Understanding USPS EPayroll: A Comprehensive Guide To Simplified Payroll Management

Whether you're a small business owner or part of a large corporation, understanding the nuances of ePayroll can significantly enhance your payroll processes. This system, designed by the United States Postal Service (USPS), integrates advanced payroll management tools that cater to both employers and employees. With its user-friendly interface and robust features, ePayroll has become a go-to solution for organizations aiming to simplify their payroll operations while ensuring compliance with federal regulations. The USPS ePayroll system stands out due to its seamless integration of payroll processing, tax filing, and employee management. By leveraging this platform, businesses can automate routine payroll tasks, reduce errors, and ensure timely payments to employees. The system also provides real-time access to payroll data, enabling employers to make informed decisions. Furthermore, its compatibility with various payroll software solutions makes it adaptable to different organizational needs. As payroll management continues to evolve, the USPS ePayroll system remains a reliable tool for businesses looking to stay ahead of the curve. As we delve deeper into this guide, we will explore the key features, benefits, and challenges of using the USPS ePayroll system. We’ll also provide actionable insights into how businesses can implement and optimize this platform to maximize efficiency. Whether you're new to ePayroll or seeking ways to enhance your current payroll processes, this article will equip you with the knowledge and tools needed to make the most of this innovative system. Let’s begin by understanding what exactly USPS ePayroll is and how it works.

Table of Contents

- What is USPS ePayroll and How Does It Work?

- Why Should You Choose USPS ePayroll Over Other Systems?

- How to Implement USPS ePayroll in Your Organization?

- What Are the Key Features of USPS ePayroll?

- What Are the Benefits of Using USPS ePayroll?

- What Are the Common Challenges of USPS ePayroll and How to Overcome Them?

- Tips for Optimizing Your USPS ePayroll System

- What Does the Future Hold for USPS ePayroll?

What is USPS ePayroll and How Does It Work?

At its core, USPS ePayroll is a digital payroll management system designed to simplify the complexities of payroll processing. The system automates tasks such as calculating employee wages, deducting taxes, and generating pay stubs. By integrating with existing payroll software and financial systems, it ensures that all payroll-related activities are streamlined and error-free. This not only saves time but also reduces the administrative burden on HR departments.

The functionality of USPS ePayroll is built around its ability to handle payroll data securely and efficiently. Employers can input employee information, such as hours worked and tax withholdings, into the system, which then processes the data to generate accurate payroll reports. Additionally, the system automatically updates tax rates and compliance requirements, ensuring that businesses remain compliant with federal and state regulations. This feature is particularly beneficial for organizations operating in multiple jurisdictions, as it eliminates the need for manual updates.

Read also:Top Free Remote Ssh Iot Platform For Android Unlocking Secure Connectivity

One of the standout aspects of USPS ePayroll is its accessibility. Both employers and employees can access the system online, allowing for real-time updates and transparency. Employees can view their pay stubs, tax forms, and other payroll-related documents through a secure portal, while employers can monitor payroll expenses and track payment histories. This dual accessibility fosters trust and accountability within organizations, making USPS ePayroll a reliable choice for modern payroll management.

Why Should You Choose USPS ePayroll Over Other Systems?

With numerous payroll systems available in the market, you might wonder what sets USPS ePayroll apart. The answer lies in its unique combination of reliability, affordability, and ease of use. Unlike other systems that may require extensive training or technical expertise, USPS ePayroll is designed to be intuitive and user-friendly. Its straightforward interface ensures that even those with minimal payroll experience can navigate the system with ease.

What Makes USPS ePayroll Cost-Effective?

One of the primary reasons businesses opt for USPS ePayroll is its cost-effectiveness. The system eliminates the need for expensive payroll software or third-party services, reducing operational costs significantly. Additionally, its automated features minimize the risk of errors, which can lead to costly penalties or audits. By streamlining payroll processes, businesses can allocate resources more efficiently and focus on growth-oriented activities.

How Does USPS ePayroll Ensure Data Security?

Data security is a top priority for any payroll system, and USPS ePayroll excels in this area. The platform employs advanced encryption protocols to protect sensitive employee and payroll data. Furthermore, it adheres to strict compliance standards, ensuring that all information is handled in accordance with federal and state regulations. This level of security provides peace of mind to employers and employees alike, knowing that their data is safe from unauthorized access.

How to Implement USPS ePayroll in Your Organization?

Implementing USPS ePayroll in your organization requires careful planning and execution. The first step is to assess your current payroll processes and identify areas where the system can add value. This involves reviewing existing workflows, identifying pain points, and determining how ePayroll can address these challenges. Once you have a clear understanding of your needs, you can proceed with the implementation process.

The next step is to set up the system by entering employee data, tax information, and payroll schedules. This can be done manually or by importing data from existing payroll software. It’s important to ensure that all information is accurate and up-to-date to avoid discrepancies in payroll processing. Additionally, training your HR and payroll teams on how to use the system effectively is crucial for a smooth transition.

Read also:Unlocking The Power Of Ssh Remote Iot Free A Comprehensive Guide

Finally, test the system thoroughly before going live. Conduct a trial run to ensure that all features are functioning as expected and that payroll calculations are accurate. Once you’re confident in the system’s performance, you can officially roll it out across your organization. Regular monitoring and feedback from users will help you fine-tune the system and address any issues that may arise.

What Are the Key Features of USPS ePayroll?

USPS ePayroll boasts a range of features that make it a versatile and powerful payroll management tool. One of its standout features is its ability to automate payroll calculations. By inputting employee hours and tax information, the system can generate accurate payroll reports in minutes. This eliminates the need for manual calculations, reducing the risk of errors and saving valuable time.

Does USPS ePayroll Offer Tax Filing Services?

Yes, USPS ePayroll includes built-in tax filing services, making it easier for businesses to comply with federal and state tax regulations. The system automatically calculates tax withholdings and submits the necessary forms to the appropriate authorities. This feature not only ensures compliance but also saves businesses the hassle of dealing with complex tax filing procedures.

Can Employees Access Their Payroll Information Online?

Absolutely! USPS ePayroll provides employees with secure online access to their payroll information. Through a dedicated portal, employees can view their pay stubs, tax forms, and payment histories. This transparency fosters trust and accountability, as employees can verify their earnings and deductions at any time. Additionally, the portal allows employees to update their personal information, such as bank account details or tax withholdings, ensuring that their records are always up-to-date.

What Are the Benefits of Using USPS ePayroll?

The benefits of using USPS ePayroll extend far beyond simplifying payroll processing. One of the most significant advantages is the time savings it offers. By automating routine tasks, businesses can free up valuable resources to focus on strategic initiatives. This not only improves efficiency but also enhances overall productivity.

Another key benefit is the reduction in payroll errors. Manual payroll processing is prone to mistakes, which can lead to costly penalties or employee dissatisfaction. USPS ePayroll eliminates this risk by ensuring that all calculations are accurate and compliant with regulations. Additionally, the system’s real-time reporting capabilities provide businesses with valuable insights into payroll expenses, helping them make informed financial decisions.

Finally, USPS ePayroll fosters transparency and trust within organizations. By providing employees with access to their payroll information, businesses can build stronger relationships with their workforce. This transparency also reduces the likelihood of disputes or misunderstandings, as employees can verify their earnings and deductions at any time.

What Are the Common Challenges of USPS ePayroll and How to Overcome Them?

While USPS ePayroll offers numerous advantages, it’s not without its challenges. One common issue is the initial setup process, which can be time-consuming and complex. Businesses may face difficulties in migrating data from existing payroll systems or configuring the platform to meet their specific needs. To overcome this, it’s essential to allocate sufficient time and resources to the setup process and seek assistance from USPS support teams if needed.

Another challenge is ensuring that all employees are comfortable using the system. While USPS ePayroll is designed to be user-friendly, some employees may require additional training to navigate the platform effectively. Offering comprehensive training sessions and providing ongoing support can help address this issue and ensure a smooth transition.

Finally, businesses may encounter technical issues, such as system downtime or data synchronization errors. To mitigate these risks, it’s important to regularly update the system and maintain open communication with USPS support teams. Additionally, having a backup plan in place, such as manual payroll processing, can help businesses stay operational during unexpected disruptions.

Tips for Optimizing Your USPS ePayroll System

To get the most out of USPS ePayroll, businesses should adopt best practices that enhance efficiency and accuracy. One effective strategy is to integrate the system with other HR and financial tools. This allows for seamless data sharing and reduces the need for manual input, minimizing the risk of errors.

Another tip is to regularly review and update payroll data. Ensuring that employee information, tax rates, and payroll schedules are accurate and up-to-date is crucial for maintaining compliance and avoiding discrepancies. Additionally, leveraging the system’s reporting features can provide valuable insights into payroll trends and expenses, helping businesses make data-driven decisions.

Finally, encourage feedback from employees and HR teams to identify areas for improvement. By addressing user concerns and implementing suggested enhancements, businesses can optimize the system to meet their evolving needs. This collaborative approach ensures that USPS ePayroll remains a valuable asset for years to come.

What Does the Future Hold for USPS ePayroll?

As technology continues to evolve, so too will USPS ePayroll. Future advancements are likely to focus on enhancing automation, improving user experience, and expanding integration capabilities. For instance, the system may incorporate artificial intelligence to predict payroll trends or offer personalized recommendations for optimizing payroll processes.

Additionally, USPS ePayroll is expected to expand its compliance features to accommodate emerging regulations. This will ensure that businesses remain compliant with changing laws and avoid potential penalties. By staying ahead of regulatory trends, the system will continue to be a reliable solution for payroll management.

Finally, the platform may introduce mobile accessibility, allowing users to manage payroll tasks on the go. This would provide greater flexibility and convenience, particularly for businesses with remote or distributed workforces. As these advancements unfold, USPS ePayroll will undoubtedly remain a leader in the payroll management space.

Frequently Asked Questions

What is the cost of using USPS ePayroll?

The cost of USPS ePayroll varies depending on the size of your organization and the specific features you require. However, it is generally considered a cost-effective solution compared to other payroll systems.

Is USPS ePayroll suitable for small businesses?

Absolutely! USPS ePayroll is designed to cater to businesses of all sizes, including small enterprises. Its user-friendly interface and affordable pricing make it an ideal choice for small businesses looking to streamline their payroll processes.

Can USPS ePayroll handle multi-state payroll processing?

Yes, USPS ePayroll is equipped to handle payroll processing for businesses operating in multiple states. The system automatically updates tax rates and compliance requirements, ensuring that businesses remain compliant with state-specific regulations.

Learn more about USPS services and solutions here.

Conclusion

USPS ePayroll is a powerful tool that simplifies payroll management for businesses of all sizes. By automating routine tasks, ensuring compliance, and fostering transparency, the system offers numerous benefits that enhance efficiency and productivity. While challenges may arise during implementation, adopting best practices and leveraging available resources can help businesses overcome these hurdles and maximize the system’s potential. As technology continues to advance, USPS ePayroll is poised to remain a leader

Chris Canty ESPN Salary: A Deep Dive Into His Career And Earnings

Audrey Hepburn's Net Worth At Death: A Legacy Beyond Wealth

Myles Garrett Serra Tumay: Unveiling The Man Behind The Name

USPS Philadephia Mark Cement

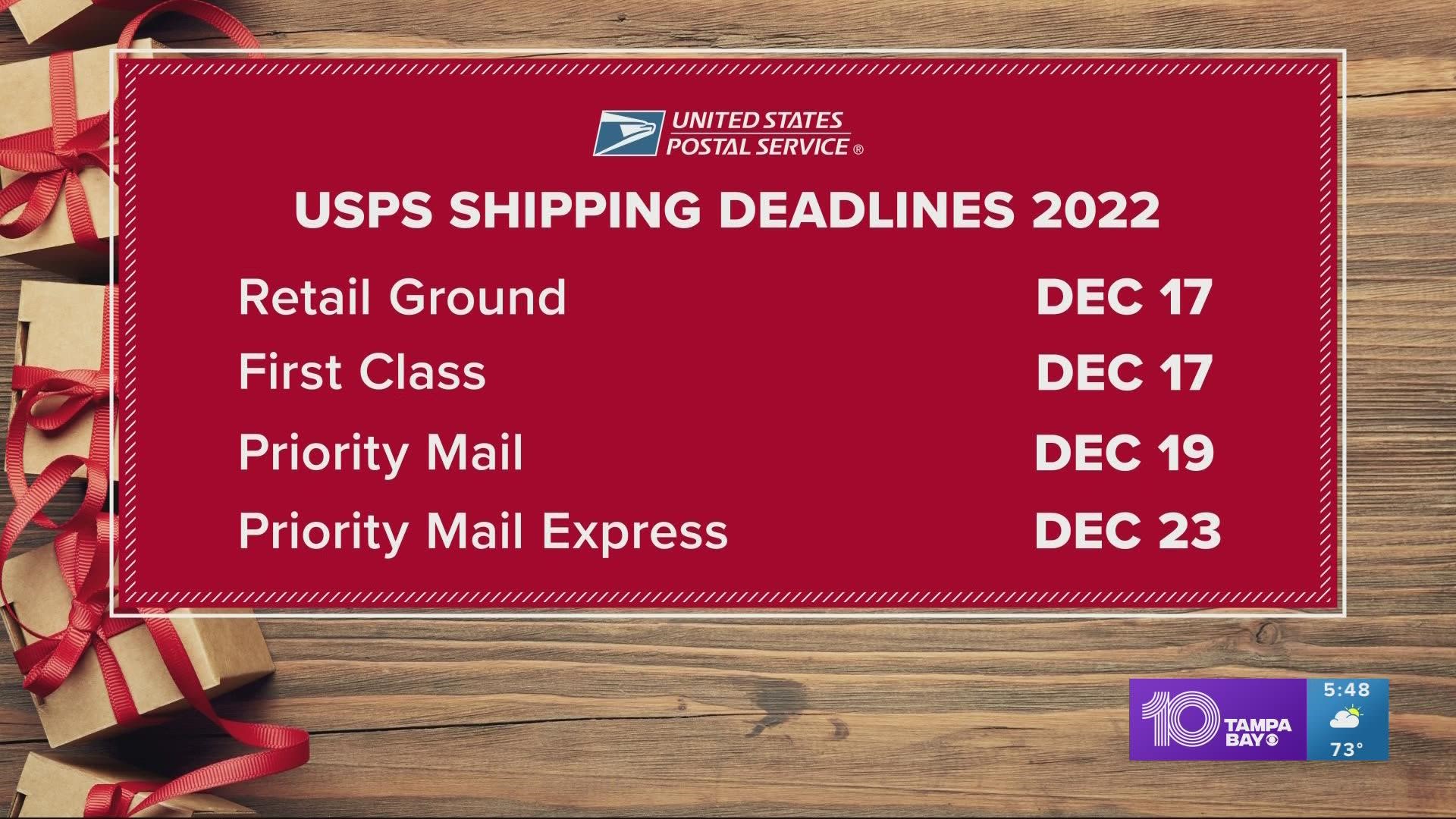

Usps Shipping Dates Christmas 2024 Usps Alfie Austine