Understanding TIAA Savings Rate: A Comprehensive Guide

Planning for retirement is one of the most important financial decisions you’ll ever make, and understanding how your savings grow is key to securing your future. TIAA savings rate plays a crucial role in helping individuals maximize their retirement contributions and achieve long-term financial stability. Whether you’re just starting your career or nearing retirement, knowing how TIAA’s savings rate works can help you make informed decisions about your investments. TIAA, or Teachers Insurance and Annuity Association, is a trusted name in retirement planning, offering competitive savings rates and a range of financial products tailored to educators and nonprofit professionals. With its commitment to stability and growth, TIAA has become a go-to choice for those seeking reliable retirement solutions.

But what exactly is TIAA’s savings rate, and how does it impact your retirement savings? Simply put, the savings rate is the percentage of your income that you contribute to your TIAA retirement account, combined with the returns generated by TIAA’s investment options. These rates are influenced by factors like market conditions, the type of account you hold, and your chosen investment strategy. Understanding these elements can help you optimize your contributions and make the most of TIAA’s offerings. By taking a closer look at how TIAA manages its savings rate, you can ensure your retirement fund grows steadily over time.

For anyone looking to build a secure financial future, TIAA’s savings rate is a critical piece of the puzzle. It’s not just about saving money—it’s about growing it wisely. In this article, we’ll explore everything you need to know about TIAA’s savings rate, from how it’s calculated to strategies for maximizing your contributions. Whether you’re new to TIAA or a seasoned investor, this guide will provide valuable insights to help you make the most of your retirement planning.

Read also:Does Barron Trump Really Play The Guitar And Sing Unveiling The Truth

Table of Contents

- What is TIAA Savings Rate and Why Does It Matter?

- How Does TIAA Calculate Its Savings Rate?

- Can You Maximize Your Contributions to TIAA Savings Rate?

- What Are the Benefits of TIAA’s Competitive Savings Rate?

- How Does TIAA’s Savings Rate Compare to Other Providers?

- Are There Hidden Fees That Affect TIAA Savings Rate?

- How Can You Optimize Investments to Boost TIAA Savings Rate?

- What Should You Consider Before Adjusting Your TIAA Savings Rate?

What is TIAA Savings Rate and Why Does It Matter?

The TIAA savings rate is more than just a number—it’s a cornerstone of your retirement planning strategy. At its core, the savings rate represents the percentage of your income that you contribute to your TIAA retirement account, along with the returns generated by your investments. This rate is essential because it directly impacts the growth of your retirement fund over time. By understanding how TIAA’s savings rate works, you can make informed decisions that align with your financial goals and ensure a comfortable retirement.

One of the unique aspects of TIAA’s savings rate is its flexibility. Depending on your financial situation, you can adjust your contributions to suit your needs. For example, if you’re in a higher income bracket, you might choose to contribute the maximum allowable amount to take advantage of tax benefits. On the other hand, if you’re just starting out, you might opt for a more modest contribution rate and gradually increase it as your income grows. TIAA’s savings rate is designed to accommodate these varying needs, making it a versatile tool for retirement planning.

But why does the TIAA savings rate matter so much? The answer lies in compound interest. When you contribute consistently and allow your investments to grow over time, the power of compounding can significantly boost your retirement savings. TIAA’s competitive savings rate ensures that your money works harder for you, even during periods of market volatility. By taking advantage of TIAA’s expertise and resources, you can build a robust retirement fund that provides financial security for years to come.

How Does TIAA Calculate Its Savings Rate?

Understanding how TIAA calculates its savings rate is key to maximizing your retirement contributions. The process involves several factors, including your chosen contribution percentage, the performance of your investments, and any employer-matching contributions. Let’s break it down step by step to give you a clearer picture.

First, your personal contribution percentage is a critical component of the TIAA savings rate. This is the portion of your income that you decide to allocate to your TIAA retirement account. For example, if you earn $50,000 annually and choose to contribute 10%, your annual contribution would be $5,000. TIAA offers various account types, such as Traditional and Roth IRAs, each with its own tax advantages, which can influence your savings rate.

What Role Does Investment Performance Play?

Investment performance is another key factor in determining your TIAA savings rate. TIAA offers a range of investment options, including mutual funds, annuities, and fixed-income products, each with varying levels of risk and return. The performance of these investments directly impacts the growth of your retirement fund. For instance, if you invest in a diversified portfolio with a strong track record, your savings rate could benefit from higher returns.

Read also:Rachel Camposduffy A Journey Of Adoption And Family Love

Does Employer Matching Affect the Savings Rate?

Yes, employer matching can significantly boost your TIAA savings rate. Many employers offer matching contributions as part of their retirement benefits package. For example, your employer might match 50% of your contributions up to a certain percentage of your salary. This effectively increases your savings rate without requiring additional contributions from you. It’s a valuable perk that can accelerate the growth of your retirement fund.

Can You Maximize Your Contributions to TIAA Savings Rate?

Maximizing your contributions to the TIAA savings rate is a smart strategy for building a substantial retirement fund. But how can you achieve this without straining your finances? The good news is that there are several practical steps you can take to optimize your contributions and make the most of TIAA’s offerings.

One effective approach is to take full advantage of employer matching. If your employer offers a matching program, it’s essentially free money that can significantly boost your savings rate. For example, if your employer matches 100% of your contributions up to 5% of your salary, contributing at least 5% ensures you’re not leaving any money on the table. This simple step can have a profound impact on your retirement savings over time.

What Strategies Can Help You Increase Contributions?

Increasing your contributions incrementally is another effective strategy. Instead of making a drastic change to your savings rate, consider gradually increasing your contributions by 1% each year. This approach allows you to adjust to the change without feeling a significant financial pinch. Additionally, automating your contributions can help you stay consistent and avoid the temptation to reduce your savings rate during tight financial periods.

Should You Adjust Contributions Based on Life Changes?

Life changes, such as a raise, bonus, or change in family circumstances, can also provide opportunities to adjust your contributions. For example, if you receive a raise, consider allocating a portion of the increase to your TIAA savings rate. This way, you can boost your retirement savings without affecting your current lifestyle. Similarly, if you experience a windfall, such as an inheritance or tax refund, directing a portion of it toward your retirement account can provide a significant boost.

What Are the Benefits of TIAA’s Competitive Savings Rate?

TIAA’s competitive savings rate offers a host of benefits that make it an attractive option for retirement planning. From tax advantages to long-term growth potential, TIAA provides a comprehensive suite of features designed to help you build a secure financial future. Let’s explore some of the key benefits that set TIAA apart from other retirement providers.

One of the standout advantages of TIAA’s savings rate is its tax efficiency. Contributions to Traditional TIAA accounts are made with pre-tax dollars, which reduces your taxable income for the year. This can result in significant tax savings, especially if you’re in a higher tax bracket. On the other hand, Roth TIAA accounts allow for tax-free withdrawals in retirement, providing flexibility depending on your financial goals and tax situation.

In addition to tax benefits, TIAA’s savings rate is backed by a strong track record of investment performance. TIAA’s investment options are designed to balance risk and reward, offering opportunities for growth while minimizing volatility. Whether you’re a conservative investor or someone willing to take on more risk for higher returns, TIAA’s diverse portfolio can accommodate your needs.

How Does TIAA’s Savings Rate Compare to Other Providers?

When evaluating retirement providers, it’s essential to compare TIAA’s savings rate to those offered by other institutions. While many providers offer similar features, TIAA stands out for its commitment to stability, competitive rates, and personalized service. Understanding these differences can help you make an informed decision about your retirement planning.

One area where TIAA excels is its focus on long-term growth. Unlike some providers that prioritize short-term gains, TIAA’s investment strategies are designed to deliver consistent returns over time. This approach aligns with the needs of educators and nonprofit professionals, who often prioritize stability and reliability in their retirement planning. Additionally, TIAA’s low fees and transparent pricing structure make it an attractive option for cost-conscious investors.

Another factor to consider is the level of customer support and educational resources TIAA provides. From retirement planning tools to personalized advice, TIAA goes above and beyond to ensure its clients have the information they need to make informed decisions. This level of service sets TIAA apart from many other providers and contributes to its reputation as a trusted partner in retirement planning.

Are There Hidden Fees That Affect TIAA Savings Rate?

One common concern among investors is whether hidden fees can impact their TIAA savings rate. The good news is that TIAA is known for its transparent fee structure, which minimizes unexpected costs and ensures your contributions go toward growing your retirement fund.

TIAA’s fees are typically lower than industry averages, making it a cost-effective choice for retirement planning. These fees cover administrative costs, investment management, and other services that support your account. By understanding these fees upfront, you can avoid surprises and make the most of your savings rate.

How Can You Optimize Investments to Boost TIAA Savings Rate?

Optimizing your investments is a powerful way to enhance your TIAA savings rate. By diversifying your portfolio and regularly reviewing your investment strategy, you can maximize returns and achieve your retirement goals more efficiently.

Start by assessing your risk tolerance and investment objectives. TIAA offers a range of options, from conservative fixed-income products to growth-oriented mutual funds. By aligning your investments with your goals, you can create a balanced portfolio that supports long-term growth.

What Should You Consider Before Adjusting Your TIAA Savings Rate?

Before making changes to your TIAA savings rate, it’s important to consider factors such as your current financial situation, long-term goals, and market conditions. Consulting with a financial advisor can provide valuable insights and help you make informed decisions.

FAQs

What is the minimum contribution required for TIAA savings rate?

The minimum contribution varies depending on your employer’s plan. However, many plans allow you to start with as little as 1% of your salary.

Can I change my TIAA savings rate at any time?

Yes, you can adjust your contributions at any time, subject to your employer’s plan rules. It’s a good idea to review your savings rate annually to ensure it aligns with your goals.

How does TIAA’s savings rate impact my taxes?

Contributions to Traditional TIAA accounts reduce your taxable income, while Roth accounts allow for tax-free withdrawals in retirement.

Conclusion

Understanding and optimizing your TIAA savings rate is a critical step in securing your financial future. By leveraging TIAA’s competitive rates, tax advantages, and investment options, you can build a robust retirement fund that supports your long-term goals. Whether you’re just starting out or nearing retirement, TIAA offers the tools and resources you need to succeed.

For more information on retirement planning, visit TIAA’s official website.

Exploring The World Of Emily_santtt Forum: Your Ultimate Guide To Online Community Engagement

Mastering Bush Patch OSRS: A Complete Guide To Old School RuneScape's Herblore

Unlocking The Benefits Of Bonvoy Tiers: A Comprehensive Guide To Marriott's Loyalty Program

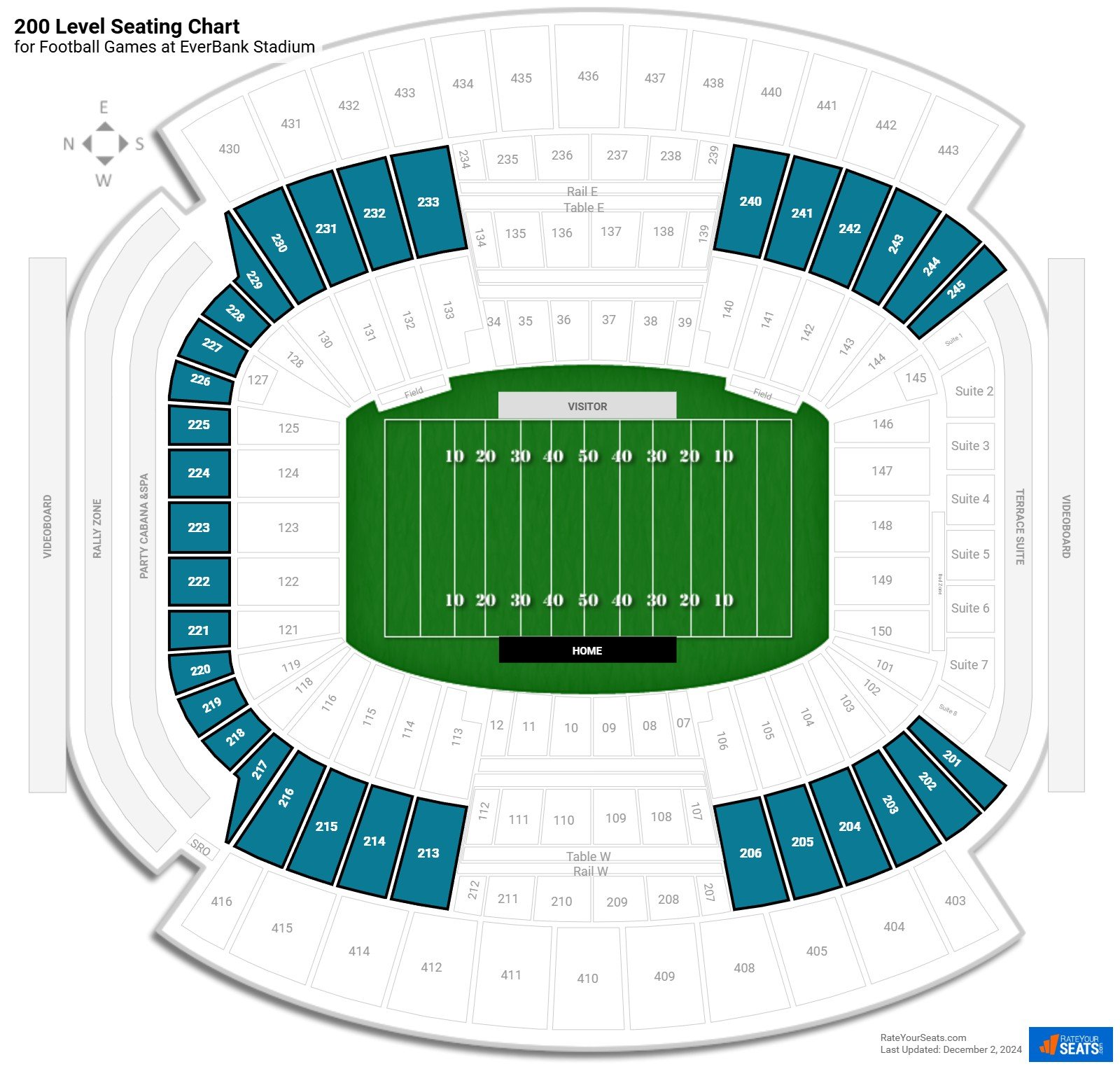

TIAA Bank Field 200 Level

Crypto markets head lower in anticipation of Wednesday’s FOMC rate hike