What Does State Farm Car Insurance Cover: A Comprehensive Guide

When it comes to protecting your vehicle and ensuring peace of mind on the road, State Farm car insurance is a name that stands out. State Farm is one of the largest and most trusted insurance providers in the United States, offering a wide range of coverage options tailored to meet the needs of drivers. Understanding what State Farm car insurance covers is essential for making informed decisions about your policy. In this guide, we’ll explore the various types of coverage, benefits, and exclusions to help you navigate the complexities of car insurance.

Car insurance is more than just a legal requirement; it’s a financial safety net that protects you, your passengers, and other drivers in the event of an accident. State Farm car insurance provides multiple layers of protection, from liability coverage to comprehensive and collision insurance. Whether you’re a new driver or a seasoned motorist, knowing the details of your policy can save you from unexpected expenses and stress. Let’s dive deeper into the specifics of State Farm car insurance and what it covers.

In this article, we’ll break down the key components of State Farm car insurance, explain the coverage options available, and provide insights into how you can customize your policy to suit your needs. We’ll also address frequently asked questions and offer tips to help you maximize your coverage while staying within your budget. By the end of this guide, you’ll have a clear understanding of what State Farm car insurance covers and how it can benefit you.

Read also:Faze Rug Net Worth Unveiling The Success Story Of A Gaming Legend

Table of Contents

- Introduction to State Farm Car Insurance

- Types of Coverage Offered by State Farm

- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Medical Payments Coverage

- Uninsured/Underinsured Motorist Coverage

- Additional Coverage Options

- Factors Affecting Your Premiums

- How to File a Claim with State Farm

- Conclusion

Introduction to State Farm Car Insurance

State Farm has been a household name in the insurance industry for decades, known for its commitment to customer service and comprehensive coverage options. As a mutual insurance company, State Farm prioritizes the needs of its policyholders, offering personalized solutions to meet individual requirements. Whether you’re looking for basic liability coverage or a full suite of protection, State Farm provides flexibility and reliability.

State Farm car insurance is designed to protect drivers from financial losses resulting from accidents, theft, vandalism, and other unforeseen events. With a network of over 19,000 agents across the United States, State Farm ensures that policyholders receive local support and guidance. This accessibility, combined with their 24/7 claims service, makes State Farm a popular choice for millions of drivers.

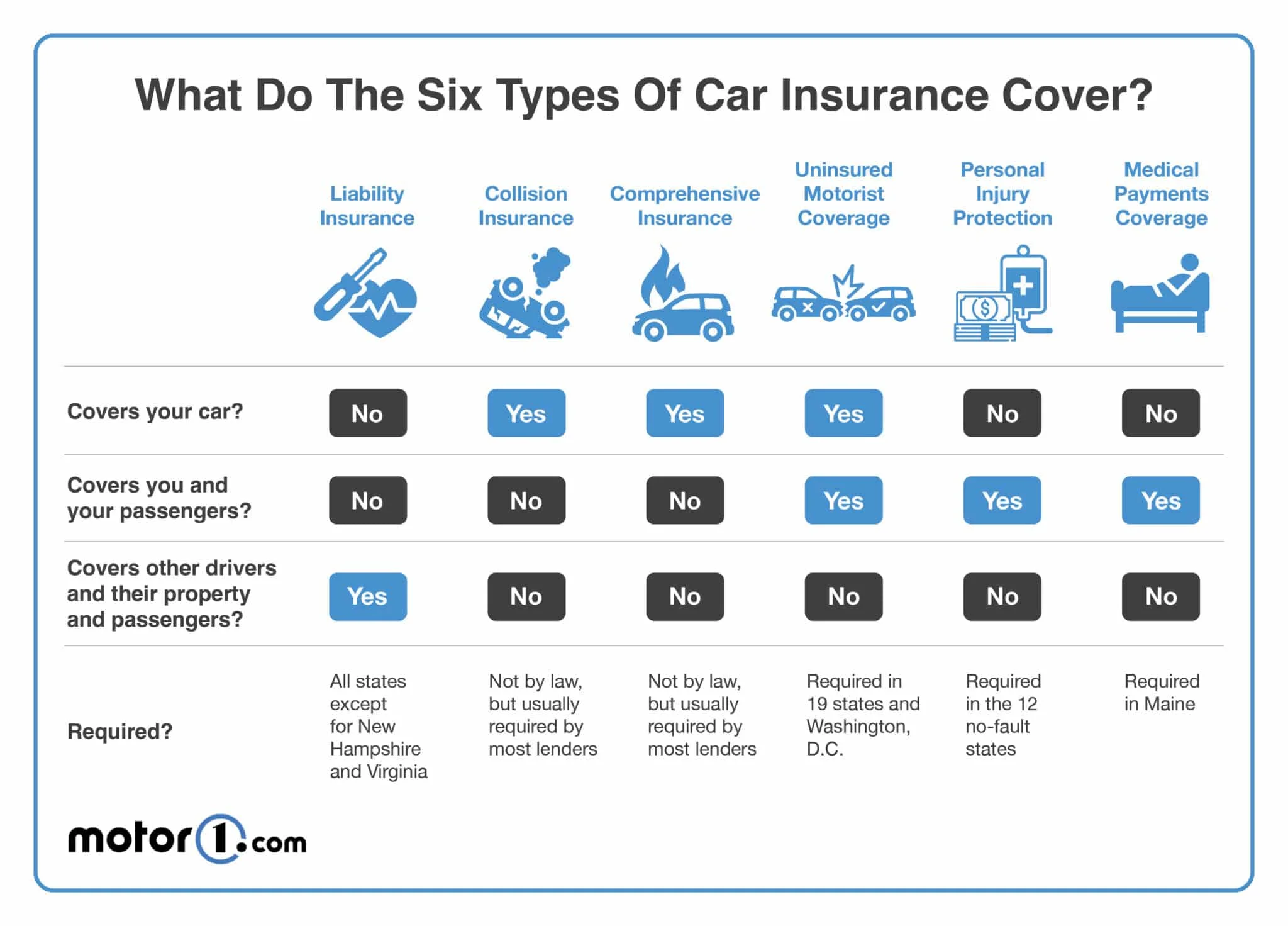

Types of Coverage Offered by State Farm

State Farm car insurance offers a variety of coverage options to suit different needs. Below are the primary types of coverage provided by State Farm:

- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Medical Payments Coverage

- Uninsured/Underinsured Motorist Coverage

- Roadside Assistance

- Rental Reimbursement

Each type of coverage serves a unique purpose, and understanding their differences is crucial for building a policy that aligns with your needs. Let’s explore these options in detail.

Liability Coverage

Liability coverage is the foundation of any car insurance policy and is required by law in most states. This type of coverage protects you financially if you’re responsible for causing an accident that results in injuries or property damage to others. State Farm offers two main components of liability coverage:

- Bodily Injury Liability: Covers medical expenses, lost wages, and legal fees for injuries sustained by others in an accident you caused.

- Property Damage Liability: Covers repair or replacement costs for property damaged in an accident you caused, such as another vehicle or a fence.

State Farm allows you to choose your liability limits, ensuring you have adequate protection without overpaying for coverage you don’t need.

Read also:Tarayummy Ethnicity Exploring The Rich Cultural Heritage And Identity

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision with another car or object, regardless of who is at fault. This coverage is particularly valuable if you own a newer or high-value vehicle. Key features of State Farm collision coverage include:

- Covers damage from accidents involving other vehicles, potholes, or stationary objects.

- Includes a deductible, which is the amount you pay out-of-pocket before your coverage kicks in.

- Provides rental car reimbursement if your vehicle is in the shop for repairs.

While collision coverage is not mandatory by law, it’s often required by lenders if you’re financing or leasing a vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against non-collision-related incidents, such as theft, vandalism, natural disasters, and animal collisions. This type of coverage is essential for safeguarding your car against unforeseen events beyond your control. Benefits of State Farm comprehensive coverage include:

- Covers damage from weather-related events like hail, floods, and hurricanes.

- Protects against theft and vandalism.

- Includes coverage for broken windshields and glass repairs.

Like collision coverage, comprehensive coverage typically includes a deductible, and it’s often paired with collision coverage for maximum protection.

Medical Payments Coverage

Medical payments coverage, also known as MedPay, helps cover medical expenses for you and your passengers after an accident, regardless of who is at fault. This coverage can be particularly beneficial in states with no-fault insurance laws. Key features of State Farm MedPay include:

- Covers hospital bills, surgery costs, and ambulance fees.

- Applies to injuries sustained in accidents involving your vehicle, even if you’re a pedestrian or cyclist.

- Supplements your health insurance, reducing out-of-pocket expenses.

MedPay is an affordable add-on that provides an extra layer of financial protection for you and your loved ones.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who lacks sufficient insurance. This type of coverage is especially important given the rising number of uninsured drivers on the road. State Farm offers two types of uninsured motorist coverage:

- Uninsured Motorist Bodily Injury: Covers medical expenses if you’re injured by an uninsured driver.

- Uninsured Motorist Property Damage: Covers repair or replacement costs for your vehicle if damaged by an uninsured driver.

This coverage ensures you’re not left financially vulnerable due to someone else’s negligence.

Additional Coverage Options

Beyond the standard coverage types, State Farm offers several optional add-ons to enhance your policy. These additional coverage options provide extra peace of mind and can be tailored to your specific needs:

- Roadside Assistance: Provides 24/7 support for emergencies like flat tires, lockouts, and towing.

- Rental Reimbursement: Covers the cost of a rental car while your vehicle is being repaired.

- Accident Forgiveness: Prevents your rates from increasing after your first accident.

- Custom Parts and Equipment: Covers modifications or customizations made to your vehicle.

These options allow you to create a personalized policy that addresses your unique circumstances and preferences.

Factors Affecting Your Premiums

Several factors influence the cost of your State Farm car insurance premiums. Understanding these factors can help you make informed decisions and potentially lower your rates:

- Driving Record: A clean driving history typically results in lower premiums.

- Vehicle Type: Newer or high-performance vehicles often cost more to insure.

- Location: Urban areas with higher traffic and crime rates may lead to increased premiums.

- Coverage Limits: Higher coverage limits result in higher premiums.

- Deductibles: Choosing a higher deductible can reduce your premium costs.

State Farm offers discounts for safe drivers, bundling policies, and installing anti-theft devices, among other incentives.

How to File a Claim with State Farm

Filing a claim with State Farm is a straightforward process. Follow these steps to ensure a smooth experience:

- Report the Incident: Contact State Farm as soon as possible to report the accident or damage.

- Gather Documentation: Collect photos, police reports, and witness statements to support your claim.

- Submit Your Claim: Use State Farm’s online portal or mobile app to file your claim.

- Work with an Adjuster: A claims adjuster will assess the damage and determine the payout.

- Receive Payment: Once approved, State Farm will issue payment for repairs or replacements.

State Farm’s 24/7 claims service ensures you receive assistance whenever you need it.

Conclusion

State Farm car insurance offers a wide range of coverage options to protect you, your passengers, and your vehicle. From liability and collision coverage to comprehensive and medical payments coverage, State Farm provides the tools you need to safeguard your financial future. By understanding what State Farm car insurance covers, you can make informed decisions and customize a policy that meets your needs.

Take the time to review your coverage options, consider additional add-ons, and explore available discounts to maximize your protection while staying within your budget. If you have questions or need assistance, State Farm’s knowledgeable agents are always ready to help. Don’t wait until it’s too late—ensure you have the right coverage in place today.

We hope this guide has provided valuable insights into what State Farm car insurance covers. If you found this article helpful, feel free to share it with others or leave a comment below. For more information on car insurance and related topics, explore our other articles and resources.

What Is Cricket Phone: Everything You Need To Know About Budget-Friendly Mobile Services

Santa Clara Diet: A Comprehensive Guide To Healthy Living And Weight Loss

Arlechino Game 8: A Comprehensive Guide To Mastering The Intriguing Puzzle Adventure

State Farm Car Insurance Review Coverage, Costs, and Trustworthiness

Your Guide To State Farm Auto Insurance From Understanding Coverages