How Effective Is Experian Boost: A Comprehensive Guide To Boosting Your Credit Score

Are you struggling to improve your credit score despite paying your bills on time? Experian Boost might be the solution you've been looking for. This innovative financial tool has gained significant attention for its ability to help individuals enhance their credit profiles by incorporating everyday payments that traditional credit scoring models often overlook. In today’s world, where credit scores play a critical role in major financial decisions, understanding how Experian Boost works is essential for anyone looking to improve their financial health.

Experian Boost is designed to give you more control over your credit score by allowing you to include utility, phone, and streaming service payments in your credit report. These types of payments are typically not factored into traditional credit scoring models, which can put individuals who are responsible bill payers but have limited credit history at a disadvantage. By adding these payments to your credit file, Experian Boost provides a more comprehensive view of your financial behavior, potentially leading to a higher credit score.

In this article, we will explore how Experian Boost works, its effectiveness, and whether it is the right tool for you. We will also discuss its potential benefits, limitations, and tips for maximizing its impact. Whether you're new to credit building or looking to improve your existing score, this guide will provide you with actionable insights to make informed decisions about your financial future.

Read also:Fadeev A Comprehensive Guide To Understanding The Concept And Its Applications

Table of Contents

What is Experian Boost?

Experian Boost is a free service offered by Experian, one of the three major credit bureaus in the United States. It allows consumers to enhance their credit scores by incorporating positive payment history from utility, phone, and streaming service accounts into their credit reports. Unlike traditional credit scoring models, which primarily focus on credit accounts like loans and credit cards, Experian Boost takes into account payments that reflect responsible financial behavior but are often overlooked.

Key Features of Experian Boost

- Free to Use: Experian Boost is completely free, making it an accessible tool for anyone looking to improve their credit score.

- Instant Updates: Once you link your accounts, Experian Boost updates your credit report in real-time, allowing you to see the impact immediately.

- Customizable: You have control over which accounts and payments are included in your credit report.

By leveraging Experian Boost, individuals can create a more accurate representation of their financial habits, which can be particularly beneficial for those with thin credit files or limited credit history.

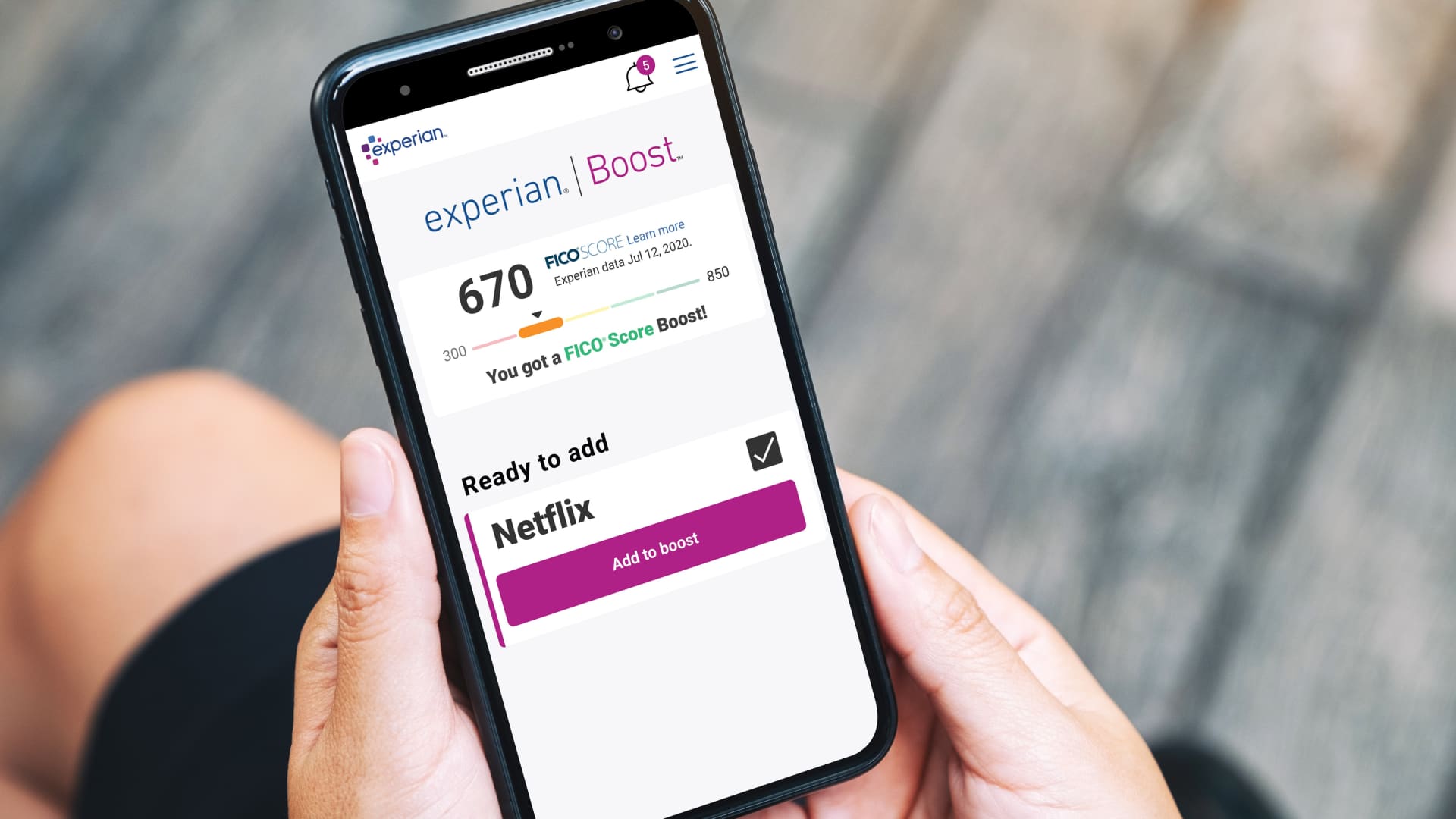

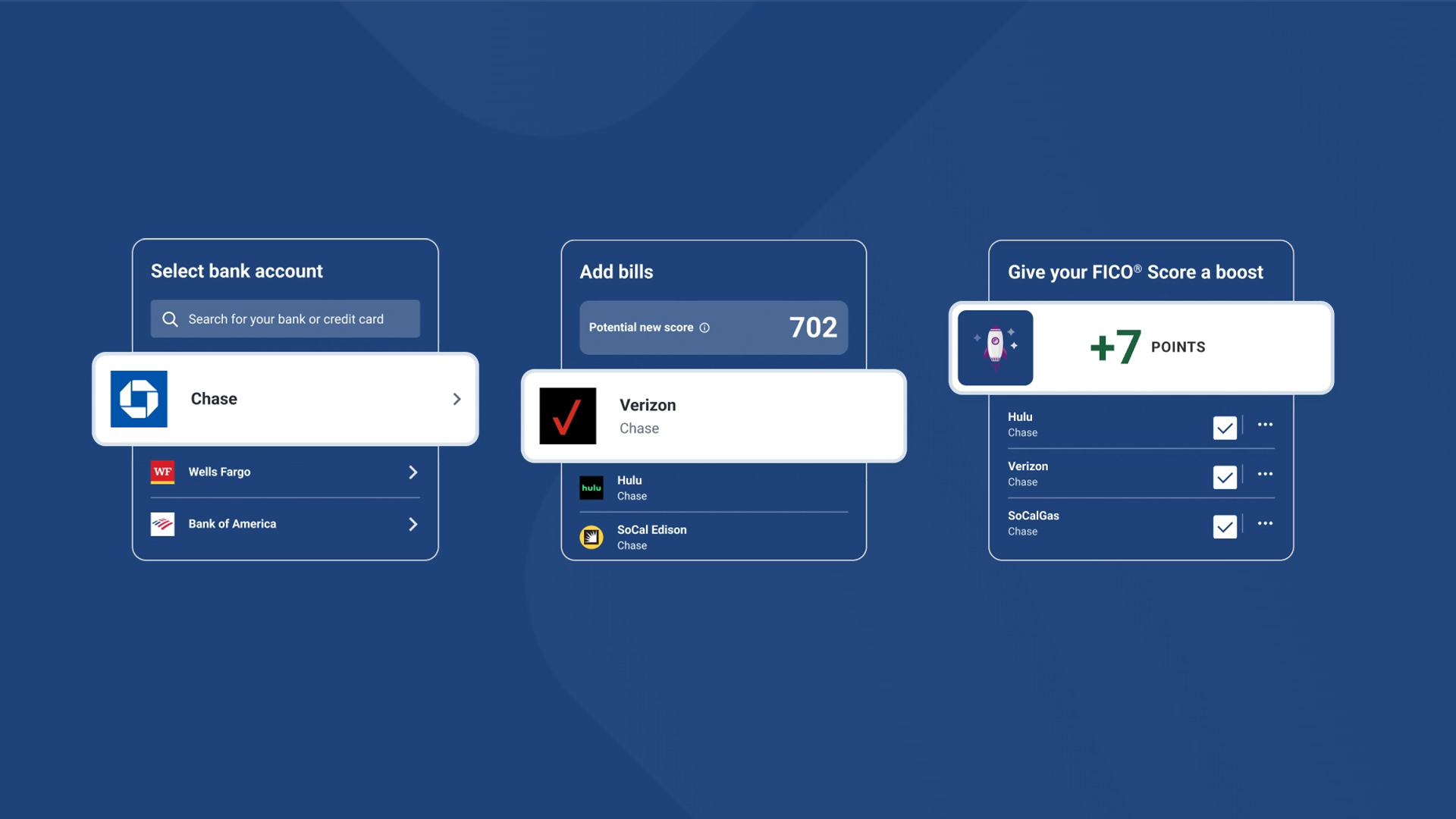

How Does Experian Boost Work?

The process of using Experian Boost is straightforward and user-friendly. Here’s a step-by-step breakdown of how it works:

Step 1: Linking Your Accounts

To get started, you need to create an account on Experian’s website and link your bank accounts. Experian uses secure technology to access your transaction history and identify eligible payments, such as utility bills, phone bills, and streaming service subscriptions.

Step 2: Selecting Payments

Once your accounts are linked, Experian will display a list of eligible payments. You can review these payments and choose which ones you want to include in your credit report. This step ensures that you have full control over the information being added to your credit file.

Step 3: Updating Your Credit Report

After selecting the payments, Experian will update your credit report to reflect this additional positive payment history. Depending on your payment history, you may see an immediate increase in your credit score.

Read also:Most Terrible Jokes Why Theyrsquore Actually The Best

Benefits of Experian Boost

Experian Boost offers several advantages for individuals looking to improve their credit scores. Here are some of the key benefits:

Improved Credit Scores

For many users, Experian Boost has resulted in a noticeable increase in their credit scores. According to Experian, the average user sees a credit score increase of 13 points, with some users experiencing even greater improvements.

Inclusion of Non-Traditional Payments

By incorporating utility, phone, and streaming service payments, Experian Boost provides a more holistic view of your financial behavior. This is particularly beneficial for individuals who pay their bills on time but have limited credit history.

Free and Accessible

Experian Boost is free to use, making it an accessible tool for anyone looking to improve their credit score without incurring additional costs.

Limitations and Considerations

While Experian Boost offers significant benefits, it is important to be aware of its limitations and considerations:

Impact Varies by Individual

The effectiveness of Experian Boost varies depending on your existing credit profile. Individuals with thin credit files or limited credit history are more likely to see significant improvements compared to those with established credit histories.

Not All Payments Are Eligible

Experian Boost only includes payments for utility, phone, and streaming services. Other types of payments, such as rent or medical bills, are not eligible for inclusion.

One-Time Impact

While Experian Boost can provide an initial boost to your credit score, its impact is typically one-time. To maintain or further improve your score, you need to continue practicing responsible financial habits.

Who Should Use Experian Boost?

Experian Boost is particularly beneficial for certain groups of individuals:

Individuals with Thin Credit Files

If you have limited credit history, Experian Boost can help you build a more comprehensive credit profile by including positive payment history from non-traditional sources.

Consumers with Low Credit Scores

For individuals with low credit scores, Experian Boost can provide a quick and effective way to improve their scores, making it easier to qualify for loans, credit cards, and other financial products.

Responsible Bill Payers

If you consistently pay your utility, phone, and streaming service bills on time, Experian Boost can help you leverage these payments to improve your credit score.

How Effective is Experian Boost?

The effectiveness of Experian Boost depends on several factors, including your current credit profile and payment history. Here’s a closer look at how effective Experian Boost can be:

Average Credit Score Increase

According to Experian, the average user sees a credit score increase of 13 points after using Experian Boost. However, some users have reported increases of up to 50 points or more, depending on their payment history and credit profile.

Real-Life Impact

Many users have shared positive experiences with Experian Boost, citing improved credit scores and increased access to financial products. For example, some users have reported qualifying for better interest rates on loans or credit cards after using Experian Boost.

Statistical Evidence

A study conducted by Experian found that 75% of users experienced an increase in their credit scores after using Experian Boost. This statistic highlights the potential effectiveness of the tool for a wide range of individuals.

Tips for Maximizing Experian Boost

To get the most out of Experian Boost, consider the following tips:

Link All Eligible Accounts

Ensure that you link all eligible accounts to maximize the number of positive payments included in your credit report.

Pay Bills on Time

Consistently paying your utility, phone, and streaming service bills on time is crucial for maximizing the impact of Experian Boost.

Monitor Your Credit Report

Regularly monitor your credit report to ensure that all payments are accurately reflected and to identify any potential errors.

Alternatives to Experian Boost

While Experian Boost is a powerful tool, there are other options available for improving your credit score:

Credit Builder Loans

Credit builder loans are designed to help individuals build credit by making small, manageable payments over time.

Authorized User Status

Becoming an authorized user on someone else’s credit card account can help you build credit, provided the primary account holder has a positive payment history.

Secured Credit Cards

Secured credit cards require a security deposit and are an excellent option for individuals looking to build or rebuild their credit.

Real-Life Experiences with Experian Boost

To provide a more personal perspective, let’s take a look at some real-life experiences with Experian Boost:

Case Study 1: Sarah’s Story

Sarah, a 28-year-old marketing professional, struggled to improve her credit score despite paying her bills on time. After using Experian Boost, she saw her credit score increase by 25 points, which helped her qualify for a car loan with a better interest rate.

Case Study 2: John’s Journey

John, a 35-year-old entrepreneur, had a thin credit file due to his limited use of credit cards. By using Experian Boost, he was able to include his utility and phone payments in his credit report, resulting in a 15-point increase in his credit score.

Conclusion

Experian Boost is a powerful tool for individuals looking to improve their credit scores by leveraging non-traditional payment history. By incorporating utility, phone, and streaming service payments into your credit report, Experian Boost provides a more comprehensive view of your financial behavior, potentially leading to a higher credit score.

While Experian Boost is not a one-size-fits-all solution, it can be particularly beneficial for individuals with thin credit files or limited credit history. By following the tips outlined in this article, you can maximize the impact of Experian Boost and take control of your financial future.

We encourage you to share your experiences with Experian Boost in the comments below or explore other articles on our site for more insights into improving your credit score. Together, we can build a stronger financial foundation for everyone.

Understanding Scam Advisor: Your Ultimate Guide To Identifying Online Scams

How To Fix BG3 Save Game Error 804: A Comprehensive Guide

Tosa Inu: A Comprehensive Guide To Japan's Majestic And Powerful Dog Breed

How Experian Boost Can Help Raise Your Credit Score

Experian Boost® Review Improve Your Credit Score