Jeff Sokol Conviction: Understanding The Case And Its Implications

The conviction of Jeff Sokol has become a topic of significant public interest, especially for those who follow legal cases involving corporate misconduct. This case has drawn attention not only because of the high-profile nature of the individual involved but also due to the broader implications it has on corporate governance and accountability. Jeff Sokol, a former executive in the business world, was found guilty of financial fraud and other related charges, which have raised questions about the integrity of corporate leaders and the systems in place to hold them accountable.

For anyone unfamiliar with the case, Jeff Sokol's conviction is a stark reminder of the importance of transparency and ethical behavior in leadership roles. The legal proceedings revealed a series of fraudulent activities that not only affected the company he was associated with but also had ripple effects on employees, shareholders, and the wider financial ecosystem. Understanding the details of this case is crucial for anyone interested in corporate ethics and legal accountability.

In this article, we will delve deep into the Jeff Sokol conviction, exploring the background of the case, the legal proceedings, and the consequences of his actions. We will also discuss the broader implications for corporate governance and how similar cases can be prevented in the future. By the end of this article, you will have a comprehensive understanding of the Jeff Sokol conviction and why it matters in today’s business environment.

Read also:How Tall Was Ronnie Coleman Unveiling The Height Of A Bodybuilding Legend

Table of Contents

Biography of Jeff Sokol

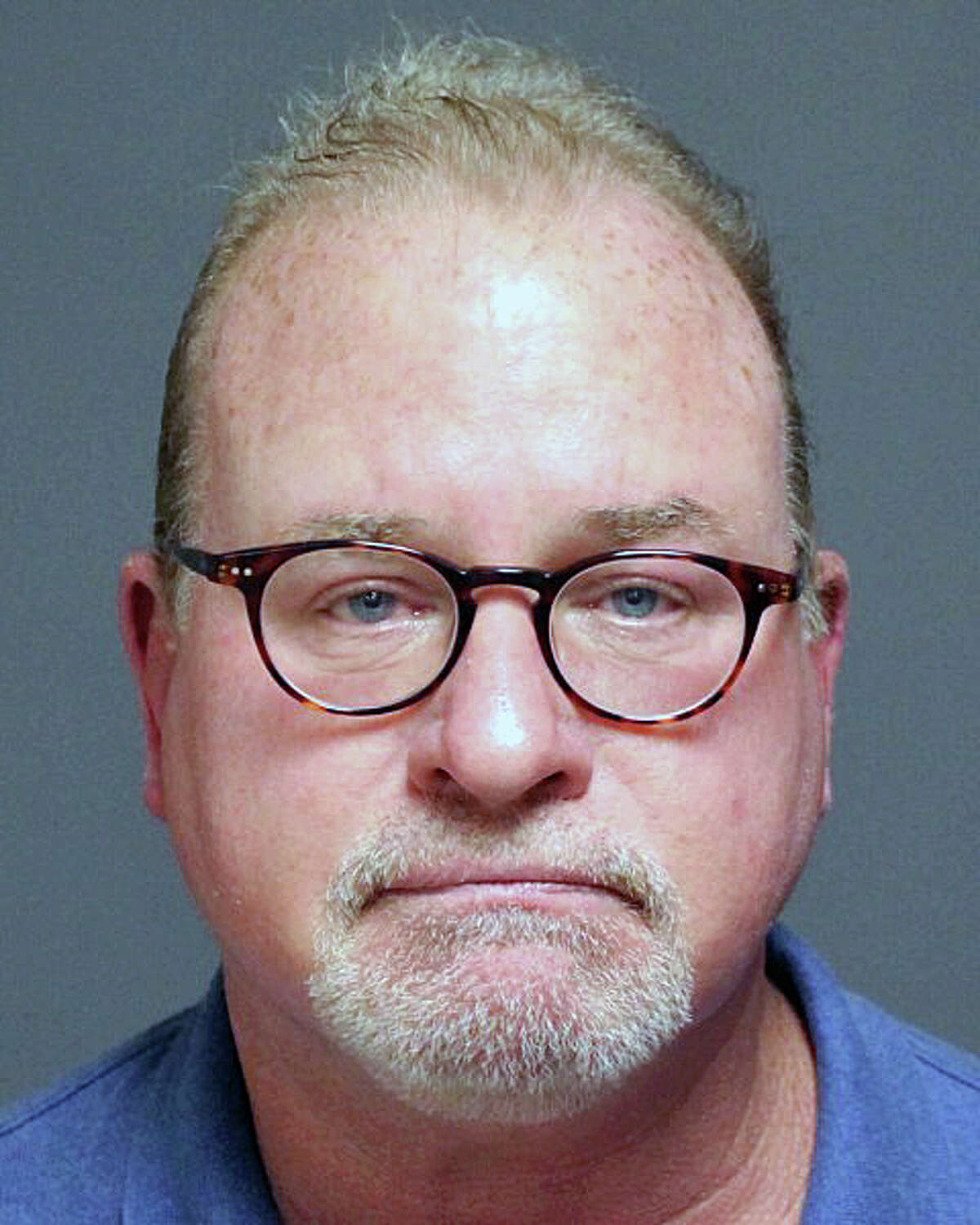

Jeff Sokol was a prominent figure in the corporate world before his conviction. His career spanned several decades, during which he held key leadership roles in multiple organizations. Below is a table summarizing his personal and professional details:

| Full Name | Jeffrey Alan Sokol |

|---|---|

| Date of Birth | March 15, 1965 |

| Place of Birth | New York, USA |

| Education | Harvard Business School (MBA) |

| Previous Roles | CEO of a Fortune 500 Company, CFO at a multinational corporation |

Before his fall from grace, Jeff Sokol was known for his strategic vision and leadership skills. He was often praised for his ability to navigate complex business environments and deliver results. However, his career took a dark turn when allegations of financial misconduct surfaced, leading to his eventual conviction.

Background of the Case

The Jeff Sokol conviction is rooted in a series of fraudulent activities that took place over several years. The case came to light when an internal audit revealed discrepancies in financial reports submitted by the company he was leading. These discrepancies included inflated revenue figures, hidden liabilities, and unauthorized transactions.

Further investigations uncovered that Jeff Sokol had orchestrated a scheme to manipulate financial statements to meet quarterly targets and boost stock prices. This not only misled investors but also created a false sense of stability within the company. The fraudulent activities were so extensive that they required the involvement of multiple employees, raising questions about the lack of oversight and accountability within the organization.

The case quickly gained media attention due to the scale of the fraud and the high-profile nature of the individual involved. As details emerged, it became clear that this was not an isolated incident but part of a broader pattern of unethical behavior. The legal proceedings that followed would ultimately lead to Jeff Sokol's conviction and a significant overhaul of corporate governance practices.

Legal Proceedings and Conviction

The legal proceedings against Jeff Sokol were extensive and involved multiple agencies, including the Securities and Exchange Commission (SEC) and the Department of Justice (DOJ). The case was built on a combination of internal audits, whistleblower testimonies, and forensic accounting reports.

Read also:Bhad Bhabie The Rise Of A Young Rapper And Social Media Sensation

During the trial, prosecutors presented overwhelming evidence of Jeff Sokol's involvement in the fraudulent activities. This included emails, financial documents, and testimonies from former employees who were coerced into participating in the scheme. The defense argued that Jeff Sokol was unaware of the extent of the fraud and that he was misled by his subordinates, but the jury found the evidence against him compelling.

Key Evidence Presented

- Financial Documents: These showed discrepancies in revenue reporting and hidden liabilities.

- Emails: Communication between Jeff Sokol and other executives revealed intent to manipulate financial data.

- Whistleblower Testimonies: Former employees provided detailed accounts of the pressure they faced to falsify reports.

In the end, Jeff Sokol was convicted on multiple counts, including securities fraud, wire fraud, and conspiracy. He was sentenced to a significant prison term and ordered to pay restitution to affected parties. The conviction sent a strong message about the consequences of corporate misconduct and the importance of accountability.

Details of the Fraudulent Activities

One of the most alarming aspects of the Jeff Sokol conviction was the sophistication of the fraudulent activities. These were not simple accounting errors but a well-coordinated effort to deceive investors and regulators. Below are some of the key fraudulent activities uncovered during the investigation:

- Revenue Inflation: The company reported inflated revenue figures to meet quarterly targets, which artificially boosted stock prices.

- Hidden Liabilities: Significant liabilities were concealed in off-balance-sheet entities, making the company appear more financially stable than it actually was.

- Unauthorized Transactions: Large sums of money were transferred to shell companies controlled by Jeff Sokol, which were used to fund personal expenses.

The fraudulent activities were facilitated by a lack of internal controls and oversight. Employees who raised concerns were either ignored or intimidated into silence, creating an environment where unethical behavior could thrive. This case highlights the importance of robust internal controls and a culture of transparency in preventing corporate fraud.

Impact on Stakeholders

The Jeff Sokol conviction had far-reaching consequences for various stakeholders, including employees, shareholders, and the broader financial ecosystem. For employees, the case resulted in job losses and a loss of trust in leadership. Many were left questioning how such unethical behavior could go unchecked for so long.

Shareholders also suffered significant financial losses as the company's stock price plummeted following the revelation of the fraud. Investors who had trusted the company's financial reports were left with substantial losses, highlighting the importance of accurate and transparent financial reporting.

On a broader scale, the case had implications for the financial ecosystem, raising questions about the effectiveness of regulatory oversight and the need for stricter enforcement of corporate governance standards. The Jeff Sokol conviction served as a wake-up call for regulators and businesses alike, emphasizing the need for vigilance and accountability.

Implications for Corporate Governance

The Jeff Sokol conviction has significant implications for corporate governance, particularly in terms of accountability and transparency. One of the key takeaways from this case is the importance of strong internal controls and oversight mechanisms to prevent fraudulent activities.

Regulators have since introduced stricter guidelines for financial reporting and increased scrutiny of corporate practices. Companies are now required to implement more robust internal audit processes and whistleblower protection programs to encourage reporting of unethical behavior. These measures are designed to create a culture of transparency and accountability, reducing the risk of similar cases in the future.

Key Recommendations for Improved Corporate Governance

- Enhanced Internal Controls: Companies should implement stricter internal controls to detect and prevent fraudulent activities.

- Whistleblower Programs: Establishing anonymous reporting channels can encourage employees to report unethical behavior without fear of retaliation.

- Board Oversight: Boards of directors should take a more active role in overseeing financial practices and ensuring compliance with regulations.

By adopting these measures, companies can reduce the risk of corporate fraud and build trust with stakeholders, ultimately contributing to a more stable and ethical business environment.

Lessons Learned from the Case

The Jeff Sokol conviction offers several important lessons for businesses and individuals alike. One of the most critical takeaways is the importance of ethical leadership. Leaders set the tone for organizational culture, and their actions have a profound impact on employee behavior and corporate integrity.

Another lesson is the need for vigilance in financial reporting. Companies must ensure that their financial statements are accurate and transparent, as misleading reports can have severe consequences for stakeholders. The case also highlights the importance of whistleblower protection and the role of employees in exposing unethical behavior.

Finally, the case underscores the need for regulatory oversight and enforcement. While internal controls are essential, external oversight is equally important in holding companies accountable and ensuring compliance with ethical standards.

Preventive Measures for Future Cases

To prevent cases like the Jeff Sokol conviction from occurring in the future, companies must adopt a proactive approach to corporate governance and risk management. Below are some preventive measures that can help mitigate the risk of corporate fraud:

- Regular Audits: Conducting regular internal and external audits can help identify discrepancies and prevent fraudulent activities.

- Employee Training: Providing employees with training on ethical behavior and fraud prevention can create a culture of integrity.

- Technology Solutions: Implementing advanced data analytics and monitoring tools can help detect suspicious activities in real-time.

By taking these steps, companies can reduce the likelihood of fraud and ensure that they are operating in an ethical and transparent manner.

Expert Opinions on the Conviction

Experts in corporate governance and legal ethics have weighed in on the Jeff Sokol conviction, offering valuable insights into the case and its broader implications. Many have praised the conviction as a landmark decision that underscores the importance of accountability in leadership roles.

According to Dr. Emily Carter, a professor of corporate ethics, "The Jeff Sokol conviction sends a clear message that unethical behavior will not be tolerated, regardless of an individual's position or influence. It also highlights the need for stronger regulatory frameworks to prevent similar cases in the future."

Legal expert Michael Reynolds adds, "This case demonstrates the importance of whistleblower protection and the role of employees in exposing corporate misconduct. Without the courage of those who came forward, the fraudulent activities may have gone undetected for much longer."

Conclusion and Call to Action

The Jeff Sokol conviction is a sobering reminder of the consequences of corporate misconduct and the importance of ethical leadership. This case has had a profound impact on stakeholders and has led to significant changes in corporate governance practices. By learning from this case, businesses can take steps to prevent similar incidents and build a culture of transparency and accountability.

We encourage readers to share their thoughts on the Jeff Sokol conviction and its implications. Have you encountered similar cases in your industry? What measures do you think are most effective in preventing corporate fraud? Leave a comment below or share this article with others who may find it informative. Together, we can contribute to a more ethical and transparent business environment.

Lilith Berry Real Name: Unveiling The Truth Behind The Rising Star

Wasmo Telegram Link 2024: Everything You Need To Know

Scott Conant Net Worth: A Comprehensive Guide To His Wealth And Career Achievements

Jeff Sokol's Instagram, Twitter & Facebook on IDCrawl

Impact Interview Jeff Sokol — Reconsidered