How To Order Checks From Chase Bank: A Comprehensive Guide

Ordering checks from Chase Bank is a straightforward process, but it can feel overwhelming if you're doing it for the first time. Whether you're a new account holder or simply running low on checks, understanding how to order checks from Chase Bank is essential for managing your finances efficiently. In this guide, we’ll walk you through the entire process, provide tips to save money, and address common questions to ensure you have a seamless experience.

Chase Bank, one of the largest financial institutions in the United States, offers a variety of check ordering options to suit your needs. From online ordering to in-branch assistance, Chase ensures that you can access the tools you need to manage your accounts effectively. However, navigating the process requires a clear understanding of the steps involved, as well as the associated costs and customization options.

By the end of this article, you'll have a comprehensive understanding of how to order checks from Chase Bank, the benefits of choosing Chase for your check needs, and how to avoid common pitfalls. Whether you're looking to reorder checks or explore new designs, this guide will equip you with the knowledge you need to make informed decisions.

Read also:Michelle Green Unveiling The Life And Achievements Of A Remarkable Personality

Table of Contents

- Introduction to Chase Bank Checks

- How to Order Checks Online

- Ordering Checks via Phone

- Ordering Checks In-Branch

- Customization Options for Your Checks

- Costs and Fees Associated with Chase Checks

- Tips for Saving Money on Check Orders

- Common Questions About Ordering Checks

- Benefits of Ordering Checks from Chase Bank

- Conclusion

Introduction to Chase Bank Checks

Chase Bank provides a reliable and convenient platform for ordering checks. Whether you're managing personal finances or running a business, Chase offers a variety of check styles and customization options to meet your needs. Their checks are compatible with both personal and business accounts, ensuring that you can maintain consistency across your financial activities.

When you order checks from Chase Bank, you can choose from standard designs or opt for custom designs that reflect your personal or business branding. This flexibility allows you to tailor your checks to your preferences while maintaining the security features required for financial transactions.

Why Choose Chase for Your Check Needs?

- Wide range of check designs and customization options.

- Secure ordering process through Chase's official platform.

- Integration with your existing Chase accounts for seamless management.

- Access to customer support for assistance with orders.

How to Order Checks Online

Ordering checks online is the most convenient option for most Chase customers. The process is simple and can be completed in just a few steps. Here's how you can order checks from Chase Bank online:

Step-by-Step Guide to Ordering Checks Online

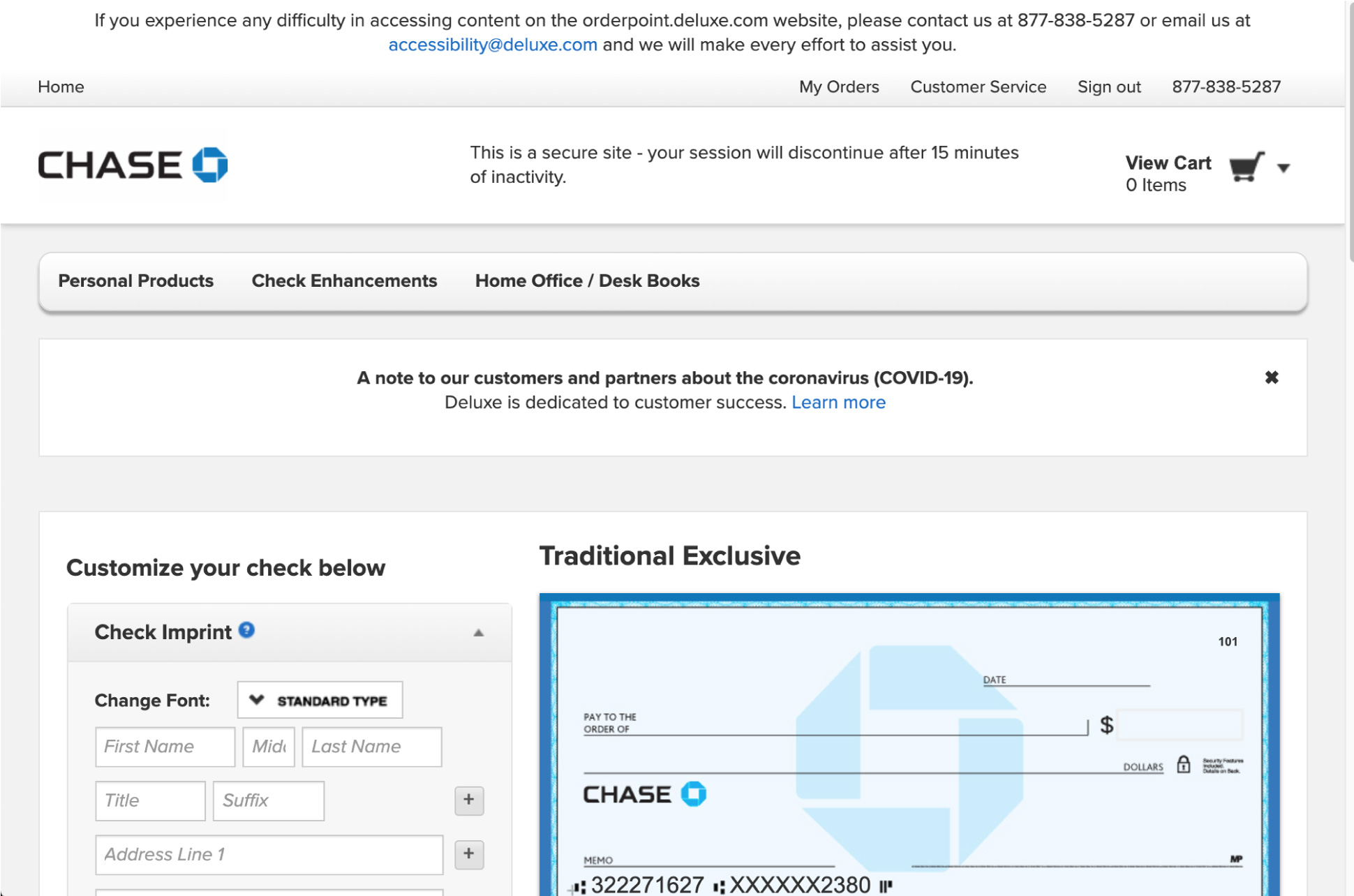

- Log in to Your Chase Account: Visit the official Chase Bank website and log in to your account using your credentials.

- Navigate to the Check Ordering Section: Once logged in, go to the "Customer Center" or "Order Checks" section.

- Select Your Account: Choose the account for which you want to order checks.

- Customize Your Checks: Choose from various designs, colors, and customization options such as adding your logo or signature.

- Review and Confirm Your Order: Double-check the details of your order, including the quantity and design, before confirming.

- Make Payment: Pay for your order using a credit card or directly from your Chase account.

Advantages of Ordering Checks Online

- Convenience: Complete the process from the comfort of your home.

- Time-Saving: Avoid waiting in line at a branch.

- Secure: Your information is protected through Chase's secure platform.

Ordering Checks via Phone

If you prefer speaking to a representative, you can order checks by calling Chase Bank's customer service. This option is ideal for customers who need assistance or have specific questions about their order.

Steps to Order Checks via Phone

- Find the Customer Service Number: Locate the official Chase Bank customer service number on their website.

- Provide Your Account Information: Be ready to share your account details and identification for verification.

- Specify Your Preferences: Inform the representative about the type of checks you need and any customization options.

- Confirm and Pay: Review the order details and make the payment over the phone.

When to Choose Phone Ordering

- If you need personalized assistance.

- When you encounter issues with online ordering.

- If you prefer verbal confirmation of your order.

Ordering Checks In-Branch

For those who prefer face-to-face interactions, visiting a Chase Bank branch is another option. This method allows you to discuss your needs with a bank representative and receive immediate assistance.

Steps to Order Checks In-Branch

- Visit Your Local Chase Branch: Locate the nearest branch using Chase's branch locator tool.

- Speak to a Representative: Request assistance with ordering checks.

- Provide Account Details: Share your account information for verification.

- Select Your Check Design: Choose from available designs and customization options.

- Complete the Order: Confirm your order and make the payment at the branch.

Benefits of In-Branch Ordering

- Personalized service and guidance.

- Immediate resolution of any issues.

- Opportunity to ask questions about other banking services.

Customization Options for Your Checks

Chase Bank offers a variety of customization options to make your checks unique. Whether you're ordering personal or business checks, you can tailor them to suit your preferences.

Read also:Janet From Threes Company Outfits A Stylish Throwback To 70s Fashion

Available Customization Features

- Designs: Choose from standard, premium, or custom designs.

- Colors: Select from a range of color options.

- Logo or Image: Add your business logo or a personal image.

- Security Features: Include watermarks or microprinting for added security.

Why Customize Your Checks?

Customizing your checks not only enhances their appearance but also adds a layer of professionalism, especially for business accounts. Personalized checks can also serve as a branding tool, helping you stand out in professional or personal transactions.

Costs and Fees Associated with Chase Checks

Understanding the costs and fees associated with ordering checks from Chase Bank is essential for budgeting purposes. While Chase offers competitive pricing, additional fees may apply depending on your customization choices.

Breakdown of Costs

- Standard Checks: Typically range from $15 to $30 per box.

- Premium Checks: May cost between $30 and $50 per box.

- Customization Fees: Additional charges for logos, images, or special designs.

- Shipping Fees: Vary based on delivery speed and location.

How to Avoid Hidden Fees

To avoid unexpected charges, always review the pricing details before confirming your order. Additionally, consider bundling your check orders with other banking services to take advantage of discounts or promotions.

Tips for Saving Money on Check Orders

While ordering checks is a necessary expense, there are ways to reduce costs without compromising quality. Here are some tips to help you save money:

Strategies to Save

- Take Advantage of Promotions: Look for discounts or special offers on Chase's website.

- Order in Bulk: Larger quantities often come with reduced per-check costs.

- Choose Standard Designs: Opt for basic designs instead of premium options.

- Use Online Ordering: Online orders may offer lower prices compared to in-branch purchases.

Additional Savings Tips

Consider using third-party check printing services that are compatible with Chase Bank. While Chase's official platform ensures security and compatibility, third-party vendors may offer competitive pricing for standard checks.

Common Questions About Ordering Checks

Here are some frequently asked questions about ordering checks from Chase Bank:

How Long Does It Take to Receive Checks?

Delivery times vary depending on your location and the shipping method chosen. Standard delivery typically takes 7-10 business days, while expedited shipping can reduce this to 3-5 business days.

Can I Order Checks Without an Account?

No, you must have an active Chase Bank account to order checks through their platform.

What If I Make a Mistake in My Order?

Contact Chase Bank's customer service immediately to correct any errors. They may be able to modify your order if it hasn't been processed yet.

Benefits of Ordering Checks from Chase Bank

Ordering checks from Chase Bank offers several advantages that make it a preferred choice for many customers:

Key Benefits

- Convenience: Multiple ordering options to suit your preferences.

- Security: Advanced security features to protect against fraud.

- Customization: Wide range of design and personalization options.

- Reliability: Backed by one of the largest banks in the U.S.

Why Chase Stands Out

Chase Bank's commitment to customer satisfaction, combined with its robust security measures, makes it a trusted choice for ordering checks. Whether you're a first-time user or a long-time customer, Chase provides the tools and support you need to manage your finances effectively.

Conclusion

Ordering checks from Chase Bank is a simple and secure process that offers numerous benefits. Whether you choose to order online, via phone, or in-branch, Chase provides the flexibility and customization options you need to meet your financial requirements. By understanding the steps involved, associated costs, and available customization features, you can make informed decisions and ensure a seamless experience.

If you found this guide helpful, feel free to share it with others who may benefit from it. For more tips and resources on managing your finances, explore our other articles. Don't forget to leave a comment below with your thoughts or questions about ordering checks from Chase Bank!

Young Jodie Foster: The Remarkable Journey Of A Child Prodigy

Baldur's Gate: Troubleshooting The Failed To Save 804 Error

Sons Of Silence: Unveiling The Secrets Of The Infamous Motorcycle Club

How to Write a Chase Check (with Example)

How to Write a Chase Check (with Example)