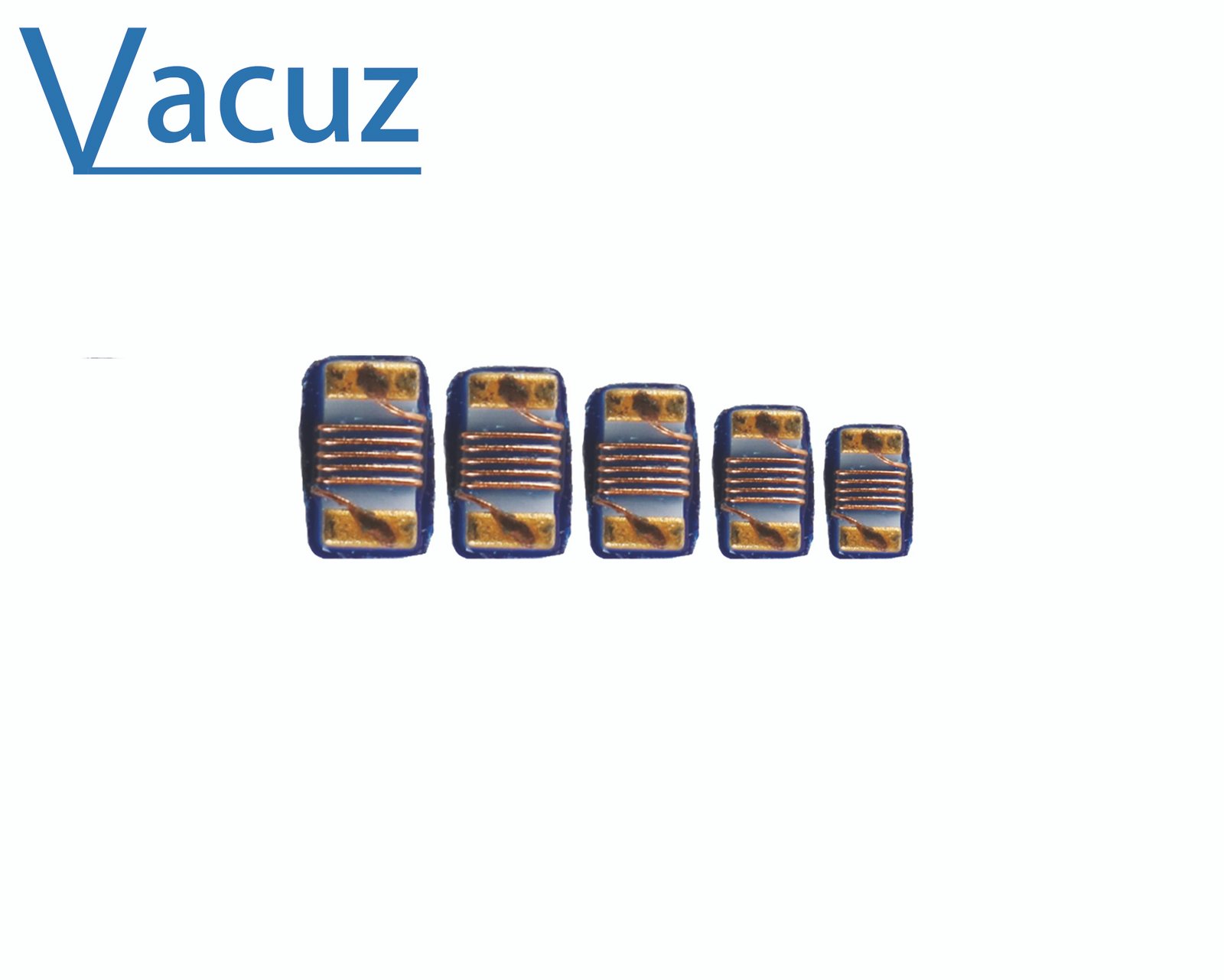

Automatic winding machine manufacturers of SMD SMT high frequency