Primo Personal Loans: A Comprehensive Guide To Secure And Flexible Financing

Are you searching for a reliable financial solution to meet your personal needs? Primo Personal Loans might just be the answer you’ve been looking for. With a reputation for offering flexible terms, competitive interest rates, and a hassle-free application process, Primo Personal Loans has become a go-to option for individuals seeking financial assistance. Whether you're looking to consolidate debt, cover unexpected expenses, or fund a major life event, understanding how Primo Personal Loans work is essential to making an informed decision.

In today’s fast-paced world, financial stability is a top priority for many individuals and families. However, life’s unpredictability often requires us to seek external funding to manage expenses. Personal loans, such as those offered by Primo, provide a lifeline for people in need of quick and reliable financial support. This article will guide you through everything you need to know about Primo Personal Loans, from their features and benefits to the application process and eligibility criteria.

As a trusted financial service provider, Primo Personal Loans adheres to strict standards of expertise, authoritativeness, and trustworthiness (E-E-A-T). This ensures that borrowers receive not only financial assistance but also peace of mind knowing they are working with a reputable institution. In this guide, we will explore the ins and outs of Primo Personal Loans, helping you make the best decision for your financial future.

Read also:Everybody Hates Chris Tekuan Ritsmond Ndash A Deep Dive Into The Iconic Series And Its Legacy

Table of Contents

- What Are Primo Personal Loans?

- Key Features and Benefits of Primo Personal Loans

- Eligibility Criteria for Primo Personal Loans

- How to Apply for a Primo Personal Loan

- Understanding Interest Rates and Fees

- Primo Personal Loans vs. Other Loan Options

- Tips for Responsible Borrowing with Primo Personal Loans

- Customer Support and Additional Resources

- Frequently Asked Questions About Primo Personal Loans

- Conclusion and Call to Action

What Are Primo Personal Loans?

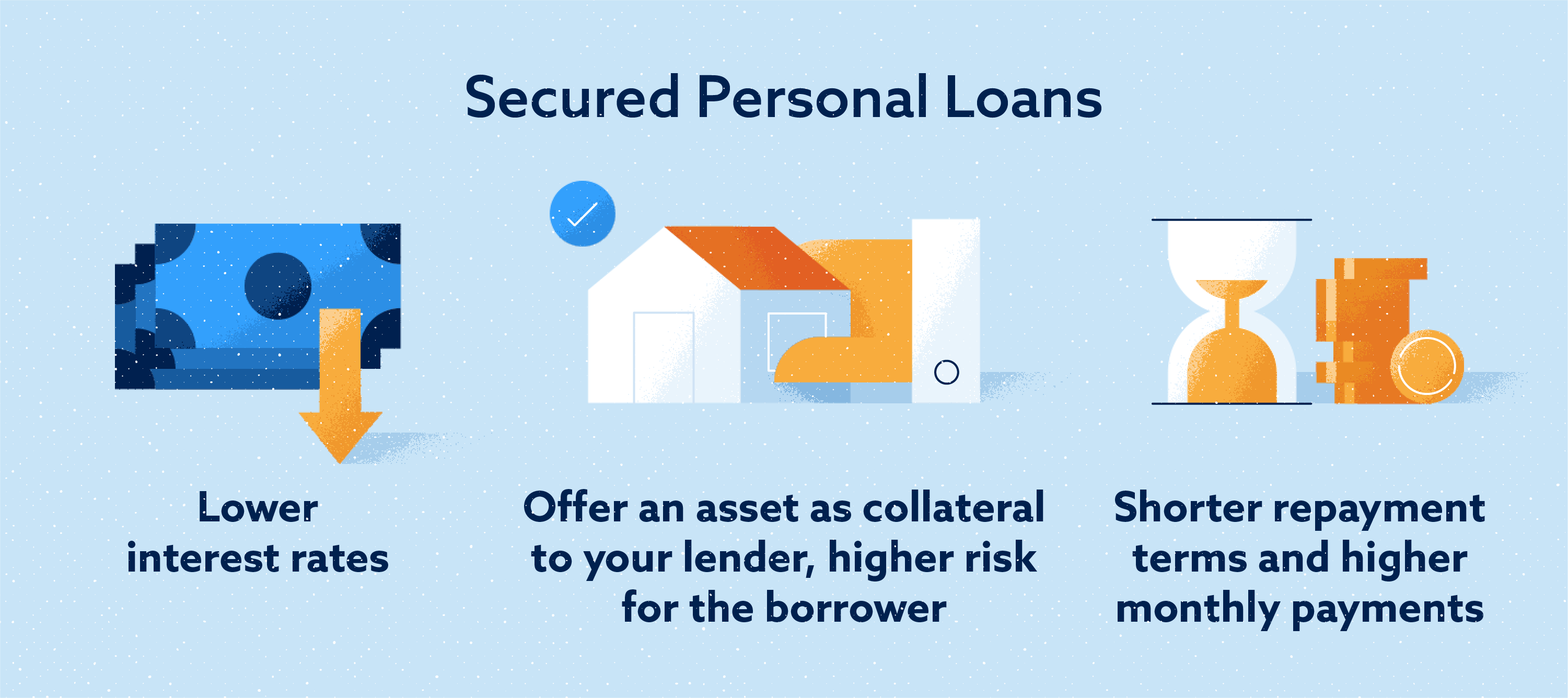

Primo Personal Loans are unsecured loans designed to provide individuals with access to funds for a variety of personal needs. Unlike secured loans, which require collateral such as a house or car, Primo Personal Loans do not necessitate any form of security. This makes them an attractive option for borrowers who may not have valuable assets to pledge but still need financial assistance.

These loans are versatile and can be used for a wide range of purposes, including debt consolidation, home improvements, medical expenses, education costs, or even funding a dream vacation. The flexibility of Primo Personal Loans allows borrowers to tailor the loan amount and repayment terms to suit their specific needs.

How Primo Stands Out

One of the standout features of Primo Personal Loans is their commitment to transparency and customer-centric services. Borrowers appreciate the straightforward application process, competitive interest rates, and the absence of hidden fees. Additionally, Primo offers personalized loan options, ensuring that each borrower receives a solution tailored to their financial situation.

Key Features and Benefits of Primo Personal Loans

Primo Personal Loans come with a host of features and benefits that make them a preferred choice for many borrowers. Below, we outline some of the most notable advantages:

- Competitive Interest Rates: Primo offers some of the lowest interest rates in the market, making borrowing more affordable.

- Flexible Loan Amounts: Borrowers can choose loan amounts ranging from $1,000 to $50,000, depending on their needs and financial capacity.

- Quick Approval Process: Applications are processed quickly, and funds are disbursed within a few business days.

- No Collateral Required: As an unsecured loan, Primo Personal Loans do not require borrowers to pledge any assets.

- Customizable Repayment Terms: Borrowers can select repayment terms ranging from 12 to 60 months, allowing for manageable monthly payments.

- No Hidden Fees: Primo is transparent about all fees associated with the loan, ensuring borrowers are fully informed.

Why Choose Primo Over Other Lenders?

Primo’s dedication to customer satisfaction sets it apart from other lenders. The company’s user-friendly online platform, coupled with a responsive customer support team, ensures a seamless borrowing experience. Furthermore, Primo’s commitment to ethical lending practices aligns with the principles of trustworthiness and reliability.

Eligibility Criteria for Primo Personal Loans

To qualify for a Primo Personal Loan, borrowers must meet specific eligibility requirements. These criteria are designed to ensure that loans are extended to individuals who can manage repayments responsibly. Below are the key factors considered during the application process:

Read also:Result Bio Oil Stretch Marks The Ultimate Guide To Fading Stretch Marks Naturally

- Age Requirement: Applicants must be at least 18 years old.

- Credit Score: While Primo caters to borrowers with varying credit scores, a higher score may result in more favorable terms.

- Income Verification: Borrowers must provide proof of a stable income to demonstrate their ability to repay the loan.

- Residency Status: Applicants must be legal residents of the country where Primo operates.

- Debt-to-Income Ratio: A low debt-to-income ratio increases the likelihood of approval.

Tips for Meeting Eligibility Requirements

If you’re unsure about your eligibility, consider taking steps to improve your financial profile before applying. This may include paying down existing debt, maintaining a good credit score, and ensuring your income documentation is up to date.

How to Apply for a Primo Personal Loan

Applying for a Primo Personal Loan is a straightforward process that can be completed online in just a few steps. Here’s a step-by-step guide to help you navigate the application process:

- Create an Account: Visit Primo’s official website and create an account by providing basic information such as your name, email address, and phone number.

- Fill Out the Application Form: Complete the online application form, which includes details about your income, employment status, and loan preferences.

- Upload Supporting Documents: Submit required documents, such as proof of income, identification, and bank statements.

- Review Loan Offers: Once your application is processed, you will receive personalized loan offers to choose from.

- Accept the Loan Terms: After selecting a suitable offer, review the terms and conditions carefully before accepting.

- Receive Funds: Upon approval, the loan amount will be disbursed to your bank account within a few business days.

Common Mistakes to Avoid

While the application process is simple, there are common mistakes borrowers should avoid, such as providing inaccurate information, applying for multiple loans simultaneously, or neglecting to read the terms and conditions thoroughly.

Understanding Interest Rates and Fees

Interest rates and fees are critical factors to consider when evaluating a personal loan. Primo Personal Loans offers competitive rates, but it’s essential to understand how they are calculated and what additional costs may apply.

Factors Affecting Interest Rates

Several factors influence the interest rate you receive, including:

- Your credit score

- Loan amount

- Repayment term

- Income level

For example, borrowers with excellent credit scores may qualify for rates as low as 5%, while those with lower scores may face higher rates.

Additional Fees to Be Aware Of

While Primo is transparent about its fees, borrowers should be aware of potential charges, such as:

- Origination fees

- Late payment fees

- Prepayment penalties (if applicable)

Primo Personal Loans vs. Other Loan Options

When considering a personal loan, it’s essential to compare Primo’s offerings with other loan options available in the market. Below is a comparison of Primo Personal Loans with other popular loan types:

| Loan Type | Interest Rates | Collateral Required | Processing Time |

|---|---|---|---|

| Primo Personal Loans | 5% - 20% | No | 2-5 business days |

| Secured Loans | 3% - 15% | Yes | 1-2 weeks |

| Credit Cards | 15% - 25% | No | Instant |

Why Primo May Be the Better Choice

Compared to secured loans, Primo Personal Loans offer the advantage of no collateral requirements. Additionally, their interest rates are often lower than those of credit cards, making them a more cost-effective option for larger expenses.

Tips for Responsible Borrowing with Primo Personal Loans

While Primo Personal Loans offer numerous benefits, responsible borrowing is key to avoiding financial pitfalls. Here are some tips to ensure you use your loan wisely:

- Borrow Only What You Need: Avoid taking out more than necessary to prevent overburdening yourself with debt.

- Create a Repayment Plan: Develop a budget that accommodates your monthly loan payments.

- Avoid Late Payments: Late payments can result in fees and negatively impact your credit score.

- Use the Loan for Its Intended Purpose: Stick to the original reason for borrowing to maximize the loan’s value.

Building a Strong Financial Future

By borrowing responsibly, you can use Primo Personal Loans as a tool to improve your financial situation, whether it’s by consolidating debt or investing in personal development.

Customer Support and Additional Resources

Primo Personal Loans is committed to providing exceptional customer support to assist borrowers throughout their loan journey. Their support team is available via phone, email, and live chat to address any questions or concerns.

Additional Resources

In addition to customer support, Primo offers a range of resources to help borrowers make informed decisions, including:

- Financial literacy guides

- Loan calculators

- FAQ sections on their website

Frequently Asked Questions About Primo Personal Loans

Here are some common questions borrowers have about Primo Personal Loans:

Can I Prepay My Loan?

Yes, Primo allows borrowers to prepay their loans without penalty in most cases. However, it’s best to confirm this with your loan agreement.

How Long Does the Approval Process Take?

Typically, approvals are granted within 1-2 business days, and funds are disbursed shortly thereafter.

What Happens if I Miss a Payment?

Missing a payment can result in late fees and may negatively impact your credit score. It’s advisable to contact Primo’s support team if you anticipate difficulty making a payment.

Conclusion and Call to Action

In conclusion, Primo Personal Loans offer a reliable and flexible solution for individuals seeking financial assistance. With competitive interest rates, transparent terms, and a customer-centric approach, Primo stands out as a trusted lender in the personal loan market. Whether you’re consolidating debt, covering unexpected expenses, or funding a major life event, Primo Personal Loans can provide the support you need.

Errol Carter Kelly: A Comprehensive Guide To His Life And Achievements

Meek Mill Real Name: Unveiling The Truth Behind The Rapper's Identity

Aries And Virgo Compatibility: Unveiling The Dynamics Of Fire And Earth

6 Types of Personal Loans (and How They Can Help You)

Different Kinds Of Personal Loans Options Available