Nelnet Student Loan Services: A Comprehensive Guide To Managing Your Education Debt

Managing student loans can be a daunting task, but with the right guidance and tools, it becomes much more manageable. Nelnet Student Loan Services is one of the leading organizations that helps borrowers navigate the complex world of education debt. Whether you're a recent graduate or someone looking to refinance your loans, Nelnet offers a variety of services tailored to meet your needs. In this article, we’ll explore everything you need to know about Nelnet Student Loan Services, from their offerings to tips on how to make the most of their programs.

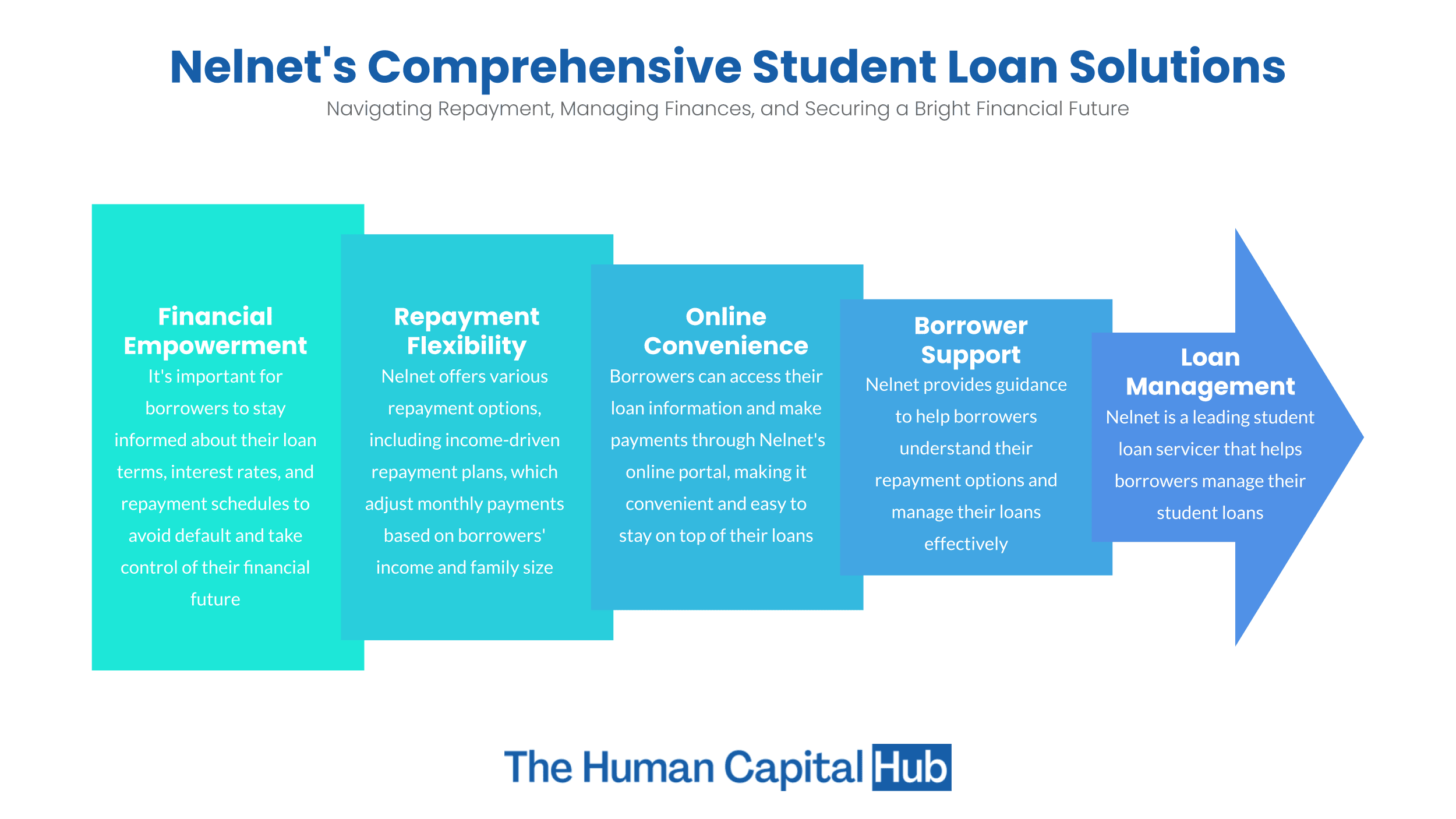

With millions of Americans burdened by student loans, understanding how to manage and repay this debt is crucial. Nelnet plays a pivotal role in this process, offering loan servicing, repayment plans, and customer support to help borrowers achieve financial stability. Their services are designed to simplify the repayment process and ensure that borrowers have access to the resources they need to succeed.

As a trusted name in the student loan industry, Nelnet adheres to strict guidelines to ensure compliance with federal regulations. This commitment to quality and transparency has earned them a reputation as a reliable partner for borrowers. In the following sections, we’ll dive deeper into Nelnet’s offerings, explore their impact on borrowers, and provide actionable tips to help you make the most of their services.

Read also:Norafawn The Ultimate Guide To A Rising Star In The Digital World

Table of Contents

- What is Nelnet Student Loan Services?

- History and Background of Nelnet

- Key Services Offered by Nelnet

- Understanding Nelnet’s Repayment Plans

- Customer Support and Resources

- Refinancing Options with Nelnet

- Pros and Cons of Using Nelnet

- Tips for Managing Your Nelnet Loans

- Student Loan Statistics and Insights

- Conclusion and Call to Action

What is Nelnet Student Loan Services?

Nelnet Student Loan Services is a company that specializes in managing and servicing federal student loans. As one of the largest loan servicers in the United States, Nelnet works with borrowers to ensure they understand their repayment options and stay on track with their financial goals. The company is contracted by the U.S. Department of Education to manage loans under the Federal Family Education Loan Program (FFELP) and the Direct Loan Program.

How Nelnet Helps Borrowers

- Assisting with loan repayment plans

- Providing customer support for account inquiries

- Offering tools and resources for financial literacy

- Facilitating loan consolidation and refinancing

History and Background of Nelnet

Nelnet was founded in 1978 and has since grown into a major player in the education finance industry. The company’s headquarters is located in Lincoln, Nebraska, and it operates under the oversight of the U.S. Department of Education. Over the years, Nelnet has expanded its services to include not only loan servicing but also technology solutions and educational content development.

Key Services Offered by Nelnet

Nelnet provides a wide range of services designed to help borrowers manage their student loans effectively. Below are some of the key offerings:

Loan Servicing

Loan servicing involves managing the day-to-day operations of a borrower’s account, including billing, payment processing, and account updates. Nelnet ensures that borrowers receive accurate and timely information about their loans.

Repayment Plans

Nelnet offers several repayment plans tailored to different financial situations, such as income-driven repayment plans, graduated repayment plans, and extended repayment options.

Loan Consolidation

Borrowers with multiple federal loans can consolidate them into a single loan through Nelnet, simplifying the repayment process and potentially lowering monthly payments.

Read also:Whats The Dougie A Comprehensive Guide To The Iconic Dance Move

Understanding Nelnet’s Repayment Plans

One of the most valuable aspects of Nelnet’s services is the variety of repayment plans available to borrowers. These plans are designed to accommodate different financial situations and help borrowers avoid default.

Income-Driven Repayment Plans

Income-driven repayment plans adjust monthly payments based on the borrower’s income and family size. These plans include:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

Graduated Repayment Plans

Graduated repayment plans start with lower payments that increase over time, making them ideal for borrowers who expect their income to grow.

Customer Support and Resources

Nelnet is known for its robust customer support system, which includes phone, email, and online chat options. Borrowers can also access a wealth of resources on Nelnet’s website, including FAQs, repayment calculators, and financial literacy tools.

Online Account Management

Through Nelnet’s online portal, borrowers can view their account details, make payments, and update personal information. This user-friendly platform makes it easy to stay on top of loan obligations.

Refinancing Options with Nelnet

While Nelnet primarily focuses on federal student loans, they also offer refinancing options through partnerships with private lenders. Refinancing can help borrowers secure a lower interest rate and reduce their overall repayment costs.

Eligibility Requirements

Refinancing eligibility typically depends on factors such as credit score, income, and employment status. Borrowers with strong financial profiles are more likely to qualify for favorable terms.

Pros and Cons of Using Nelnet

Like any service provider, Nelnet has its advantages and disadvantages. Below is a breakdown of the pros and cons:

Pros

- Wide range of repayment options

- Accessible customer support

- User-friendly online portal

Cons

- Occasional complaints about customer service

- Limited refinancing options compared to private lenders

Tips for Managing Your Nelnet Loans

To make the most of Nelnet’s services, consider the following tips:

- Regularly review your account details to ensure accuracy

- Explore all available repayment plans to find the best fit

- Utilize Nelnet’s financial literacy resources to improve your money management skills

Student Loan Statistics and Insights

Understanding the broader context of student loans can help borrowers make informed decisions. Here are some key statistics:

- Total student loan debt in the U.S. exceeds $1.7 trillion

- Approximately 43 million Americans have federal student loans

- The average student loan debt per borrower is around $37,000

These numbers highlight the importance of effective loan management and the role companies like Nelnet play in supporting borrowers.

Conclusion and Call to Action

Nelnet Student Loan Services offers a comprehensive suite of tools and resources to help borrowers manage their education debt. From flexible repayment plans to robust customer support, Nelnet is committed to empowering borrowers to achieve financial stability. By understanding the services available and taking proactive steps to manage your loans, you can reduce stress and focus on building a brighter financial future.

If you found this article helpful, please share it with others who may benefit from learning about Nelnet’s services. Additionally, feel free to leave a comment below with any questions or experiences you’d like to share. For more resources on student loans and financial planning, explore our other articles on the site.

Young Sheldon Paige Real Name: Everything You Need To Know

Wake Forest Mascot Name: Discover The Spirit Behind The Demon Deacons

Faith Andaza Viral: Unpacking The Phenomenon And Its Impact

Student Loans Everything you Need to Know

Student Loans