Zillow Home Estimate: Everything You Need To Know About Zestimate

Are you curious about how much your home is worth? Zillow Home Estimate, commonly known as Zestimate, is a powerful tool that provides homeowners and buyers with an estimated market value of a property. This free online tool has revolutionized the way people assess real estate values, making it easier than ever to get an idea of a home's worth without hiring a professional appraiser. In this article, we will explore everything you need to know about Zillow Home Estimate, including how it works, its accuracy, and how you can use it to make informed decisions about your property.

For many homeowners, understanding the value of their property is crucial, whether they're planning to sell, refinance, or simply keep track of their investment. Zillow Home Estimate provides a quick and accessible way to get a ballpark figure, but it’s important to know its strengths and limitations. This article will guide you through the intricacies of Zestimate, helping you make the most of this tool while avoiding common pitfalls.

As we delve deeper into the topic, we will also discuss how Zillow calculates its estimates, the factors that influence Zestimate values, and how it compares to professional appraisals. By the end of this article, you’ll have a comprehensive understanding of Zillow Home Estimate and how it can fit into your real estate strategy. Whether you're a first-time homebuyer, a seasoned investor, or simply curious about your home's value, this guide will equip you with the knowledge you need to navigate the world of property valuation.

Read also:Discover The Inspiring Journey Of Trisha Krisnan A Rising Star In The Digital Age

- What is Zillow Home Estimate?

- How Zestimate Works

- Factors Affecting Zestimate

- Accuracy of Zestimate

- Zestimate vs. Professional Appraisal

- Limitations of Zillow Home Estimate

- How to Improve Your Zestimate

- Using Zestimate for Home Buying

- Zestimate for Real Estate Investors

- Conclusion

What is Zillow Home Estimate?

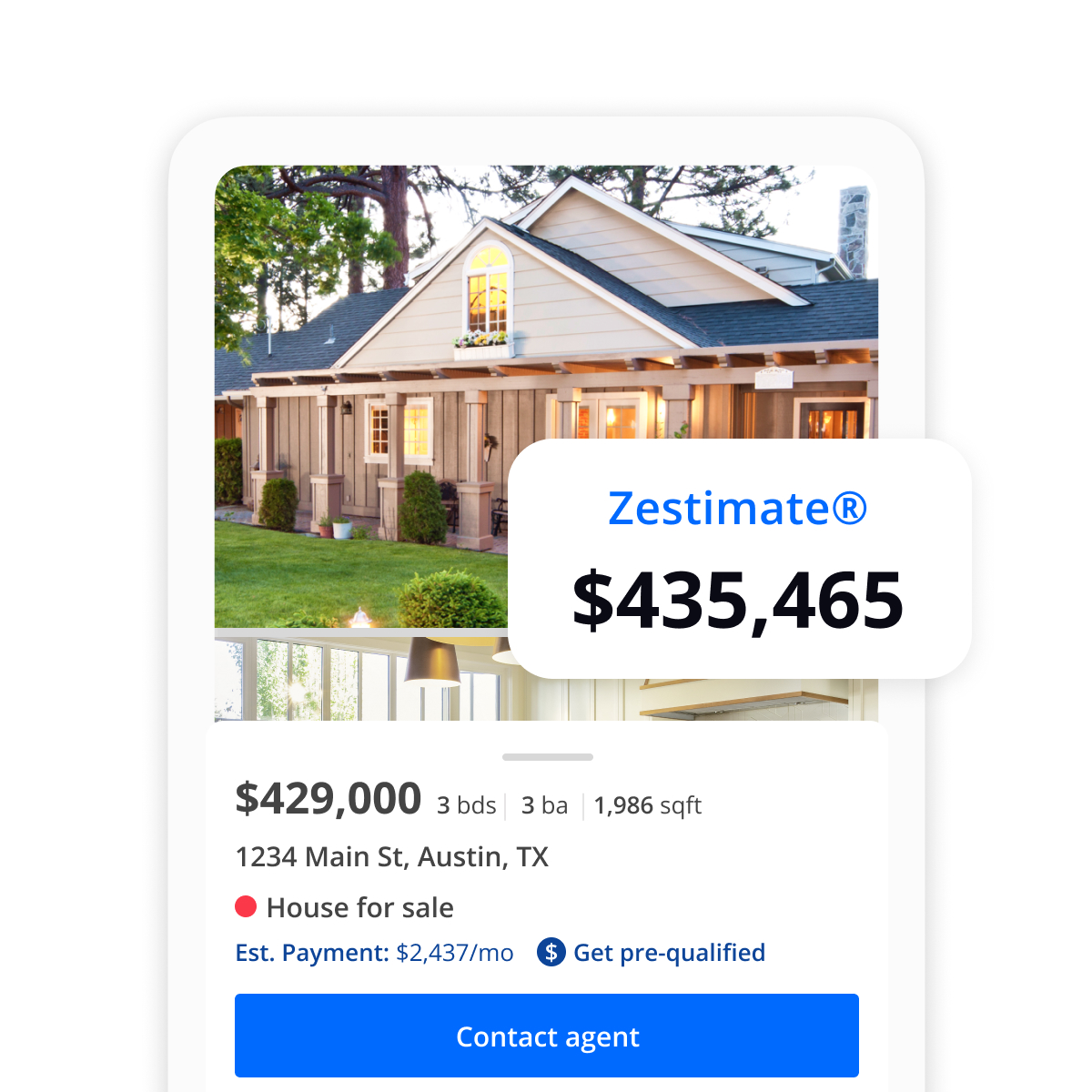

Zillow Home Estimate, or Zestimate, is an automated valuation model (AVM) developed by Zillow, one of the largest real estate marketplaces in the United States. Launched in 2006, Zestimate provides users with an estimated market value of a property based on publicly available data, user-submitted information, and proprietary algorithms. The tool is designed to give homeowners, buyers, and sellers a quick snapshot of a home's value without the need for a formal appraisal.

One of the key features of Zillow Home Estimate is its accessibility. Anyone can visit Zillow's website, enter an address, and receive an instant estimate of a property's value. This has made Zestimate an invaluable resource for people looking to understand the real estate market or make informed decisions about their property. However, it's important to note that Zestimate is not a substitute for a professional appraisal, as it relies on algorithms and data that may not always reflect the nuances of a specific property.

How Zillow Home Estimate Became Popular

Zillow Home Estimate gained popularity due to its user-friendly interface and the transparency it brought to the real estate market. Before Zestimate, homeowners often had to rely on real estate agents or appraisers to get an idea of their home's value. Zillow changed the game by making this information accessible to everyone, empowering users to take control of their real estate decisions.

Over the years, Zillow has refined its algorithms, incorporating more data points and improving the accuracy of its estimates. Today, Zestimate is one of the most widely used tools for property valuation, with millions of users relying on it for insights into the housing market.

How Zestimate Works

At its core, Zillow Home Estimate uses a combination of data sources and advanced algorithms to generate property valuations. The process begins with Zillow collecting publicly available data, such as tax records, sales history, and property characteristics. This data is then combined with user-submitted information, such as home improvements or renovations, to create a more comprehensive picture of a property's value.

Zillow's proprietary algorithms analyze this data to estimate a property's market value. These algorithms take into account factors like location, square footage, the number of bedrooms and bathrooms, and recent sales of comparable properties in the area. The result is a Zestimate, which is updated regularly to reflect changes in the real estate market.

Read also:Gottesman Net Worth A Comprehensive Guide To His Wealth And Achievements

Data Sources Used by Zillow

- Public Records: Zillow pulls data from county tax records, which include information on property size, age, and previous sales.

- User Contributions: Homeowners can update their property details on Zillow, providing additional information that may not be available in public records.

- Market Trends: Zillow analyzes trends in the housing market, such as changes in demand and inventory, to adjust its estimates.

By leveraging these data sources, Zillow Home Estimate provides users with a quick and easy way to assess their property's value. However, it's important to understand that Zestimate is not a definitive valuation and should be used as a starting point rather than a final figure.

Factors Affecting Zestimate

Several factors influence the accuracy of Zillow Home Estimate. Understanding these factors can help you interpret your Zestimate more effectively and identify areas where it may fall short.

Location

Location is one of the most significant factors in determining a property's value. Zillow takes into account the neighborhood, school district, proximity to amenities, and local market conditions when calculating a Zestimate. Properties in desirable areas with strong demand tend to have higher Zestimates, while those in less popular areas may have lower estimates.

Property Size and Features

The size and features of a property also play a crucial role in Zestimate calculations. Zillow considers factors like square footage, the number of bedrooms and bathrooms, and any unique features, such as a pool or updated kitchen. Larger homes with more amenities typically have higher Zestimates, while smaller or outdated properties may have lower values.

Market Conditions

Real estate markets are constantly changing, and Zillow adjusts its estimates to reflect these fluctuations. For example, during a seller's market with high demand and low inventory, Zestimates may increase. Conversely, in a buyer's market with low demand and high inventory, Zestimates may decrease. Keeping an eye on market trends can help you understand how they impact your Zestimate.

Accuracy of Zestimate

While Zillow Home Estimate is a valuable tool, it's important to recognize its limitations when it comes to accuracy. Zillow itself acknowledges that Zestimates are not appraisals and may not reflect the true market value of a property. According to Zillow, the median error rate for Zestimates is approximately 1.9% for homes that have recently sold, but this rate can vary significantly depending on the location and property type.

In some cases, Zestimates can be surprisingly accurate, especially in areas with robust public records and consistent market activity. However, in markets with limited data or unique properties, Zestimates may be less reliable. Factors like outdated information, incomplete data, and the inability to account for subjective elements like curb appeal can all contribute to inaccuracies.

How to Interpret Your Zestimate

When reviewing your Zillow Home Estimate, it's essential to take it with a grain of salt. Use it as a general guideline rather than a definitive valuation. If you're considering selling your home or making a significant financial decision based on your Zestimate, it's always a good idea to consult a real estate professional or hire a licensed appraiser for a more accurate assessment.

Zestimate vs. Professional Appraisal

While Zillow Home Estimate provides a quick and convenient way to assess your property's value, it's important to understand how it compares to a professional appraisal. A professional appraisal involves a licensed appraiser visiting the property, inspecting its condition, and analyzing recent sales of comparable homes in the area. This hands-on approach allows appraisers to account for factors that Zestimate may miss, such as the quality of renovations, the condition of the roof, or the appeal of the landscaping.

Professional appraisals are often required for mortgage applications, refinancing, or legal purposes, as they provide a more accurate and reliable valuation. While Zillow Home Estimate can be a useful starting point, it should not be relied upon for decisions that involve significant financial implications.

Limitations of Zillow Home Estimate

Despite its popularity, Zillow Home Estimate has several limitations that users should be aware of. One of the primary issues is the reliance on publicly available data, which may not always be up-to-date or accurate. For example, if a homeowner has made significant renovations but hasn't updated their property details on Zillow, the Zestimate may not reflect these improvements.

Another limitation is the inability of Zestimate to account for subjective factors like curb appeal, interior design, or unique architectural features. These elements can significantly impact a property's market value but are difficult to quantify in an automated valuation model. Additionally, Zestimates may be less reliable in rural areas or markets with limited sales activity, where data is scarce.

When to Use Zestimate and When to Seek Professional Help

Zillow Home Estimate is a great tool for getting a general idea of your property's value, especially if you're in the early stages of buying or selling a home. However, if you're making a significant financial decision, such as listing your home for sale, refinancing, or settling an estate, it's best to consult a real estate professional or hire a licensed appraiser for a more accurate valuation.

How to Improve Your Zestimate

If you're concerned about the accuracy of your Zillow Home Estimate, there are steps you can take to improve it. One of the most effective ways is to update your property details on Zillow. By providing accurate information about your home's size, features, and recent renovations, you can help Zillow's algorithms generate a more accurate estimate.

Tips for Updating Your Zillow Profile

- Claim Your Home: If you haven't already, claim your home on Zillow to gain access to its profile and make updates.

- Add Photos: High-quality photos can showcase your home's best features and attract more accurate comparisons.

- Provide Accurate Data: Update details like square footage, the number of bedrooms and bathrooms, and any recent upgrades.

By taking these steps, you can help ensure that your Zillow Home Estimate reflects the true value of your property.

Using Zestimate for Home Buying

For homebuyers, Zillow Home Estimate can be a valuable tool for identifying potential properties and understanding their market value. By reviewing Zestimates, buyers can get a sense of whether a home is priced fairly and make more informed offers. However, it's important to use Zestimate as a starting point rather than the sole determinant of a property's value.

Tips for Buyers Using Zestimate

- Compare Multiple Listings: Use Zestimate to compare similar properties in the area and identify trends in pricing.

- Consult a Realtor: Work with a real estate agent to get a more accurate valuation and navigate the buying process.

- Visit the Property: Always visit a property in person to assess its condition and appeal, as these factors may not be reflected in the Zestimate.

Zestimate for Real Estate Investors

Real estate investors can also benefit from Zillow Home Estimate by using it to identify potential investment opportunities and assess market trends. By analyzing Zestimates for multiple properties, investors can spot undervalued homes or areas with strong growth potential. However, as with homebuyers, investors should use Zestimate as a supplementary tool rather than the sole basis for their decisions.

How Investors Can Leverage Zestimate

- Identify Undervalued Properties: Look for homes with Zestimates significantly lower than their asking price.

- Track Market Trends: Use Zestimate to monitor changes in property values over time and identify emerging markets.

- Conduct Due

What Is McAfee: A Comprehensive Guide To The Leading Cybersecurity Solution

Breeder Cup Payouts: A Comprehensive Guide To Maximizing Your Winnings

How Long Does It Take To Get Your Guard Card: A Comprehensive Guide

How to Find a House on Zillow with Advanced Search Techniques Zillow

How Does Zillow Estimate Home Value PRORFETY