Understanding State Farm Liability Coverage: A Comprehensive Guide

Liability coverage is one of the most crucial components of any insurance policy, especially when it comes to protecting your assets and financial future. State Farm, one of the largest insurance providers in the United States, offers a variety of liability coverage options designed to safeguard you from unforeseen accidents and legal claims. Whether you're a homeowner, driver, or business owner, understanding how State Farm liability coverage works can help you make informed decisions about your insurance needs.

Liability insurance is designed to protect you from financial losses if you're held legally responsible for causing harm to others. This could include bodily injury, property damage, or personal injury claims. State Farm liability coverage is tailored to meet the needs of different individuals and businesses, ensuring that you have the right level of protection. In this article, we will explore the various aspects of State Farm liability coverage, including its benefits, types, and how to choose the best policy for your needs.

As a leading provider in the insurance industry, State Farm has built a reputation for offering reliable and comprehensive coverage options. With decades of experience and a strong commitment to customer service, State Farm is a trusted name for liability insurance. Whether you're looking for auto, home, or business liability coverage, this guide will provide you with the information you need to make an informed decision. Let's dive into the details of State Farm liability coverage and how it can protect you in various scenarios.

Read also:Margot Robbie A Comprehensive Look At The Life And Career Of A Hollywood Star

Table of Contents

- What is Liability Coverage?

- Types of State Farm Liability Coverage

- Benefits of State Farm Liability Coverage

- How to Choose the Right Coverage

- Factors Affecting Liability Coverage Costs

- Common Misconceptions About Liability Coverage

- State Farm Liability Coverage for Homeowners

- State Farm Liability Coverage for Drivers

- State Farm Liability Coverage for Businesses

- Conclusion and Next Steps

What is Liability Coverage?

Liability coverage is a type of insurance that protects you from financial losses if you are found legally responsible for causing harm to others. This can include bodily injury, property damage, or personal injury claims. Liability coverage is often included in various types of insurance policies, such as auto, home, and business insurance. It is designed to cover legal fees, medical expenses, and compensation payments if you are sued for damages.

There are two main types of liability coverage: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses, lost wages, and legal fees if someone is injured due to your actions. Property damage liability covers the cost of repairing or replacing someone else's property that you accidentally damage. Understanding these distinctions is essential for choosing the right level of coverage for your needs.

Why is Liability Coverage Important?

- Financial Protection: Liability coverage protects your assets and financial future by covering legal fees and compensation payments.

- Legal Requirements: Many states require drivers to carry a minimum amount of liability coverage to legally operate a vehicle.

- Peace of Mind: Knowing that you are protected from unexpected accidents and lawsuits can provide peace of mind.

Types of State Farm Liability Coverage

State Farm offers a variety of liability coverage options to meet the needs of different individuals and businesses. These include auto liability coverage, home liability coverage, and business liability coverage. Each type of coverage is designed to protect you from specific risks and liabilities. Let's explore these options in more detail.

Auto Liability Coverage

Auto liability coverage is a standard component of most auto insurance policies. It covers bodily injury and property damage that you may cause to others while driving. State Farm's auto liability coverage includes:

- Bodily Injury Liability: Covers medical expenses, lost wages, and legal fees if someone is injured in an accident you cause.

- Property Damage Liability: Covers the cost of repairing or replacing someone else's property that you damage in an accident.

Home Liability Coverage

Home liability coverage is part of a standard homeowners insurance policy. It protects you from financial losses if someone is injured on your property or if you accidentally damage someone else's property. State Farm's home liability coverage includes:

- Personal Liability: Covers legal fees and compensation payments if you are sued for bodily injury or property damage.

- Medical Payments Coverage: Covers medical expenses for minor injuries that occur on your property, regardless of fault.

Business Liability Coverage

Business liability coverage is designed to protect businesses from financial losses due to lawsuits and claims. State Farm offers a variety of business liability coverage options, including:

Read also:Danielle Peskowitz Bregoli The Rise Of A Social Media Sensation

- General Liability: Covers bodily injury, property damage, and personal injury claims related to your business operations.

- Professional Liability: Covers claims of negligence or mistakes in professional services provided by your business.

Benefits of State Farm Liability Coverage

State Farm liability coverage offers several benefits that make it a popular choice among policyholders. These benefits include:

- Comprehensive Protection: State Farm offers a wide range of liability coverage options to protect you from various risks and liabilities.

- Customizable Policies: You can tailor your policy to meet your specific needs and budget.

- Reliable Customer Service: State Farm is known for its excellent customer service and support.

Additional Benefits

In addition to the core benefits, State Farm liability coverage also offers:

- Discounts: State Farm offers various discounts to help you save on your insurance premiums.

- Claims Support: State Farm provides 24/7 claims support to help you navigate the claims process.

How to Choose the Right Coverage

Choosing the right liability coverage can be challenging, but there are several factors to consider that can help you make an informed decision. These factors include:

- Assess Your Risks: Evaluate the potential risks you face based on your lifestyle, property, and business operations.

- Understand Your Needs: Determine the level of coverage you need to protect your assets and financial future.

- Compare Policies: Compare different policies and coverage options to find the best value for your money.

Tips for Choosing the Right Coverage

- Consult an Expert: Speak with an insurance agent or broker to get personalized advice and recommendations.

- Review Policy Details: Carefully review the terms and conditions of each policy to ensure it meets your needs.

Factors Affecting Liability Coverage Costs

Several factors can affect the cost of liability coverage, including:

- Location: Where you live can impact your insurance premiums due to varying state regulations and risk levels.

- Coverage Limits: Higher coverage limits typically result in higher premiums.

- Deductibles: Choosing a higher deductible can lower your premiums but increase your out-of-pocket costs in the event of a claim.

Additional Factors

- Credit Score: Your credit score can influence your insurance premiums, as insurers use it to assess risk.

- Claims History: A history of frequent claims can lead to higher premiums.

Common Misconceptions About Liability Coverage

There are several misconceptions about liability coverage that can lead to confusion and poor decision-making. Some of these misconceptions include:

- Liability Coverage is Optional: While some types of liability coverage are optional, others are legally required, such as auto liability coverage.

- One Size Fits All: Liability coverage needs vary based on individual circumstances, and a one-size-fits-all approach may not provide adequate protection.

Debunking Myths

- Higher Coverage Equals Higher Costs: While higher coverage limits can increase premiums, they also provide greater protection and peace of mind.

- Liability Coverage Only Applies to Accidents: Liability coverage can also apply to lawsuits and claims related to negligence or mistakes.

State Farm Liability Coverage for Homeowners

State Farm offers comprehensive liability coverage for homeowners, protecting them from financial losses due to accidents and lawsuits. This coverage is typically included in a standard homeowners insurance policy and includes:

- Personal Liability: Covers legal fees and compensation payments if you are sued for bodily injury or property damage.

- Medical Payments Coverage: Covers medical expenses for minor injuries that occur on your property, regardless of fault.

Additional Homeowner Benefits

- Umbrella Coverage: Provides additional liability protection beyond the limits of your standard policy.

- Customizable Options: You can tailor your policy to include additional coverage for specific risks, such as water damage or theft.

State Farm Liability Coverage for Drivers

State Farm's auto liability coverage is designed to protect drivers from financial losses due to accidents and lawsuits. This coverage is typically required by law and includes:

- Bodily Injury Liability: Covers medical expenses, lost wages, and legal fees if someone is injured in an accident you cause.

- Property Damage Liability: Covers the cost of repairing or replacing someone else's property that you damage in an accident.

Additional Driver Benefits

- Collision Coverage: Covers damage to your vehicle in the event of an accident.

- Comprehensive Coverage: Covers damage to your vehicle from non-collision events, such as theft or natural disasters.

State Farm Liability Coverage for Businesses

State Farm offers a variety of liability coverage options for businesses, protecting them from financial losses due to lawsuits and claims. These options include:

- General Liability: Covers bodily injury, property damage, and personal injury claims related to your business operations.

- Professional Liability: Covers claims of negligence or mistakes in professional services provided by your business.

Additional Business Benefits

- Product Liability: Covers claims related to products your business manufactures or sells.

- Employment Practices Liability: Covers claims related to employment practices, such as wrongful termination or discrimination.

Conclusion and Next Steps

In conclusion, State Farm liability coverage offers comprehensive protection for individuals and businesses, safeguarding you from financial losses due to accidents and lawsuits. Whether you're a homeowner, driver, or business owner, understanding the various types of liability coverage and their benefits can help you make informed decisions about your insurance needs.

We encourage you to review your current insurance policies and assess whether you have adequate liability coverage. If you have any questions or need personalized advice, consider speaking with an insurance agent or broker. Additionally, feel free to leave a comment below or share this article with others who may find it helpful. For more information on insurance topics, explore our other articles and resources.

Top Features Of IPhone 11: Why It Continues To Be A Popular Choice

Vixen Media Group Founded: A Comprehensive Guide To The Adult Entertainment Powerhouse

Did David Arquette Appear On Friends? Unveiling The Truth Behind The Rumors

How Does State Farm Rideshare Insurance Work?

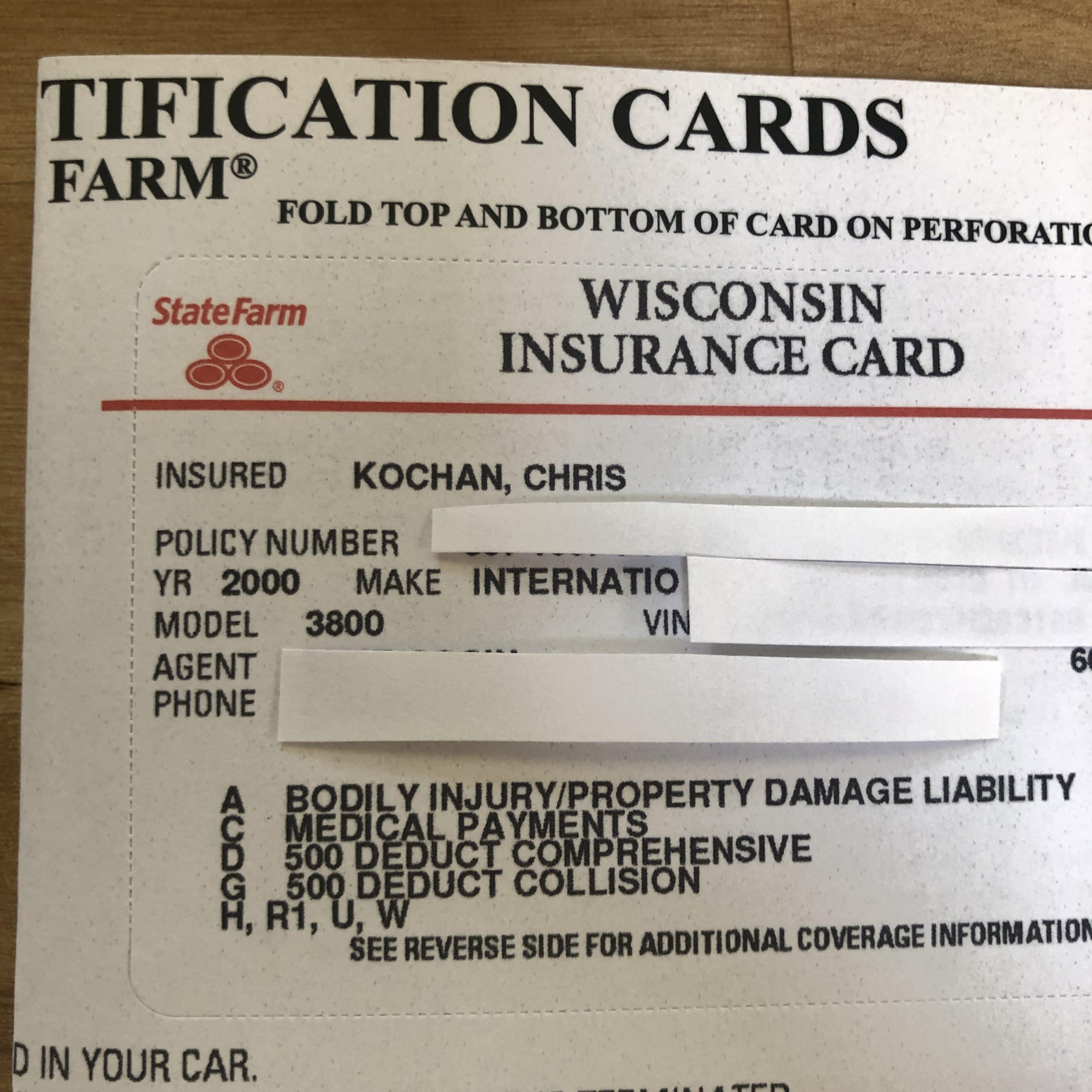

State Farm Full Coverage Insurance State Farm Insurance Card Fill