Understanding Kabbage Funding Requirements: A Complete Guide

With its innovative approach to small business lending, Kabbage has become a go-to solution for entrepreneurs seeking quick and hassle-free access to funds. Whether you're looking to expand your operations, manage cash flow, or invest in new equipment, understanding Kabbage's funding requirements is the first step toward achieving your business goals. In this guide, we’ll explore everything you need to know about qualifying for Kabbage funding and how it can benefit your business. Kabbage Funding Requirements are designed to be straightforward and accessible, making it easier for small businesses to secure the financial support they need. Unlike traditional loans, Kabbage focuses on evaluating the health of your business rather than solely relying on credit scores. This approach allows more businesses to qualify, even if they have less-than-perfect credit. By leveraging real-time data from your business accounts, Kabbage provides a quick and transparent application process that ensures you get the funding you need when you need it. Whether you're a startup or an established business, understanding these requirements can help you make informed decisions about your financial future. In this comprehensive guide, we’ll delve into the specifics of Kabbage Funding Requirements, including eligibility criteria, the application process, and tips for maximizing your chances of approval. We’ll also address common questions and concerns about Kabbage funding, providing clarity on how it works and what you can expect. By the end of this article, you’ll have a clear understanding of how Kabbage can support your business and the steps you need to take to secure funding. Let’s dive in and explore how Kabbage can help you achieve your business aspirations.

Table of Contents

- What Are Kabbage Funding Requirements?

- How Do Kabbage Funding Requirements Differ from Traditional Loans?

- What Are the Eligibility Criteria for Kabbage Funding?

- How Can You Prepare Your Business for Kabbage Funding?

- What Documents Do You Need to Meet Kabbage Funding Requirements?

- How Does Kabbage Evaluate Your Business for Funding?

- What Are the Benefits of Meeting Kabbage Funding Requirements?

- How Can Kabbage Funding Help Your Business Grow?

What Are Kabbage Funding Requirements?

Kabbage Funding Requirements are designed to evaluate the financial health and operational stability of a business. Unlike traditional lenders, Kabbage takes a holistic approach, focusing on real-time business performance rather than just credit history. To qualify for Kabbage funding, businesses typically need to meet specific criteria that demonstrate their ability to repay the loan. These requirements include having a minimum annual revenue, a certain length of time in operation, and a solid business banking history.

One of the key aspects of Kabbage Funding Requirements is the emphasis on transparency. The platform uses advanced algorithms to analyze data from various sources, such as bank accounts, accounting software, and payment processors. This data-driven approach allows Kabbage to provide quick decisions, often within minutes, while ensuring that businesses with strong financials are prioritized. For example, businesses with consistent revenue streams and healthy cash flow are more likely to meet the requirements and secure funding.

Read also:Mastering Remoteiot Behind Firewalls A Comprehensive Guide

In addition to financial metrics, Kabbage also considers other factors, such as the industry in which the business operates and the overall economic climate. This ensures that the funding is tailored to the specific needs and risks associated with each business. By understanding these requirements, entrepreneurs can better position themselves for success and take advantage of the opportunities that Kabbage funding offers.

How Do Kabbage Funding Requirements Differ from Traditional Loans?

When comparing Kabbage Funding Requirements to traditional loans, the differences are significant. Traditional loans often require extensive paperwork, collateral, and a high credit score, making them inaccessible to many small businesses. In contrast, Kabbage simplifies the process by focusing on real-time business data rather than relying heavily on credit scores. This approach allows businesses with lower credit scores but strong financial performance to qualify for funding.

What Are the Advantages of Kabbage Over Traditional Loans?

- Speed: Kabbage provides quick approval decisions, often within minutes, compared to weeks or months for traditional loans.

- Flexibility: Kabbage offers flexible repayment terms and funding amounts, tailored to the specific needs of your business.

- Accessibility: Businesses with less-than-perfect credit can still qualify, as long as they meet other Kabbage Funding Requirements.

How Does Kabbage Use Technology to Simplify Funding?

Kabbage leverages cutting-edge technology to streamline the funding process. By integrating with platforms like QuickBooks, PayPal, and Shopify, Kabbage can access real-time data about your business's financial health. This eliminates the need for manual documentation and ensures that the evaluation process is both accurate and efficient. Additionally, Kabbage's automated algorithms provide a transparent view of how funding decisions are made, giving business owners peace of mind.

What Are the Eligibility Criteria for Kabbage Funding?

To qualify for Kabbage funding, businesses must meet specific eligibility criteria. These include having a minimum annual revenue of $50,000, being in operation for at least one year, and having a business bank account in good standing. Additionally, businesses must operate in an eligible industry, as Kabbage does not fund certain high-risk sectors like gambling or adult entertainment.

Another important aspect of Kabbage Funding Requirements is the need for a solid online presence. Businesses that use e-commerce platforms or digital payment processors are often viewed more favorably, as these platforms provide verifiable data about sales and revenue. This makes it easier for Kabbage to assess the financial health of the business and determine its eligibility for funding.

How Can You Prepare Your Business for Kabbage Funding?

Preparing your business to meet Kabbage Funding Requirements involves several key steps. First, ensure that your financial records are up-to-date and accurate. This includes maintaining clean books, reconciling bank statements, and ensuring that all tax filings are current. Additionally, focus on improving your business's cash flow by managing expenses and increasing revenue.

Read also:How To Play Fortnite Unblocked Ultimate Guide For Gamers

What Steps Can You Take to Improve Your Chances of Approval?

- Optimize Cash Flow: Ensure consistent revenue streams and minimize unnecessary expenses.

- Strengthen Online Presence: Use e-commerce platforms and digital payment processors to showcase your business's financial activity.

- Build a Solid Credit History: While not the primary focus, having a decent credit score can still strengthen your application.

What Documents Do You Need to Meet Kabbage Funding Requirements?

When applying for Kabbage funding, you’ll need to provide specific documents to verify your business's financial health. These typically include bank statements, tax returns, and proof of business ownership. Additionally, Kabbage may request access to your accounting software or payment processor accounts to analyze real-time data.

Why Are These Documents Important for Kabbage Funding?

These documents are crucial because they provide a clear picture of your business's financial performance. Bank statements, for example, show your cash flow and spending patterns, while tax returns verify your annual revenue. By providing accurate and complete documentation, you increase your chances of meeting Kabbage Funding Requirements and securing the funding you need.

How Does Kabbage Evaluate Your Business for Funding?

Kabbage evaluates businesses based on a combination of financial data, operational history, and industry performance. The platform uses advanced algorithms to analyze this information, providing a comprehensive view of your business's financial health. This evaluation process ensures that funding decisions are fair, accurate, and tailored to the specific needs of each business.

What Are the Benefits of Meeting Kabbage Funding Requirements?

Meeting Kabbage Funding Requirements offers numerous benefits for small businesses. These include access to flexible funding options, quick approval decisions, and transparent terms. Additionally, Kabbage provides ongoing support and resources to help businesses grow and succeed.

How Can Kabbage Funding Help Your Business Grow?

Kabbage funding can be a game-changer for small businesses looking to expand or manage cash flow. By providing access to capital when you need it most, Kabbage empowers entrepreneurs to invest in growth opportunities, hire new employees, and purchase essential equipment. This financial support can help your business thrive in competitive markets and achieve long-term success.

Frequently Asked Questions

What Are the Main Kabbage Funding Requirements?

To qualify for Kabbage funding, businesses must have a minimum annual revenue of $50,000, be in operation for at least one year, and operate in an eligible industry. Additionally, a business bank account in good standing is required.

How Quickly Can I Receive Funding from Kabbage?

Kabbage provides quick approval decisions, often within minutes. Once approved, funds are typically deposited into your account within 1-2 business days.

Can I Use Kabbage Funding for Any Business Purpose?

Yes, Kabbage funding can be used for a variety of business purposes, including managing cash flow, purchasing inventory, or investing in marketing campaigns.

Conclusion

Kabbage Funding Requirements offer a flexible and accessible solution for small businesses in need of capital. By understanding these requirements and preparing your business accordingly, you can secure the funding you need to grow and succeed. With its innovative approach and commitment to transparency, Kabbage is a trusted partner for entrepreneurs across various industries.

For more information about Kabbage and its funding options, visit their official website.

Understanding Monos De Luto: A Comprehensive Guide To Funeral Attire

Ekaterina Shelehova Age: Unveiling The Life And Achievements Of A Rising Star

Adrian Martinez Contract: A Comprehensive Guide To His Career And Future

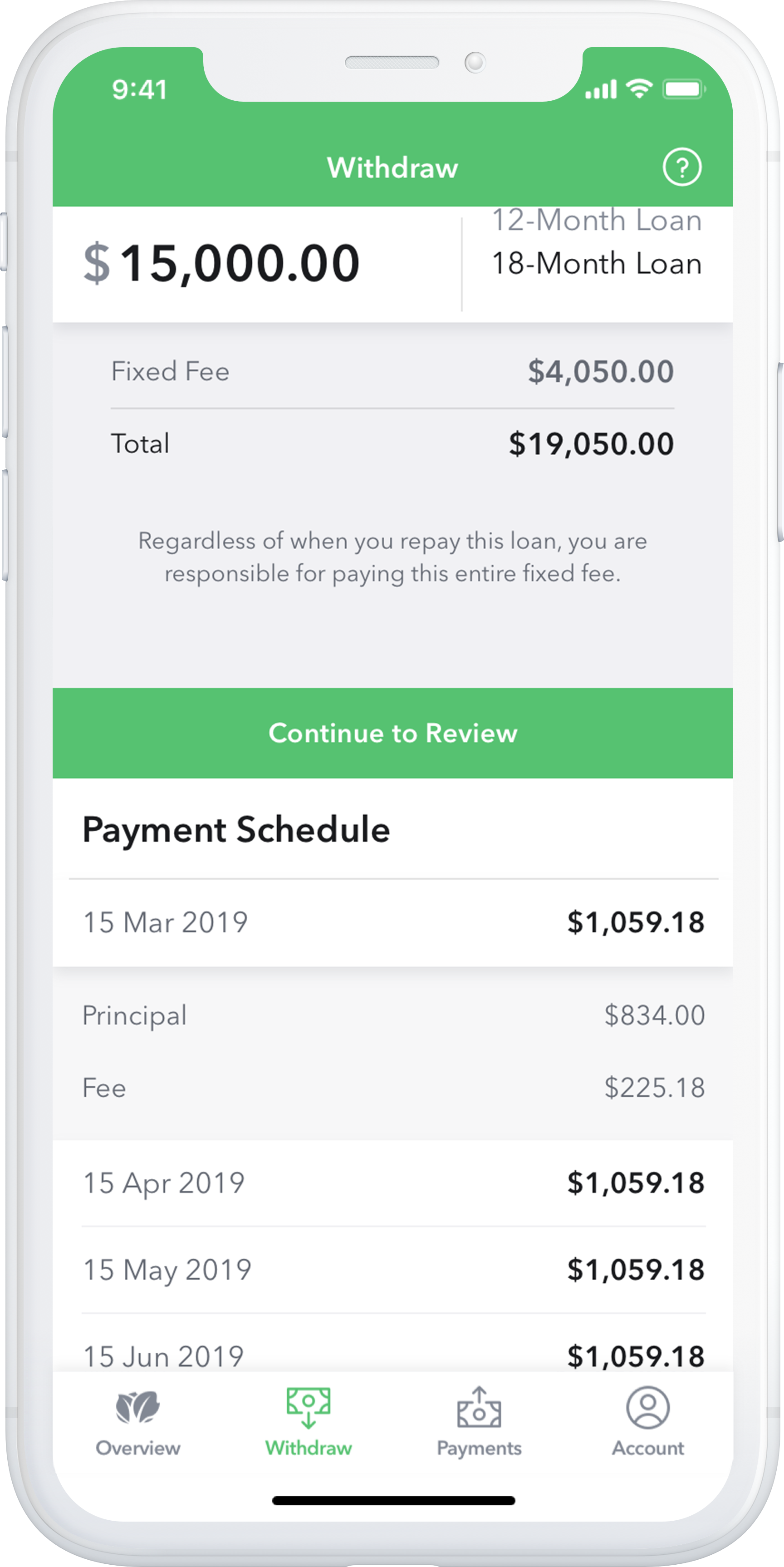

Screenshots Kabbage Newsroom

![Kabbage Funding Amex +3 Small Business Alternatives [2023]](https://alexmedawar.com/wp-content/uploads/2022/11/kabbage-funding-american-express-business-insights.jpeg)

Kabbage Funding Amex +3 Small Business Alternatives [2023]