Order Chase Checks: A Comprehensive Guide To Managing Your Financial Transactions

Table of Contents

Introduction

In today's digital age, managing financial transactions efficiently is more important than ever. One tool that remains relevant is the use of checks, particularly Chase checks. Order Chase checks can be a convenient way to manage payments, whether for personal or business purposes. This article will delve into the intricacies of Chase checks, guiding you through the process of ordering, customizing, and utilizing them effectively.

Chase Bank, one of the largest financial institutions in the United States, offers a variety of banking services, including the issuance of checks. These checks are not only a secure method of payment but also a reliable way to keep track of your financial transactions. Whether you're a business owner or an individual looking for a convenient payment solution, understanding how to order Chase checks is crucial.

In this comprehensive guide, we'll explore the benefits of using Chase checks, how to order them, the different types available, and much more. By the end of this article, you'll have a thorough understanding of Chase checks and how they can fit into your financial strategy.

Read also:Chris Browns Child Everything You Need To Know About The Life And Family Of The Rampb Star

What Are Chase Checks?

Chase checks are personalized checks issued by Chase Bank to its account holders. These checks allow individuals and businesses to make payments securely and conveniently. When you order Chase checks, you receive a booklet of pre-printed checks that contain your account information, making it easy to draw funds directly from your account.

Chase checks come in various designs and formats, catering to both personal and business needs. They are widely accepted and recognized, providing a reliable method of payment that is still preferred by many over digital alternatives.

Benefits of Using Chase Checks

There are several advantages to using Chase checks, including:

- Security: Chase checks come with advanced security features to prevent fraud and unauthorized use.

- Convenience: They are easy to use and widely accepted, making them a practical payment solution.

- Record Keeping: Checks provide a paper trail, making it easier to track your financial transactions.

- Customization: You can personalize your checks with different designs and features to suit your preferences.

How to Order Chase Checks

Ordering Chase checks is a straightforward process. Follow these steps to get started:

- Log in to Your Account: Access your Chase Bank account online or via the mobile app.

- Navigate to the Check Ordering Section: Look for the option to order checks, usually found under the "Services" or "Account Settings" tab.

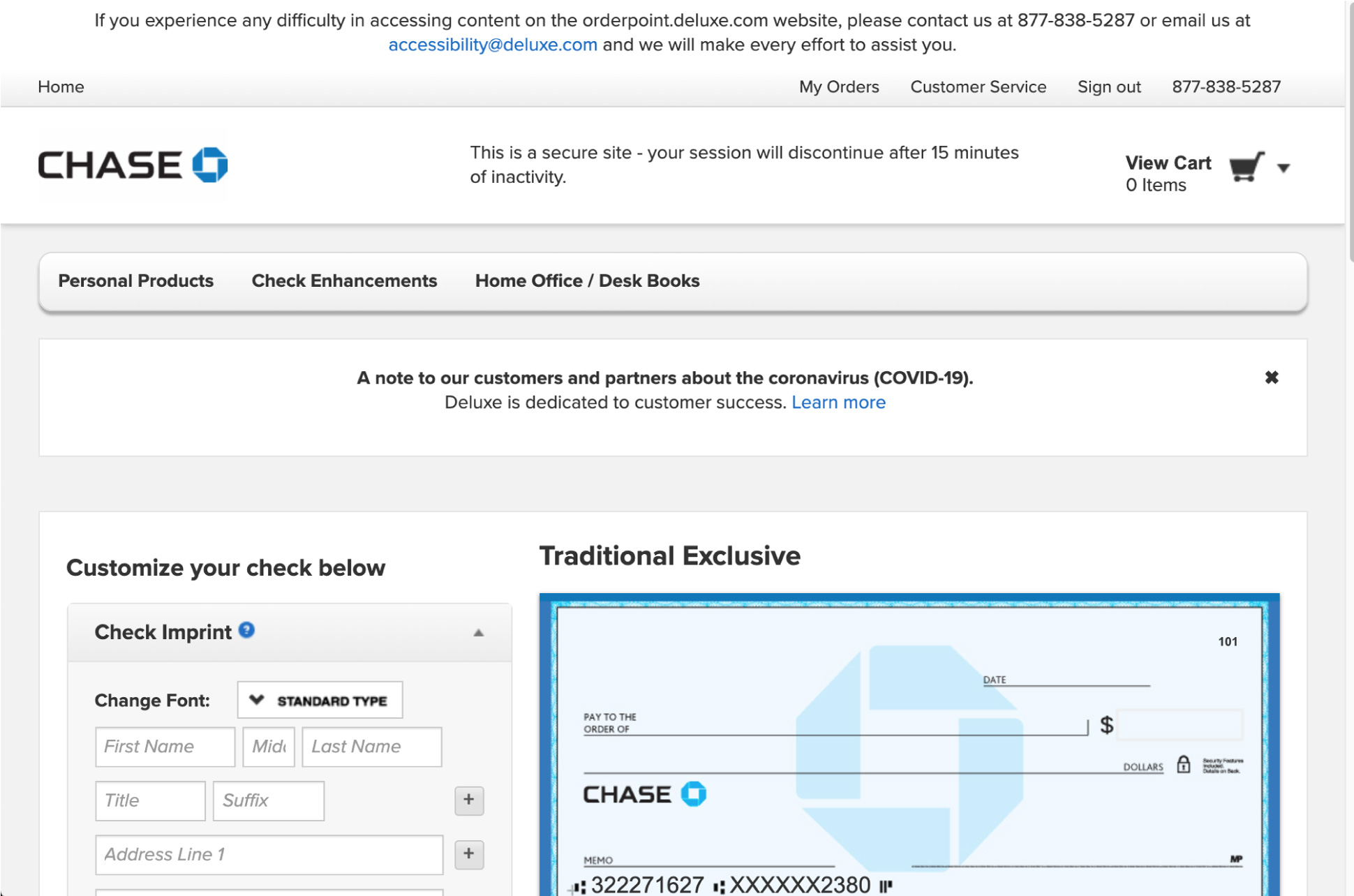

- Select Your Check Design: Choose from a variety of designs and customization options.

- Review and Confirm Your Order: Double-check your details and confirm your order.

- Payment and Delivery: Pay for your checks and select your preferred delivery method.

Types of Chase Checks

Chase offers several types of checks to cater to different needs:

Personal Checks

These are designed for individual use and come in various styles and designs.

Read also:What Is Amber Rose Net Worth A Comprehensive Guide To Her Wealth And Career

Business Checks

Ideal for businesses, these checks often include additional features like company logos and security enhancements.

Voucher Checks

These checks include a voucher section for recording transaction details, making them suitable for businesses that require detailed record-keeping.

Customizing Your Chase Checks

Customization options for Chase checks include:

- Designs: Choose from a variety of designs to reflect your personal or business style.

- Fonts and Colors: Customize the font and color of your checks for a unique look.

- Additional Features: Add features like security holograms or watermarks for enhanced protection.

Security Features of Chase Checks

Chase checks are equipped with several security features to protect against fraud:

- Microprinting: Tiny text that is difficult to replicate.

- Watermarks: Visible when held up to the light, ensuring authenticity.

- Security Holograms: Reflective patterns that add an extra layer of security.

- Chemical Protection: Prevents alterations by reacting to chemical tampering.

Common Issues and Solutions

While Chase checks are reliable, users may encounter some common issues:

Delayed Delivery

If your checks are delayed, contact Chase customer service to inquire about the status of your order.

Incorrect Information

Double-check all details before confirming your order to avoid errors. If mistakes occur, Chase offers a correction service.

Alternatives to Chase Checks

While Chase checks are a popular choice, there are alternatives worth considering:

- Online Payment Platforms: Services like PayPal and Venmo offer digital payment solutions.

- Wire Transfers: Ideal for large transactions, offering speed and security.

- Debit and Credit Cards: Convenient for everyday purchases and online transactions.

Conclusion

In conclusion, ordering Chase checks can be a valuable tool in managing your financial transactions. They offer security, convenience, and customization options that cater to both personal and business needs. By understanding how to order and utilize Chase checks effectively, you can enhance your financial management strategy.

We hope this guide has provided you with the information you need to make informed decisions about Chase checks. If you found this article helpful, please consider sharing it with others or leaving a comment below. For more financial tips and guides, explore our other articles on this site.

Breaking Benjamin Genre: A Comprehensive Exploration Of Their Musical Style And Influence

BG3 Code 804: A Comprehensive Guide To Understanding And Fixing The Issue

How Is Taurus In A Relationship: A Comprehensive Guide To Love And Compatibility

How to Write a Chase Check (with Example)

How to Write a Chase Check (with Example)