ICCU Mortgage Calculator: A Comprehensive Guide To Simplify Your Home Loan Planning

Planning to buy a home or refinance your mortgage? Understanding your monthly payments is crucial to making informed financial decisions. The ICCU Mortgage Calculator is a powerful tool that helps you estimate your mortgage payments, interest rates, and loan terms with ease. Whether you're a first-time homebuyer or looking to refinance, this guide will walk you through everything you need to know about using the ICCU Mortgage Calculator effectively.

Buying a home is one of the most significant financial decisions you’ll ever make. With so many factors to consider—such as down payments, interest rates, and loan terms—it’s easy to feel overwhelmed. That’s where tools like the ICCU Mortgage Calculator come into play. This calculator simplifies the process by providing accurate estimates tailored to your financial situation.

In this article, we’ll explore the features and benefits of the ICCU Mortgage Calculator, how to use it, and why it’s an essential tool for anyone navigating the home-buying process. We’ll also cover tips for optimizing your mortgage planning and ensuring you get the best deal possible. Let’s dive in!

Read also:Eddie Guerrero Full Name Unveiling The Legacy Of A Wrestling Legend

Table of Contents

- What is ICCU Mortgage Calculator?

- How Does ICCU Mortgage Calculator Work?

- Benefits of Using ICCU Mortgage Calculator

- Key Features of ICCU Mortgage Calculator

- How to Use ICCU Mortgage Calculator

- Understanding Mortgage Terms

- Tips for Effective Mortgage Planning

- Common Mistakes to Avoid

- Additional Resources

- Conclusion

What is ICCU Mortgage Calculator?

The ICCU Mortgage Calculator is an online tool provided by the Idaho Central Credit Union (ICCU) to help individuals estimate their monthly mortgage payments. Designed to be user-friendly, this calculator allows you to input key details such as loan amount, interest rate, and loan term to generate a detailed breakdown of your mortgage payments.

ICCU, a trusted financial institution, has developed this tool to empower homebuyers and refinancers with the information they need to make informed decisions. By using the ICCU Mortgage Calculator, you can compare different loan scenarios, evaluate affordability, and plan your finances accordingly.

How Does ICCU Mortgage Calculator Work?

The ICCU Mortgage Calculator works by taking a few essential inputs from the user and performing calculations based on standard mortgage formulas. Here’s a step-by-step breakdown of how it functions:

- Loan Amount: Enter the total amount you plan to borrow for your home purchase or refinance.

- Interest Rate: Input the annual interest rate offered by your lender or the rate you’re considering.

- Loan Term: Specify the duration of the loan, typically in years (e.g., 15, 20, or 30 years).

- Down Payment: If applicable, include the percentage or amount of the down payment you plan to make.

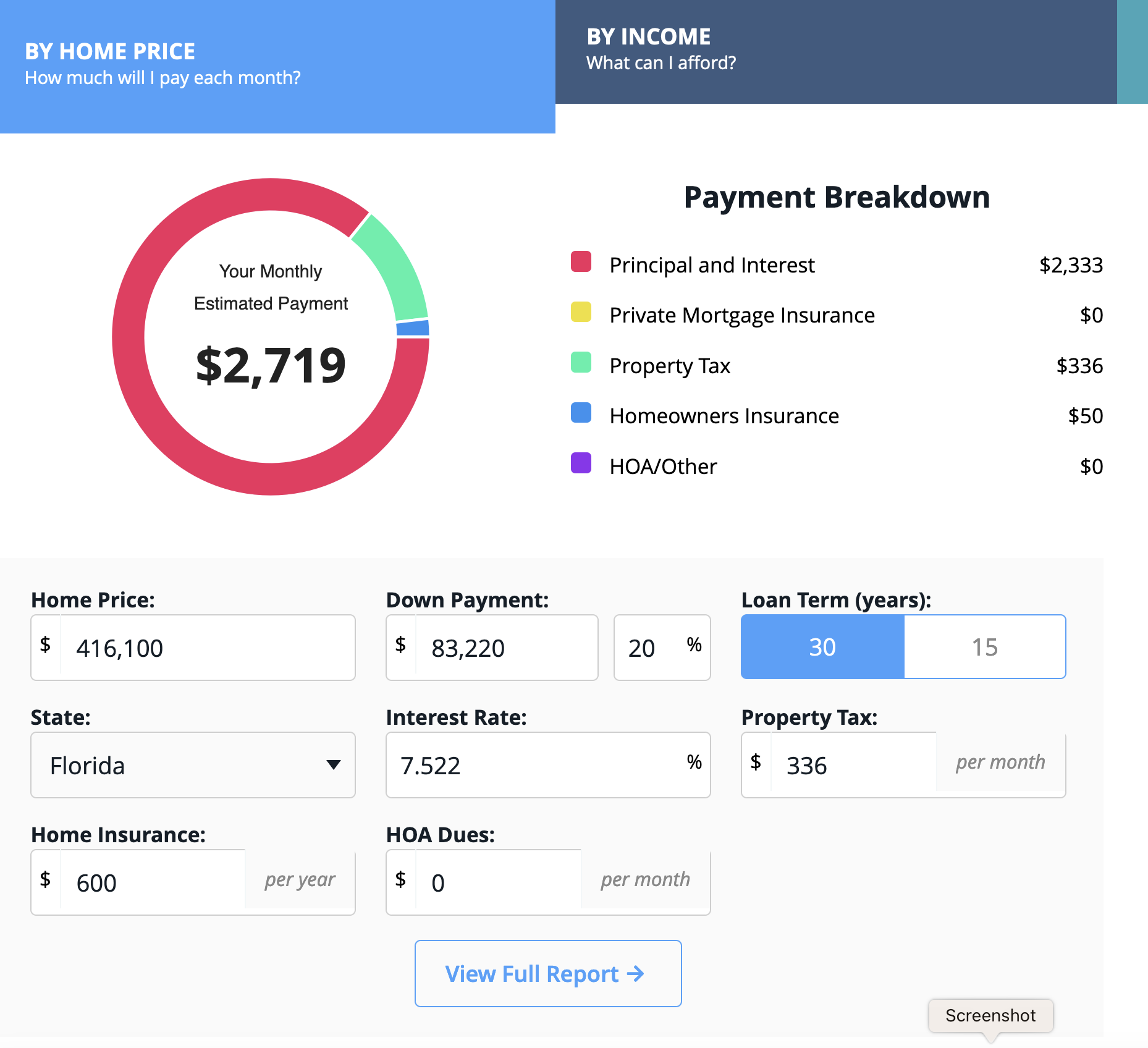

Once you’ve entered these details, the calculator will generate an estimated monthly payment, including principal and interest. Some versions of the calculator may also factor in additional costs like property taxes, homeowners insurance, and private mortgage insurance (PMI).

Benefits of Using ICCU Mortgage Calculator

Using the ICCU Mortgage Calculator offers several advantages, especially for individuals navigating the complexities of home financing. Here are some key benefits:

- Accurate Estimates: The calculator provides precise estimates of your monthly payments, helping you budget effectively.

- Scenario Comparison: You can test different loan amounts, interest rates, and terms to find the best option for your financial situation.

- Time-Saving: Instead of manually calculating mortgage payments, the tool simplifies the process and delivers results instantly.

- Financial Planning: By understanding your potential payments, you can plan for other expenses, such as home maintenance and utilities.

Key Features of ICCU Mortgage Calculator

The ICCU Mortgage Calculator is packed with features that make it a valuable resource for homebuyers. Here are some of its standout features:

Read also:Enhypen Ages Discover The Dynamic Members Of This Rising Kpop Group

- Customizable Inputs: Tailor the calculator to your specific needs by adjusting loan amounts, interest rates, and terms.

- Comprehensive Breakdown: View a detailed breakdown of your monthly payment, including principal, interest, taxes, and insurance.

- Amortization Schedule: Generate an amortization schedule to track how your loan balance decreases over time.

- Mobile-Friendly: Access the calculator from any device, making it convenient to use on the go.

How to Use ICCU Mortgage Calculator

Using the ICCU Mortgage Calculator is straightforward, even for those who are new to mortgage planning. Follow these simple steps:

- Visit the ICCU Website: Navigate to the mortgage calculator section on ICCU’s official website.

- Enter Loan Details: Input the loan amount, interest rate, loan term, and down payment percentage.

- Review Results: Once you’ve entered the required information, the calculator will display your estimated monthly payment.

- Adjust Variables: Experiment with different inputs to see how they impact your payment.

Understanding Mortgage Terms

To make the most of the ICCU Mortgage Calculator, it’s essential to understand common mortgage terms. Here’s a breakdown of key concepts:

Interest Rates

Interest rates play a significant role in determining your monthly mortgage payment. They represent the cost of borrowing money and are expressed as a percentage of the loan amount. Fixed-rate mortgages have a consistent interest rate throughout the loan term, while adjustable-rate mortgages (ARMs) may fluctuate based on market conditions.

Loan Terms

Loan terms refer to the duration of the mortgage. Common terms include 15-year, 20-year, and 30-year loans. Shorter terms typically come with higher monthly payments but lower overall interest costs, while longer terms offer lower monthly payments but higher total interest expenses.

Tips for Effective Mortgage Planning

Planning for a mortgage involves more than just calculating payments. Here are some tips to ensure you make the best financial decisions:

- Improve Your Credit Score: A higher credit score can help you secure a lower interest rate.

- Save for a Larger Down Payment: A bigger down payment reduces your loan amount and monthly payments.

- Shop Around for Lenders: Compare offers from multiple lenders to find the best rates and terms.

- Factor in Additional Costs: Don’t forget to account for property taxes, insurance, and maintenance expenses.

Common Mistakes to Avoid

When using a mortgage calculator or planning for a home purchase, it’s easy to make mistakes. Here are some common pitfalls to watch out for:

- Underestimating Costs: Failing to account for taxes, insurance, and maintenance can lead to financial strain.

- Ignoring Long-Term Impacts: Focus on the total cost of the loan, not just the monthly payment.

- Skipping Pre-Approval: Getting pre-approved for a mortgage helps you understand your budget and strengthens your offer.

Additional Resources

For further information on mortgages and home financing, consider exploring these trusted resources:

Conclusion

The ICCU Mortgage Calculator is an invaluable tool for anyone navigating the home-buying process. By providing accurate estimates and allowing you to compare different scenarios, it empowers you to make informed financial decisions. Whether you’re a first-time buyer or refinancing your current home, this calculator simplifies the process and helps you plan for the future.

Remember, buying a home is a significant commitment, and proper planning is key to success. Use the ICCU Mortgage Calculator to explore your options, understand your budget, and avoid common pitfalls. If you found this guide helpful, feel free to share it with others or leave a comment below. For more resources on mortgages and personal finance, check out our other articles!

Errol Spence Jr. Record: A Comprehensive Look At The Undefeated Boxing Champion

Exploring East Blackfell Junction: Once Human And Its Mysteries

Chinese Horoscope 1952: Unveiling The Secrets Of The Water Dragon Year

Secure Your Dream Home ICCU Mortgages for Flexible Financing

How to Calculate Mortgage Interest