Will Lenders Use My Experian Boost Score? Everything You Need To Know

Are you curious about whether lenders will consider your Experian Boost score when evaluating your creditworthiness? This question is on the minds of many consumers who are looking to improve their financial standing. Experian Boost is a relatively new tool designed to help individuals enhance their credit scores by incorporating alternative data, such as utility and streaming service payments, into their credit reports. Understanding how this score impacts lending decisions is crucial for anyone aiming to secure loans or credit cards. In this article, we’ll explore everything you need to know about Experian Boost, its role in the lending process, and how it can affect your financial future.

Experian Boost has gained significant attention since its introduction, as it offers a unique way to improve credit scores without relying solely on traditional credit accounts. For many people, especially those with limited credit history, this tool can be a game-changer. However, its adoption by lenders is not universal, and there are important factors to consider when determining whether it will benefit you in loan applications. This article will delve into the specifics of how Experian Boost works, its acceptance among lenders, and its potential impact on your financial decisions.

In the following sections, we’ll break down the mechanics of Experian Boost, explore its benefits and limitations, and provide actionable insights for consumers. Whether you’re a first-time borrower or someone looking to rebuild credit, this guide will help you navigate the complexities of credit scoring and lending practices. By the end of this article, you’ll have a clear understanding of whether Experian Boost can play a role in your financial journey.

Read also:Chris Browns Father A Deep Dive Into His Life And Influence

Table of Contents

- What is Experian Boost?

- How Does Experian Boost Work?

- Benefits of Using Experian Boost

- Limitations and Challenges

- Do Lenders Use Experian Boost?

- How to Improve Your Credit Score Beyond Experian Boost

- Factors Lenders Consider Beyond Credit Scores

- Real-Life Examples of Experian Boost Users

- Frequently Asked Questions About Experian Boost

- Conclusion

What is Experian Boost?

Experian Boost is a free service offered by Experian, one of the three major credit bureaus in the United States. It allows consumers to add positive payment history from utility bills, phone bills, and streaming services to their credit reports. The goal of this tool is to provide a more comprehensive view of an individual’s financial responsibility, especially for those who may not have extensive credit histories.

Traditionally, credit scores are calculated based on factors such as credit card payments, loans, and mortgages. However, many people regularly pay their utility and phone bills on time but don’t receive credit for these payments in their credit reports. Experian Boost bridges this gap by incorporating these payments, potentially increasing a consumer’s credit score.

It’s important to note that Experian Boost only affects your Experian credit report and not the reports from the other two credit bureaus, Equifax and TransUnion. This means that lenders who rely on data from Equifax or TransUnion may not see the impact of Experian Boost on your credit profile.

How Does Experian Boost Work?

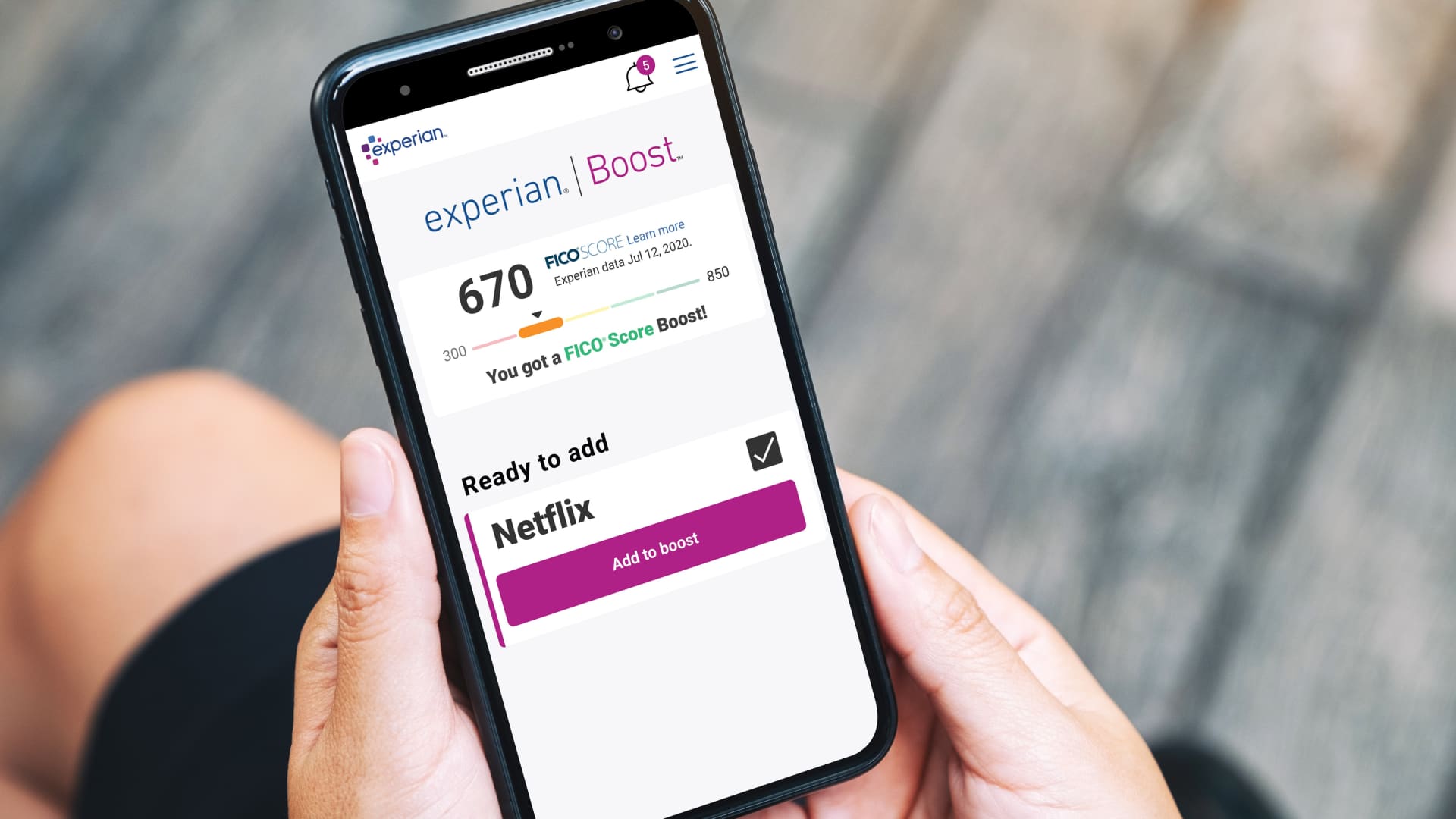

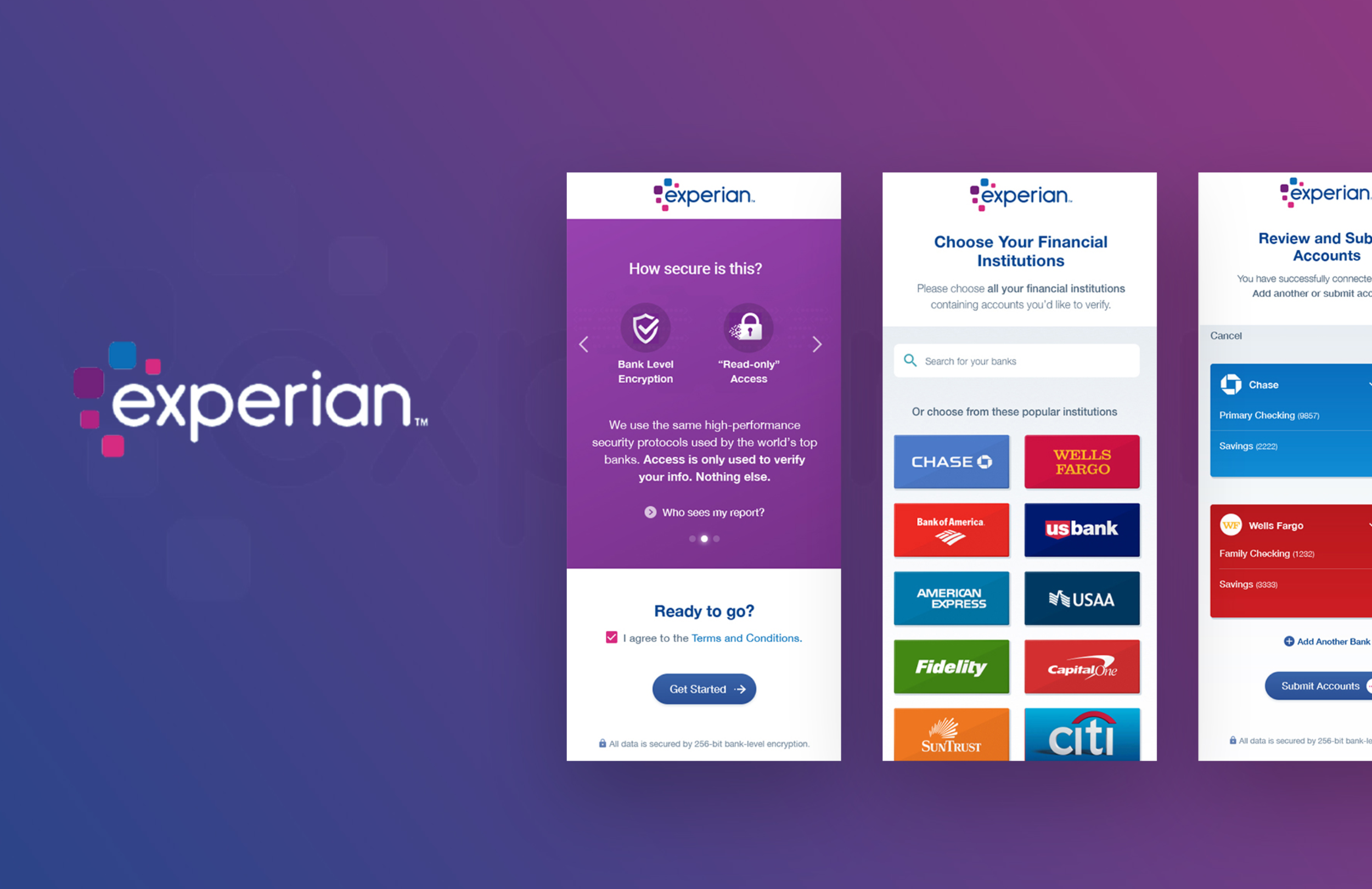

Using Experian Boost is a straightforward process. First, you’ll need to create an account on Experian’s website and link your bank accounts. Once linked, Experian will analyze your transaction history to identify qualifying payments, such as utility bills, phone bills, and subscriptions. These payments are then added to your Experian credit report.

After the data is incorporated, your Experian credit score may be recalculated to reflect the new information. Many users have reported an immediate increase in their credit scores after using Experian Boost. However, the extent of the increase varies depending on your existing credit profile and payment history.

Qualifying Payments

Not all payments qualify for Experian Boost. The tool primarily focuses on recurring payments for:

Read also:Tamra Judges Fitness Journey Inspiring Transformation And Wellness Tips

- Utility bills (electricity, water, gas)

- Phone and internet services

- Streaming services (Netflix, Hulu, etc.)

Payments that are inconsistent or irregular, such as one-time purchases or late payments, are not included in the calculation.

Benefits of Using Experian Boost

Experian Boost offers several advantages for consumers, particularly those with limited credit history or thin credit files. Below are some of the key benefits:

Improved Credit Scores

For many users, Experian Boost can lead to an immediate increase in their credit scores. According to Experian, the average user sees a credit score increase of 13 points. This boost can make a significant difference when applying for loans, credit cards, or rental agreements.

Inclusion of Alternative Data

By incorporating alternative data, Experian Boost provides a more holistic view of an individual’s financial behavior. This is particularly beneficial for people who may not have traditional credit accounts but consistently pay their utility and phone bills on time.

Free and Easy to Use

Experian Boost is a free service, making it accessible to anyone looking to improve their credit score. The setup process is simple and can be completed in a matter of minutes.

Limitations and Challenges

While Experian Boost offers numerous benefits, it’s not without its limitations. Understanding these challenges is essential for managing your expectations and making informed financial decisions.

Limited Impact on Other Bureaus

As mentioned earlier, Experian Boost only affects your Experian credit report. Lenders who rely on data from Equifax or TransUnion may not see the improvements reflected in your Experian score.

Not All Lenders Use Experian

Some lenders may prioritize data from other credit bureaus or use their own proprietary scoring models. In such cases, the impact of Experian Boost may be negligible.

Potential for Misuse

If not used responsibly, Experian Boost could lead to overconfidence in one’s creditworthiness. It’s important to remember that improving your credit score is just one aspect of financial health.

Do Lenders Use Experian Boost?

One of the most common questions about Experian Boost is whether lenders actually consider it when evaluating loan applications. The answer is nuanced and depends on several factors.

While Experian Boost can improve your Experian credit score, not all lenders use Experian as their primary credit bureau. Some lenders may rely on data from Equifax or TransUnion, while others use a combination of all three. Additionally, certain lenders use their own scoring models that may not incorporate the data added through Experian Boost.

Acceptance Among Lenders

Despite these limitations, many lenders have started recognizing the value of alternative data in assessing creditworthiness. Experian Boost is particularly appealing to lenders who want to provide opportunities for underserved populations, such as young adults or immigrants with limited credit history.

Impact on Mortgage and Auto Loans

For major financial decisions like mortgages and auto loans, lenders typically conduct a thorough review of an applicant’s credit profile. While Experian Boost can help improve your credit score, it’s unlikely to be the sole determining factor in these high-stakes decisions.

How to Improve Your Credit Score Beyond Experian Boost

While Experian Boost can be a valuable tool, it’s important to adopt a comprehensive approach to improving your credit score. Below are some additional strategies to consider:

Pay Bills on Time

Payment history is the most significant factor in your credit score. Consistently paying your bills on time can have a substantial positive impact on your credit profile.

Reduce Debt

High levels of debt can negatively affect your credit utilization ratio. Aim to pay down existing balances and avoid taking on new debt unnecessarily.

Monitor Your Credit Report

Regularly reviewing your credit report can help you identify errors or discrepancies that may be dragging down your score. You’re entitled to one free credit report from each bureau annually through AnnualCreditReport.com.

Factors Lenders Consider Beyond Credit Scores

While credit scores are an essential part of the lending process, they’re not the only factor lenders consider. Below are some additional criteria that can influence lending decisions:

Income and Employment History

Lenders want to ensure that borrowers have a stable source of income to repay their debts. A strong employment history and consistent income can improve your chances of loan approval.

Debt-to-Income Ratio

This ratio compares your monthly debt payments to your gross monthly income. A lower debt-to-income ratio is generally viewed more favorably by lenders.

Credit History Length

The length of your credit history can also impact lending decisions. Longer credit histories provide more data for lenders to assess your financial behavior.

Real-Life Examples of Experian Boost Users

To better understand the impact of Experian Boost, let’s look at some real-life examples of individuals who have used the tool to improve their credit scores.

Case Study 1: Sarah’s Journey to Homeownership

Sarah, a first-time homebuyer, struggled to qualify for a mortgage due to her limited credit history. After using Experian Boost, her credit score increased by 20 points, making her eligible for a competitive mortgage rate. This improvement allowed her to secure financing for her dream home.

Case Study 2: John’s Credit Rebuilding Efforts

John, who had previously faced financial difficulties, used Experian Boost to demonstrate his financial responsibility. By adding his utility and phone payments to his credit report, he was able to rebuild his credit and qualify for an auto loan.

Frequently Asked Questions About Experian Boost

Here are some common questions and answers about Experian Boost:

Is Experian Boost Safe to Use?

Yes, Experian Boost is a secure service. Your bank account information is encrypted, and Experian does not store your login credentials.

Can Experian Boost Hurt My Credit Score?

No, Experian Boost cannot lower your credit score. It only adds positive payment history to your credit report.

How Long Does It Take to See Results?

Most users see an immediate increase in their credit score after linking their accounts and adding qualifying payments.

Conclusion

Experian Boost is a powerful tool for individuals looking to improve their credit scores by incorporating alternative data into their credit reports. While it may not be universally adopted by all lenders, its benefits are undeniable for those with limited credit history or thin credit files. By understanding how Experian Boost works, its limitations, and its potential impact on lending decisions, you can make informed choices about your financial future.

Remember, improving your credit score is just one piece of the puzzle. Focus on maintaining good financial habits, such as paying bills on time and reducing debt, to achieve long-term financial success. If you found this article helpful, consider sharing it with others or exploring more resources on our website to continue your financial education journey.

Discover The Charm Of Latrobe, PA: A Hidden Gem In Pennsylvania

Discover The Best Music With RateYourMusic App: Your Ultimate Guide

Jamie Siminoff Net Worth 2024: A Comprehensive Guide To His Wealth And Achievements

How Experian Boost Can Help Raise Your Credit Score

Experian