US Bank Layoffs 2025: What You Need To Know

In recent years, the banking industry in the United States has been undergoing significant changes, driven by technological advancements, economic shifts, and evolving consumer demands. One of the most pressing concerns for employees and stakeholders is the potential wave of layoffs expected to hit the sector by 2025. As banks strive to adapt to a rapidly changing landscape, workforce reductions have become a recurring theme. This article dives deep into the factors contributing to US bank layoffs in 2025, their implications, and what individuals and organizations can do to navigate this challenging period.

The banking sector has always been sensitive to economic cycles, regulatory changes, and technological disruptions. In 2025, these factors are converging in unprecedented ways, creating a perfect storm that could lead to widespread layoffs. From automation and artificial intelligence to cost-cutting measures and shifting customer preferences, banks are reevaluating their operational strategies. This raises critical questions about job security, career transitions, and the future of work in the financial services industry.

Understanding the dynamics behind these layoffs is essential for employees, job seekers, and industry observers. Whether you’re a banking professional concerned about your career trajectory or a business leader seeking insights into workforce trends, this article provides a comprehensive overview of the situation. By exploring the root causes, potential impacts, and actionable solutions, we aim to equip you with the knowledge needed to make informed decisions in these uncertain times.

Read also:Khali Daniya Renee Spraggins A Rising Star In Movies And Tv Shows

Table of Contents

- Introduction to US Bank Layoffs 2025

- Key Factors Driving Layoffs

- Technological Advancements and Automation

- Economic Challenges and Market Pressures

- Regulatory Changes and Compliance Costs

- Impact on Employees and Workforce

- Case Studies of Recent Layoffs

- Strategies for Navigating Layoffs

- Future of the Banking Industry

- Conclusion and Call to Action

Introduction to US Bank Layoffs 2025

US bank layoffs in 2025 are projected to be among the most significant workforce disruptions in the financial services industry in recent history. This trend is not isolated to a single institution but is expected to affect banks of all sizes, from regional players to global giants. The primary drivers of these layoffs include technological innovation, economic uncertainties, and regulatory changes.

As banks increasingly adopt digital solutions to streamline operations and enhance customer experiences, many traditional roles are becoming obsolete. For instance, the rise of online banking platforms and mobile apps has reduced the need for in-branch staff. Similarly, advancements in artificial intelligence and machine learning are automating tasks that were once performed by human employees, such as data analysis, fraud detection, and customer service.

While layoffs are often viewed negatively, they also present opportunities for growth and transformation. Employees who proactively upskill and adapt to the changing landscape may find themselves in high demand for emerging roles. Additionally, banks that strategically manage workforce transitions can position themselves as leaders in innovation and customer satisfaction.

Key Factors Driving Layoffs

Technological Advancements and Automation

One of the most significant contributors to US bank layoffs in 2025 is the rapid adoption of technology and automation. Banks are investing heavily in digital transformation to remain competitive and meet evolving customer expectations. This includes the implementation of AI-driven chatbots, robotic process automation (RPA), and advanced analytics tools.

- AI and Machine Learning: These technologies are being used to automate repetitive tasks, such as loan processing and risk assessment, reducing the need for manual intervention.

- Robotic Process Automation (RPA): RPA is streamlining back-office operations, such as data entry and compliance reporting, leading to workforce reductions in these areas.

- Blockchain Technology: The adoption of blockchain is transforming payment systems and reducing reliance on intermediaries, further impacting job roles.

While automation offers numerous benefits, such as increased efficiency and cost savings, it also raises concerns about job displacement. Employees in roles that are highly susceptible to automation, such as tellers and administrative staff, are particularly vulnerable to layoffs.

Economic Challenges and Market Pressures

The economic environment plays a crucial role in shaping workforce trends in the banking industry. In 2025, banks are facing mounting pressure to cut costs and improve profitability amid slowing economic growth and rising interest rates. This has led to a focus on workforce optimization as a means of achieving financial stability.

Read also:Kelly Reilly Feet A Comprehensive Guide To Her Style Roles And Influence

- Interest Rate Hikes: The Federal Reserve’s monetary policy decisions have increased borrowing costs, affecting banks’ lending activities and profitability.

- Market Volatility: Uncertainty in global markets has prompted banks to adopt a more cautious approach, leading to reduced hiring and potential layoffs.

- Cost-Cutting Measures: Many banks are implementing cost-reduction strategies, such as consolidating branches and outsourcing non-core functions.

These economic challenges are forcing banks to reassess their operational models and make difficult decisions about workforce size and composition. While some layoffs are inevitable, banks must balance cost-cutting measures with the need to retain skilled talent and maintain customer trust.

Regulatory Changes and Compliance Costs

Regulatory changes are another key factor driving layoffs in the US banking sector. In response to the financial crisis of 2008, regulatory bodies such as the Federal Reserve and the Securities and Exchange Commission (SEC) have imposed stricter oversight and compliance requirements on banks. While these regulations aim to enhance financial stability, they also increase operational costs and administrative burdens.

- Compliance Workforce: Banks are required to maintain large teams dedicated to compliance and risk management, diverting resources from other areas.

- Regulatory Reporting: The need for accurate and timely reporting has led to increased demand for specialized roles, while other positions may be eliminated.

- Impact of New Regulations: Emerging regulations, such as those related to data privacy and cybersecurity, are forcing banks to reevaluate their staffing needs.

While regulatory changes are necessary to ensure the integrity of the financial system, they also contribute to workforce instability. Banks must carefully manage the transition to a more compliant and efficient operating model to minimize the impact on employees.

Impact on Employees and Workforce

The wave of layoffs expected in 2025 will have far-reaching implications for employees and the broader workforce. Job losses in the banking sector can lead to financial hardship, reduced consumer spending, and increased unemployment rates. However, the impact is not limited to those directly affected by layoffs.

For employees who remain with their organizations, the threat of layoffs can create a culture of uncertainty and anxiety. This may result in decreased morale, productivity, and engagement. Additionally, the skills gap created by layoffs can hinder banks’ ability to innovate and adapt to changing market conditions.

To mitigate these challenges, banks must prioritize workforce development and support initiatives. This includes offering retraining programs, career counseling, and severance packages to affected employees. By investing in their workforce, banks can foster loyalty, retain talent, and maintain a positive reputation.

Case Studies of Recent Layoffs

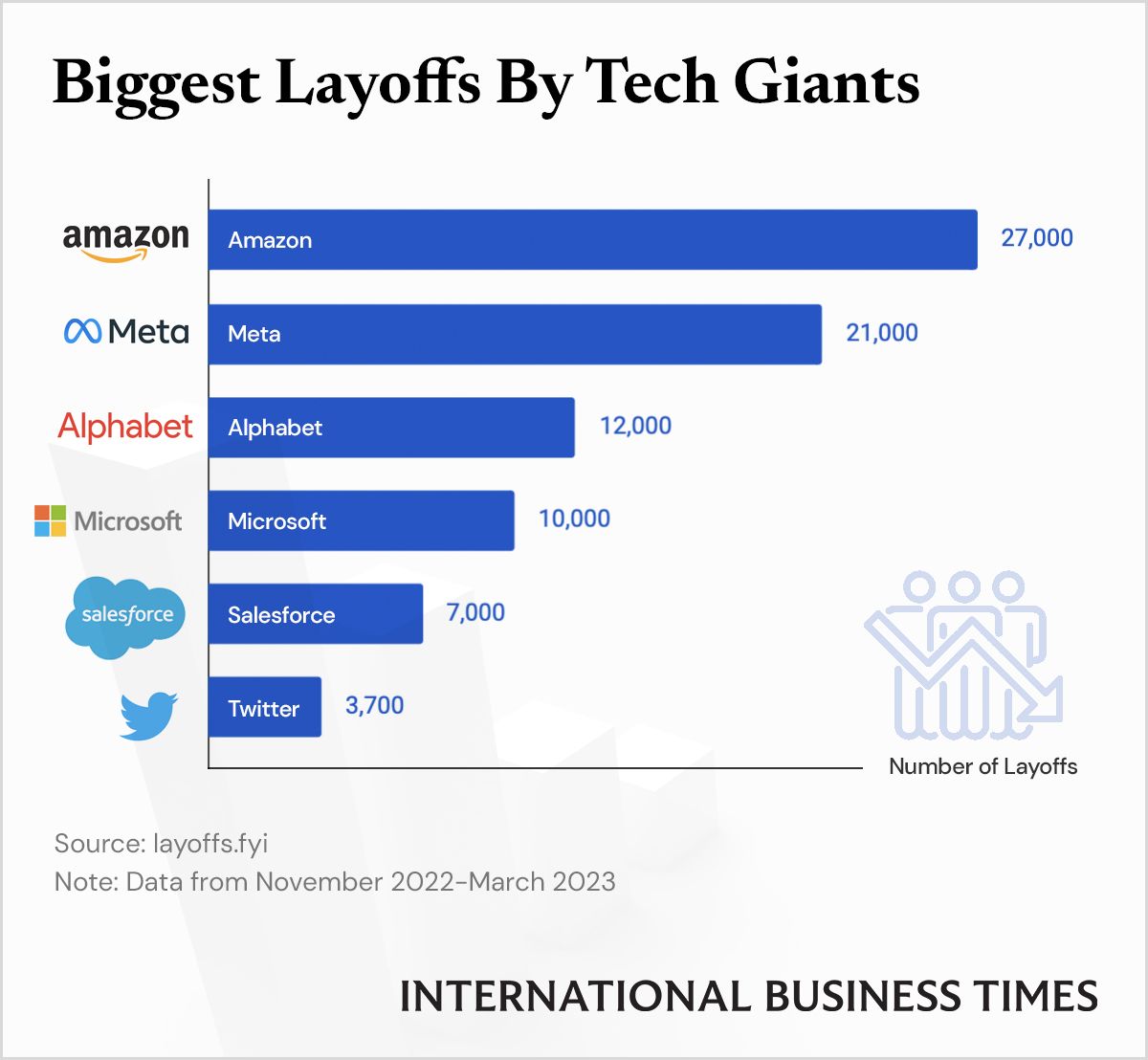

Several high-profile layoffs in the banking industry provide valuable insights into the trends and challenges shaping the sector. For example, in 2023, a major US bank announced plans to cut 10% of its workforce due to cost pressures and technological advancements. Similarly, another global bank implemented a restructuring program that resulted in the elimination of thousands of jobs.

These case studies highlight the importance of strategic planning and communication in managing layoffs. Banks that proactively engage with employees, stakeholders, and the public are better positioned to navigate workforce transitions successfully. Additionally, these examples underscore the need for banks to balance short-term cost-cutting measures with long-term growth strategies.

Strategies for Navigating Layoffs

For employees facing the prospect of layoffs, it is essential to take proactive steps to protect their careers and financial well-being. This includes upskilling, networking, and exploring alternative employment opportunities. Additionally, individuals should familiarize themselves with their rights and entitlements under employment law.

Banks, on the other hand, must adopt a holistic approach to workforce management. This includes implementing transparent communication strategies, offering support programs, and investing in employee development. By prioritizing the needs of their workforce, banks can build resilience and adaptability in the face of change.

Future of the Banking Industry

The future of the banking industry is likely to be shaped by continued technological innovation, evolving customer expectations, and regulatory developments. While layoffs may be an unfortunate consequence of these changes, they also present opportunities for growth and transformation.

As banks embrace digital transformation, new roles and career paths are emerging in areas such as cybersecurity, data analytics, and customer experience. By investing in education and training, employees can position themselves for success in the evolving job market. Similarly, banks that prioritize innovation and workforce development can strengthen their competitive advantage and drive long-term success.

Conclusion and Call to Action

In conclusion, US bank layoffs in 2025 are a complex and multifaceted issue driven by technological advancements, economic challenges, and regulatory changes. While these layoffs pose significant challenges for employees and organizations, they also offer opportunities for growth and transformation. By understanding the root causes and implications of these workforce disruptions, individuals and businesses can take proactive steps to navigate this period of change successfully.

We encourage readers to share their thoughts and experiences in the comments section below. Have you been impacted by layoffs in the banking sector? What strategies have you found effective in adapting to these changes? Additionally, we invite you to explore other articles on our site for more insights into workforce trends and career development. Together, we can build a more resilient and future-ready banking industry.

Gwyn Vose: A Comprehensive Guide To His Life, Achievements, And Influence

Fry99.c: A Comprehensive Guide To Understanding And Utilizing This Versatile Tool

Understanding IBI Architecture: A Comprehensive Guide

Layoffs 2025 Statistics Sk Luna Anisa

Bank Of America The Layoff