Top Subprime Auto Lenders: A Comprehensive Guide To Financing Options

Table of Contents

Introduction

Are you looking for a reliable way to finance a car despite having less-than-perfect credit? Subprime auto lenders can be the solution you need. For many individuals, purchasing a vehicle is a necessity, but a low credit score can make securing a traditional auto loan challenging. Subprime auto lenders specialize in providing loans to borrowers with poor credit histories, offering a pathway to vehicle ownership. In this article, we will explore the top subprime auto lenders, their benefits, and important considerations to keep in mind.

Subprime auto loans have become increasingly popular as more people face financial challenges that impact their credit scores. These loans are designed to help individuals with credit scores below 600 obtain financing for a vehicle. While they can be a lifeline for many, it's crucial to understand the terms and conditions associated with these loans to avoid potential pitfalls.

In this comprehensive guide, we will break down everything you need to know about subprime auto lenders. From identifying the best lenders to understanding the risks involved, this article will equip you with the knowledge to make an informed decision. Let’s dive in and explore the world of subprime auto lending.

Read also:Centers In Nfl The Unsung Heroes Of The Game

What Are Subprime Auto Loans?

Subprime auto loans are specifically designed for borrowers with credit scores that fall below the prime threshold, typically under 600. These loans are offered by lenders who specialize in working with individuals who may have a history of late payments, defaults, or bankruptcy. While traditional lenders may deny such borrowers, subprime lenders take on the higher risk by offering loans with higher interest rates.

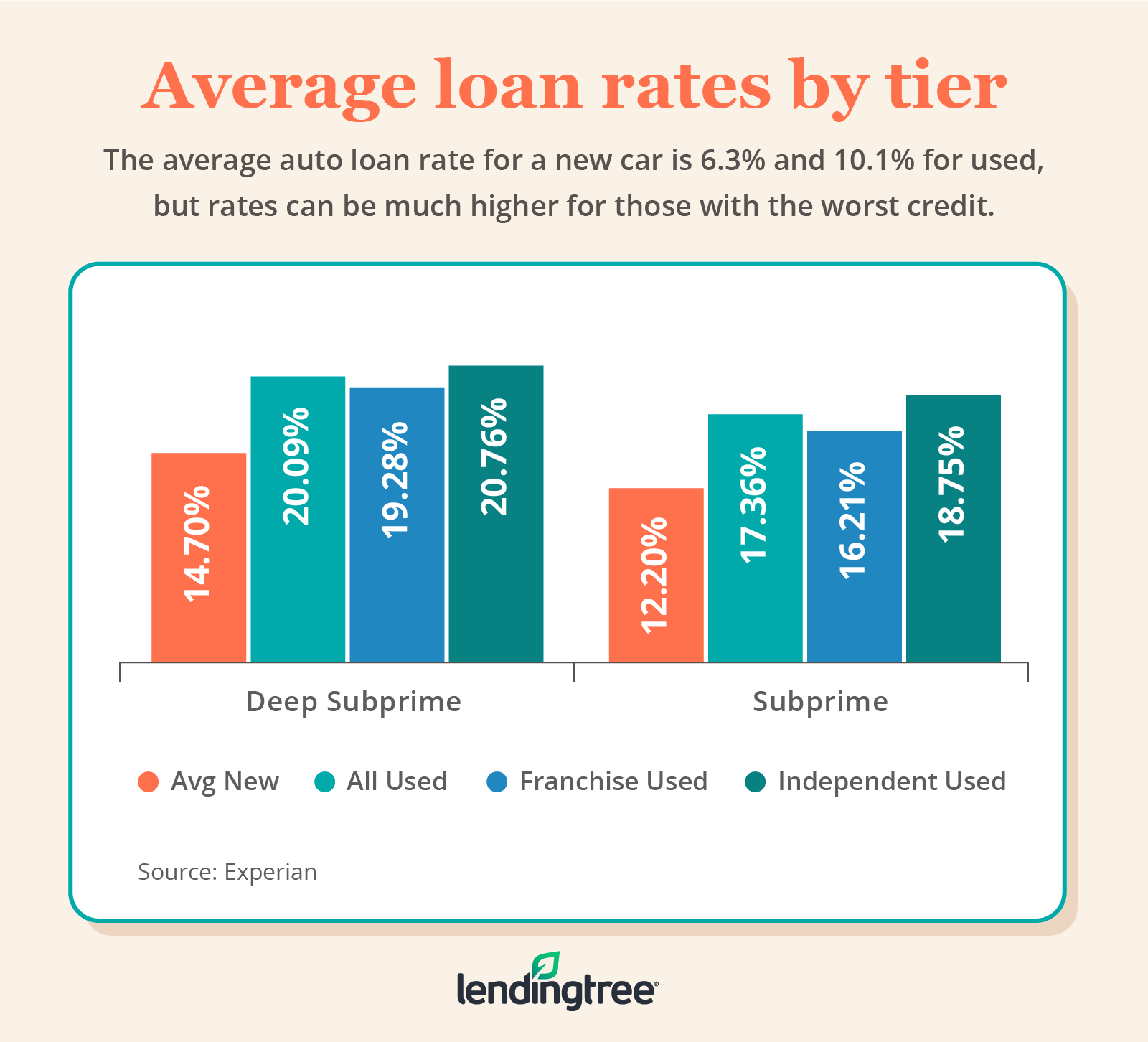

One of the key characteristics of subprime auto loans is the higher interest rates compared to prime loans. This is because lenders are compensating for the increased risk of lending to borrowers with poor credit. Interest rates for subprime loans can range from 15% to 30%, depending on the borrower’s credit score and financial history.

Subprime auto loans also often come with shorter repayment terms and larger down payment requirements. These terms help mitigate the lender’s risk and ensure that the borrower is committed to repaying the loan. While subprime loans can be a viable option for those with poor credit, it’s essential to carefully evaluate the terms to avoid financial strain.

Top Subprime Auto Lenders

1. Santander Consumer USA

Santander Consumer USA is one of the largest subprime auto lenders in the United States. They specialize in providing financing options for borrowers with credit scores below 600. Santander offers competitive interest rates and flexible repayment terms, making them a popular choice for many consumers.

2. Ally Financial

Ally Financial is another leading subprime auto lender that provides loans through a network of dealerships. They offer a range of financing options, including loans for used and new vehicles. Ally Financial is known for its customer-friendly policies and transparent terms.

3. Capital One Auto Finance

Capital One Auto Finance offers subprime auto loans with a focus on helping borrowers rebuild their credit. They provide personalized loan options and tools to help borrowers manage their payments effectively.

Read also:Best Eye Cream La Rocheposay A Comprehensive Guide To Achieving Radiant Undereyes

4. Wells Fargo

Wells Fargo offers subprime auto loans through its dealership network. They provide flexible terms and competitive rates, making them a reliable option for borrowers with less-than-perfect credit.

5. Exeter Finance

Exeter Finance specializes in subprime auto lending and works with a wide range of dealerships to provide financing options. They are known for their quick approval process and customer support.

6. Westlake Financial Services

Westlake Financial Services offers subprime auto loans with a focus on affordability. They provide loans for both new and used vehicles and are known for their transparent terms and conditions.

How to Choose the Right Lender

Choosing the right subprime auto lender is crucial to ensuring a positive borrowing experience. Here are some key factors to consider:

- Interest Rates: Compare the interest rates offered by different lenders to find the most affordable option.

- Loan Terms: Look for lenders that offer flexible repayment terms that align with your financial situation.

- Reputation: Research the lender’s reputation by reading customer reviews and checking their ratings with organizations like the Better Business Bureau.

- Customer Support: Ensure the lender provides reliable customer support to assist with any questions or issues.

Additionally, it’s important to read the fine print and understand all fees associated with the loan. Hidden fees can significantly increase the cost of borrowing, so transparency is key.

Benefits and Risks of Subprime Auto Loans

Benefits

- Access to Financing: Subprime loans provide an opportunity for individuals with poor credit to purchase a vehicle.

- Credit Building: Timely payments on a subprime loan can help improve your credit score over time.

- Fewer Restrictions: Subprime lenders often have more lenient requirements compared to traditional lenders.

Risks

- High Interest Rates: Subprime loans typically come with higher interest rates, which can increase the overall cost of the loan.

- Potential for Default: The higher monthly payments can make it challenging for some borrowers to keep up with their obligations.

- Hidden Fees: Some lenders may include hidden fees that can add to the financial burden.

It’s essential to weigh the benefits and risks before committing to a subprime auto loan. Understanding these factors will help you make an informed decision.

Improving Your Credit Score for Better Loan Options

Improving your credit score can open up better financing options in the future. Here are some steps you can take to boost your credit score:

- Pay Bills on Time: Consistently paying your bills on time is one of the most effective ways to improve your credit score.

- Reduce Debt: Focus on paying down existing debt to lower your credit utilization ratio.

- Check Your Credit Report: Regularly review your credit report for errors and dispute any inaccuracies.

- Limit New Credit Inquiries: Avoid applying for multiple new credit accounts in a short period, as this can negatively impact your score.

Improving your credit score takes time, but the effort is worth it. A higher credit score can qualify you for better loan terms and lower interest rates.

Alternatives to Subprime Auto Loans

If subprime auto loans seem too risky or expensive, there are alternative financing options to consider:

1. Credit Unions

Credit unions often offer more affordable loan options with lower interest rates compared to traditional subprime lenders.

2. Buy-Here-Pay-Here Dealerships

These dealerships provide in-house financing, allowing borrowers to purchase a vehicle directly from the dealer. However, interest rates can be high, so proceed with caution.

3. Personal Loans

Some borrowers opt for personal loans from banks or online lenders to finance their vehicle purchases. These loans may offer better terms depending on your credit profile.

4. Co-Signer Loans

If you have a trusted friend or family member with good credit, they can co-sign your loan to help you secure better terms.

Exploring these alternatives can help you find a financing option that aligns with your financial goals.

Frequently Asked Questions

1. What is a subprime auto loan?

A subprime auto loan is a type of financing designed for borrowers with poor credit scores, typically below 600.

2. Are subprime auto loans a good idea?

Subprime auto loans can be a good option for borrowers who need a vehicle but have poor credit. However, they come with higher interest rates and risks, so careful consideration is necessary.

3. How can I qualify for a subprime auto loan?

To qualify, you’ll need to demonstrate a stable income and provide proof of residency. Some lenders may also require a down payment.

4. Can I improve my credit score while repaying a subprime loan?

Yes, making timely payments on your subprime loan can help improve your credit score over time.

Conclusion

Subprime auto lenders provide a valuable service for individuals with poor credit who need access to vehicle financing. While these loans come with higher interest rates and risks, they can be a stepping stone to rebuilding your credit and achieving financial stability. By understanding the top subprime auto lenders, their benefits, and potential pitfalls, you can make an informed decision that aligns with your needs.

If you’re considering a subprime auto loan, take the time to research your options and compare lenders. Always read the terms and conditions carefully to avoid hidden fees or unfavorable terms. Additionally, consider exploring alternatives like credit unions or co-signer loans to find the best financing solution for your situation.

We hope this guide has provided you with valuable insights into the world of subprime auto lending. If you found this article helpful, please share it with others who may benefit. Feel free to leave a comment or explore more articles on our site for additional resources!

Understanding UK Nominal Voltage: A Comprehensive Guide

Milanesa Steak: A Delicious Twist On Classic Comfort Food

Kayam Churna Benefits: A Comprehensive Guide To Its Uses And Health Advantages

Subprime Lenders Subprime Auto Leads

Subprime Auto Loans Getting the Best Loan LendingTree