Chase Mortgage: A Comprehensive Guide To Home Financing

Buying a home is one of the most significant financial decisions you’ll ever make, and securing the right mortgage can make all the difference. Chase Mortgage offers a range of home financing options tailored to meet the needs of first-time buyers, refinancers, and seasoned homeowners alike. With competitive rates, flexible terms, and a streamlined application process, Chase has positioned itself as a trusted name in the mortgage industry. Whether you're looking to purchase your dream home or refinance your existing loan, Chase Mortgage provides the tools and resources to guide you through every step of the process.

For many, the idea of navigating the mortgage landscape can feel overwhelming. From understanding interest rates to evaluating loan types, there’s a lot to consider. Chase Mortgage simplifies this journey by offering personalized support and digital tools that empower borrowers to make informed decisions. Their commitment to transparency ensures that you’re never left in the dark about fees, terms, or your financial obligations. With a strong reputation built on decades of experience, Chase Mortgage continues to be a go-to choice for individuals and families seeking reliable home financing solutions.

In this article, we’ll explore everything you need to know about Chase Mortgage, from eligibility requirements to the application process and beyond. By the end, you’ll have a clear understanding of how Chase Mortgage works and whether it’s the right fit for your financial goals. Whether you're a first-time buyer or a seasoned homeowner, this guide will equip you with the knowledge you need to make confident decisions about your home financing journey.

Read also:How To Master Remote Iot Monitoring With Ssh And Raspberry Pi A Complete Guide

Table of Contents

- What is Chase Mortgage and How Does It Work?

- What Are the Different Types of Loans Offered by Chase Mortgage?

- What Are the Eligibility Requirements for Chase Mortgage?

- How Does the Chase Mortgage Application Process Work?

- How Competitive Are Chase Mortgage Rates and Fees?

- Why Are Chase Mortgage’s Digital Tools Worth Exploring?

- How Reliable Is Chase Mortgage Customer Support?

- Frequently Asked Questions About Chase Mortgage

What is Chase Mortgage and How Does It Work?

Chase Mortgage is a division of JPMorgan Chase & Co., one of the largest financial institutions in the United States. It specializes in providing home financing solutions to individuals and families across the country. Whether you're purchasing a new home, refinancing an existing mortgage, or exploring home equity options, Chase Mortgage offers a variety of products designed to meet your needs. The company’s mission is to simplify the mortgage process, making it accessible and stress-free for borrowers.

At its core, Chase Mortgage operates by connecting borrowers with the funds they need to purchase or refinance a home. The process begins with a loan application, where borrowers provide details about their income, credit history, and the property they wish to finance. Chase then evaluates this information to determine the borrower’s eligibility and the terms of the loan. Once approved, borrowers can choose from fixed-rate or adjustable-rate mortgages, each with its own set of benefits. Fixed-rate mortgages offer stability with consistent monthly payments, while adjustable-rate mortgages may provide lower initial rates that can fluctuate over time.

One of the standout features of Chase Mortgage is its commitment to transparency. Borrowers are provided with clear information about interest rates, closing costs, and other fees upfront. This approach helps eliminate surprises and ensures that borrowers fully understand their financial obligations. Additionally, Chase Mortgage offers resources such as online calculators, educational materials, and personalized consultations to help borrowers make informed decisions. Whether you're a first-time homebuyer or a seasoned homeowner, Chase Mortgage’s comprehensive offerings and customer-centric approach make it a reliable choice for your home financing needs.

What Are the Different Types of Loans Offered by Chase Mortgage?

Chase Mortgage provides a diverse range of loan options to cater to different financial situations and homeownership goals. Understanding the types of loans available can help you choose the one that best aligns with your needs. Below, we’ll explore the most common loan types offered by Chase Mortgage, along with their unique features and benefits.

Fixed-Rate Mortgages

Fixed-rate mortgages are a popular choice for borrowers who value stability and predictability in their monthly payments. With this type of loan, the interest rate remains constant throughout the life of the loan, which can span 15, 20, or 30 years. This makes it easier for borrowers to budget and plan their finances without worrying about fluctuating rates. Fixed-rate mortgages are ideal for individuals who plan to stay in their homes for an extended period and want to avoid the uncertainty of market-driven rate changes.

Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages, or ARMs, offer a lower initial interest rate compared to fixed-rate loans. However, the rate is subject to change periodically based on market conditions. Chase Mortgage typically offers ARMs with an initial fixed-rate period of 5, 7, or 10 years, after which the rate adjusts annually. ARMs are a good option for borrowers who expect to sell or refinance their homes before the adjustable period begins. They can also be beneficial in a declining interest rate environment.

Read also:How To Access Your Raspberry Pi Remotely With Remoteiot Web Ssh For Free

FHA Loans

FHA loans are government-backed mortgages insured by the Federal Housing Administration. These loans are designed to make homeownership more accessible, especially for first-time buyers or those with limited financial resources. Chase Mortgage offers FHA loans with lower down payment requirements and more lenient credit score criteria compared to conventional loans. Borrowers are required to pay mortgage insurance premiums, but the trade-off is increased affordability and flexibility.

VA Loans

VA loans are available to eligible veterans, active-duty service members, and their families. Backed by the U.S. Department of Veterans Affairs, these loans offer competitive rates and often require no down payment. Chase Mortgage provides VA loans with minimal closing costs and no private mortgage insurance (PMI), making them an attractive option for those who qualify. The streamlined process and favorable terms make VA loans a valuable resource for military personnel and their families.

Jumbo Loans

For borrowers seeking to finance luxury properties or homes in high-cost areas, Chase Mortgage offers jumbo loans. These loans exceed the conforming loan limits set by the Federal Housing Finance Agency (FHFA) and are designed for higher-priced properties. Jumbo loans typically require larger down payments and stricter credit qualifications but provide the necessary funding for borrowers with substantial financing needs.

Other Loan Options

In addition to the above, Chase Mortgage also offers specialized loan programs, such as refinancing options and home equity loans. Refinancing allows borrowers to lower their interest rates, reduce monthly payments, or switch from an adjustable-rate to a fixed-rate mortgage. Home equity loans and lines of credit (HELOCs) enable homeowners to tap into the equity they’ve built in their property for home improvements, debt consolidation, or other financial needs.

By offering such a wide variety of loan options, Chase Mortgage ensures that borrowers can find a solution tailored to their unique circumstances. Whether you're a first-time buyer, a veteran, or someone looking to finance a high-value property, Chase Mortgage has a loan product that can meet your needs.

What Are the Eligibility Requirements for Chase Mortgage?

Securing a mortgage with Chase requires meeting specific eligibility criteria, which are designed to ensure that borrowers can manage their financial obligations responsibly. These requirements vary depending on the type of loan you’re applying for, but there are some general guidelines that apply across the board. Understanding these criteria can help you prepare for the application process and increase your chances of approval.

Credit Score Requirements

Your credit score plays a crucial role in determining your eligibility for a Chase Mortgage. While the exact score requirements may vary based on the loan type, a higher credit score generally improves your chances of approval and helps you secure more favorable terms. For conventional loans, Chase typically requires a minimum credit score of 620. However, government-backed loans like FHA and VA loans may accept lower scores, sometimes as low as 580, depending on other factors such as your debt-to-income ratio.

Income and Employment Verification

Chase Mortgage requires borrowers to provide proof of stable income and employment. This typically includes submitting recent pay stubs, W-2 forms, and tax returns for the past two years. Self-employed individuals may need to provide additional documentation, such as profit-and-loss statements or bank statements, to demonstrate their financial stability. Lenders assess your income to ensure that you can comfortably afford your monthly mortgage payments without overextending your budget.

Down Payment Requirements

The down payment is another critical factor in the eligibility process. Conventional loans typically require a down payment of at least 3% to 20% of the home’s purchase price, depending on your credit score and other qualifications. FHA loans, on the other hand, allow for down payments as low as 3.5%, while VA loans often require no down payment at all. Jumbo loans usually demand a higher down payment, often ranging from 10% to 20%, due to the larger loan amounts involved.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is a key metric that Chase Mortgage evaluates during the application process. This ratio compares your monthly debt obligations to your gross monthly income. A lower DTI ratio indicates that you have sufficient income to cover your debts, making you a less risky borrower. Chase typically prefers a DTI ratio of 43% or lower, although exceptions may be made for borrowers with strong credit profiles or substantial assets.

Residency and Citizenship Requirements

Borrowers must also meet residency and citizenship requirements to qualify for a Chase Mortgage. U.S. citizens, permanent residents, and certain non-citizens with valid visas may apply for a mortgage. Additionally, Chase requires borrowers to use the financed property as their primary residence, second home, or investment property, depending on the loan type. Providing accurate information about your residency status and intended use of the property is essential for a smooth application process.

By understanding and meeting these eligibility requirements, you can position yourself as a qualified candidate for a Chase Mortgage. Preparing your financial documents, improving your credit score, and ensuring a stable income are all steps you can take to increase your chances of approval. With the right preparation, securing a mortgage with Chase can be a straightforward and rewarding experience.

How Does the Chase Mortgage Application Process Work?

Applying for a Chase Mortgage is a structured process designed to evaluate your financial readiness and determine the best loan options for your needs. While the steps may vary slightly depending on the type of loan you’re pursuing, the overall process remains consistent. Understanding how the application works can help you navigate it with confidence and efficiency.

Step 1: Pre-Qualification

The first step in the Chase Mortgage application process is pre-qualification. This is an informal assessment where you provide basic financial information, such as your income, credit score, and estimated down payment. Chase uses this data to give you an idea of how much you may qualify to borrow. Pre-qualification is not a guarantee of approval, but it helps you understand your budget and demonstrates to sellers that you’re a serious buyer. You can complete this step online or by speaking with a Chase representative.

Step 2: Loan Application

Once you’re ready to move forward, the formal application process begins. This involves submitting detailed documentation to verify your financial information. You’ll need to provide proof of income (such as pay stubs and tax returns), bank statements, and details about any existing debts or assets. Chase Mortgage offers an online application portal, making it convenient to upload documents and track your progress. If you’re applying for a government-backed loan like an FHA or VA loan, additional paperwork may be required to meet specific program guidelines.

Step 3: Loan Processing

After submitting your application, Chase’s underwriting team reviews your documents to assess your eligibility. This step involves verifying your income, credit history, and property details. The lender may also order an appraisal of the property to ensure its value aligns with the loan amount. During this phase, you may be asked to provide additional documentation or clarify certain details. It’s important to respond promptly to any requests to avoid delays in the process.

Step 4: Loan Approval and Closing

Once your application is approved, you’ll receive a Loan Estimate document outlining the terms of your mortgage, including interest rates, monthly payments, and closing costs. Carefully review this document to ensure everything aligns with your expectations. If you agree to the terms, you’ll move on to the closing stage. At closing, you’ll sign the final paperwork, pay any remaining fees, and officially take ownership of the property. Chase Mortgage provides a digital closing option for added convenience, allowing you to complete the process online if preferred.

Tips for a Smooth Application Process

- G

Discover The Timeless Elegance Of Luciana Paluzzi: A Journey Through Her Life And Legacy

Unveiling The Secrets Of Lizard Monsters Inc: The Ultimate Guide

Chappelle Roan Height: Unveiling The Rising Star's Stature And Journey

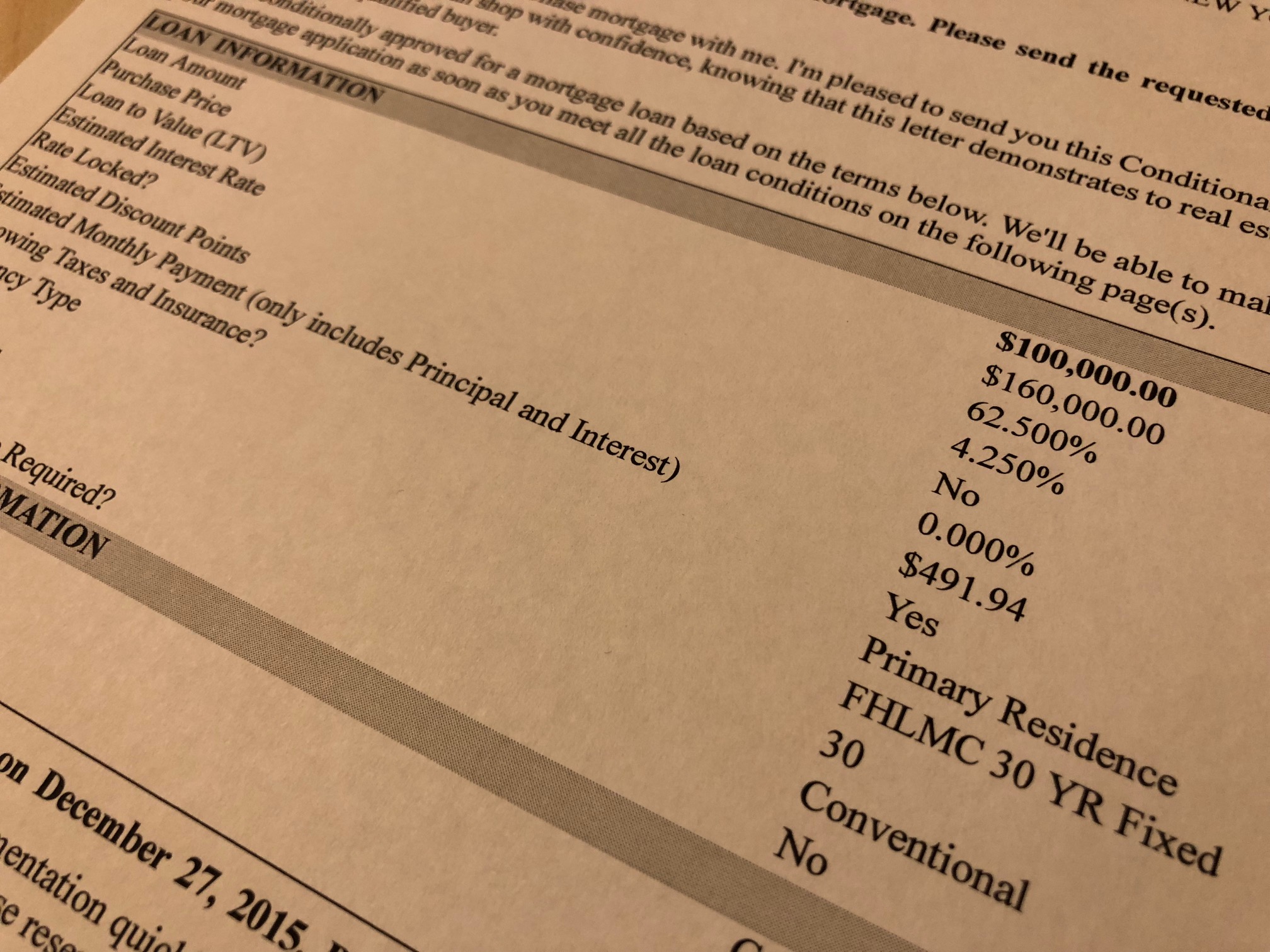

Chase mortgage estimator DermotHilary

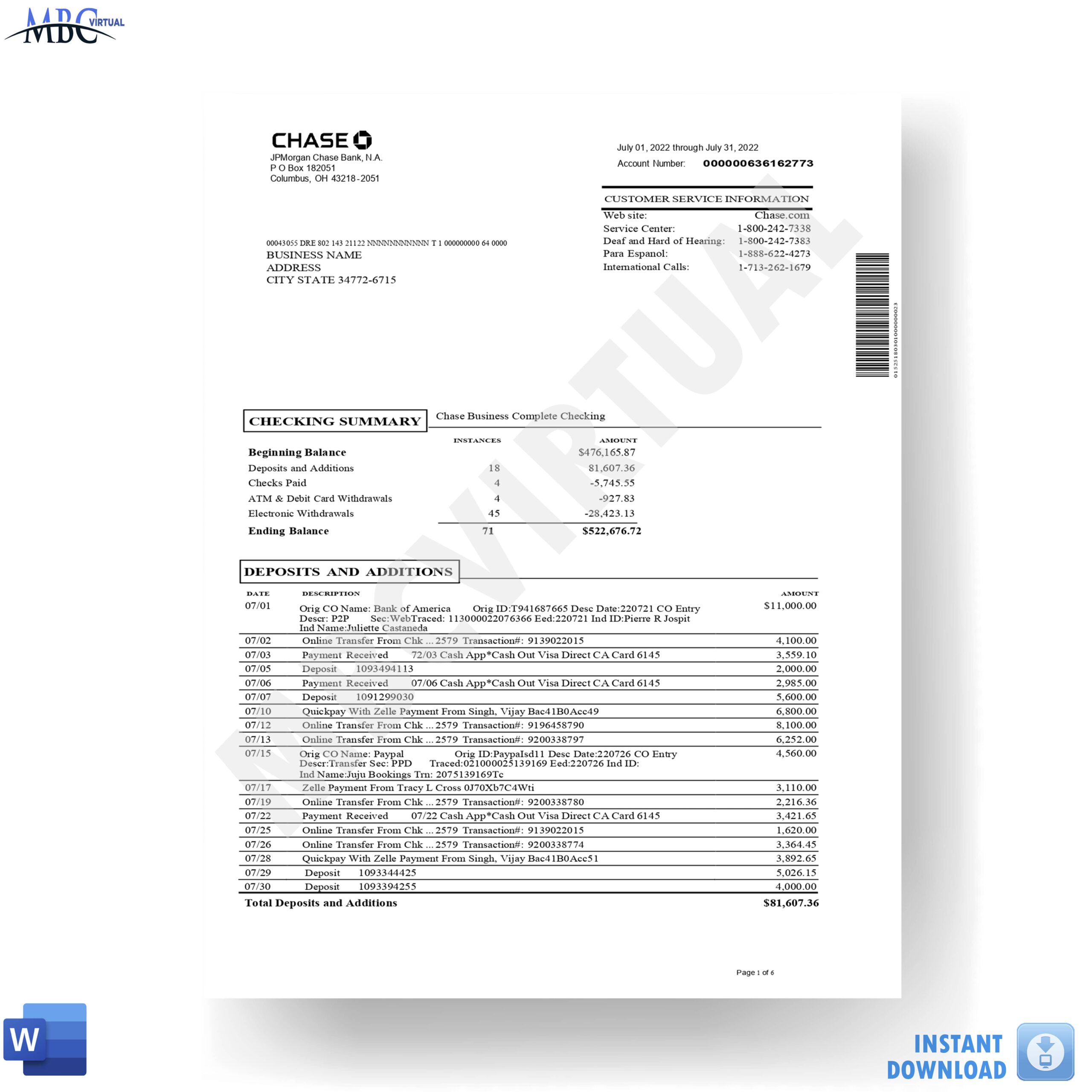

Chase Mortgage Statement ubicaciondepersonas.cdmx.gob.mx