Understanding Routing Number NJ: A Comprehensive Guide To New Jersey's Banking System

Routing numbers are essential for processing financial transactions, and understanding them is crucial, especially if you're banking in New Jersey (NJ). These unique nine-digit codes are used by banks to identify specific financial institutions during transactions like wire transfers, direct deposits, and bill payments. If you're a resident of New Jersey or managing finances that involve NJ-based banks, knowing about routing numbers is not just helpful but necessary.

New Jersey, with its vibrant economy and diverse population, is home to numerous banks, each with its own routing number. Whether you're setting up automatic payments, transferring funds, or verifying your account, having the correct routing number is vital. This article aims to provide you with an in-depth understanding of routing numbers in New Jersey, their importance, and how to use them effectively.

By the end of this guide, you'll have all the information you need about NJ routing numbers, including how to locate them, their role in financial transactions, and tips to avoid common mistakes. Let’s dive into the details and explore how routing numbers can streamline your banking experience.

Read also:Understanding Phone Code 221 A Comprehensive Guide

Table of Contents

- What Are Routing Numbers?

- The Importance of Routing Numbers in Banking

- How to Find Your Routing Number in NJ

- Different Types of Routing Numbers

- Common Mistakes to Avoid When Using Routing Numbers

- Major Banks in New Jersey and Their Routing Numbers

- Using NJ Routing Numbers for International Transactions

- Security Tips for Protecting Your Routing Number

- Frequently Asked Questions About Routing Numbers

- Conclusion and Call to Action

What Are Routing Numbers?

A routing number, also known as an ABA (American Bankers Association) routing number, is a nine-digit code used by banks in the United States to identify specific financial institutions during transactions. These numbers were first introduced in 1910 to streamline the check processing system, and today, they play a critical role in various banking activities.

Routing numbers are primarily used for domestic transactions within the U.S., such as direct deposits, wire transfers, and automated bill payments. Each bank or credit union has its own unique routing number, which ensures that funds are directed to the correct institution.

How Routing Numbers Work

When you initiate a financial transaction, your bank uses the routing number to communicate with other banks involved in the process. For example, if you're setting up direct deposit for your paycheck, your employer will require your bank's routing number to ensure the funds are deposited into the correct account.

- Direct Deposits: Used for payroll, tax refunds, and government benefits.

- Wire Transfers: Essential for sending or receiving money domestically or internationally.

- Bill Payments: Required for automatic payments to utilities, loans, and other services.

The Importance of Routing Numbers in Banking

Routing numbers are the backbone of the U.S. banking system, ensuring that financial transactions are processed accurately and efficiently. Without these numbers, banks would face significant challenges in identifying the correct institutions, leading to delays, errors, and potential fraud.

In New Jersey, where the economy thrives on industries like finance, healthcare, and retail, routing numbers are indispensable. They facilitate seamless transactions for businesses, individuals, and government entities, supporting the state's economic growth.

Key Benefits of Routing Numbers

- Accuracy: Ensures funds are directed to the correct bank and account.

- Efficiency: Speeds up the processing of transactions, reducing delays.

- Security: Adds a layer of verification to prevent unauthorized transactions.

How to Find Your Routing Number in NJ

Finding your routing number in New Jersey is a straightforward process. Whether you're using online banking, checks, or contacting your bank directly, there are several ways to locate this essential information.

Read also:Enhypen Members Ages A Comprehensive Guide To The Kpop Sensation

Methods to Locate Your Routing Number

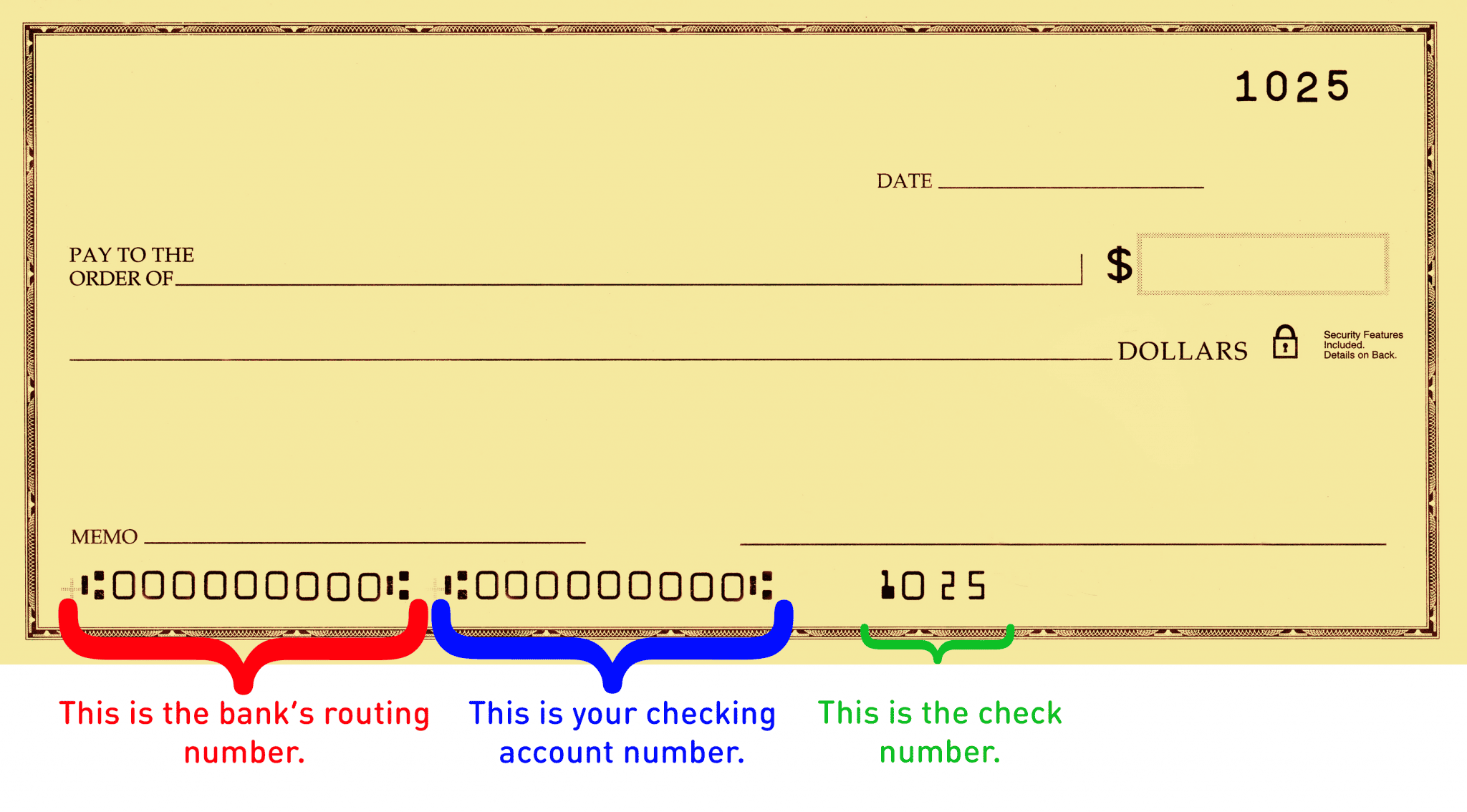

- Checkbook: The routing number is typically printed at the bottom-left corner of your checks, followed by your account number and check number.

- Online Banking: Log in to your online banking account and navigate to the account details section. Most banks display the routing number prominently.

- Bank's Website: Visit your bank's official website and search for the "Routing Number" or "ABA Number" section. Many banks provide a list of routing numbers based on location.

- Customer Service: Call your bank's customer service hotline and ask for the routing number associated with your account.

Different Types of Routing Numbers

Not all routing numbers are the same. Banks often use different routing numbers for various purposes, such as wire transfers, ACH transactions, and paper checks. Understanding these distinctions is crucial for ensuring the correct number is used in each scenario.

Common Types of Routing Numbers

- ACH Routing Numbers: Used for electronic transactions like direct deposits and bill payments.

- Wire Transfer Routing Numbers: Required for domestic and international wire transfers.

- Check Routing Numbers: Printed on checks for processing paper transactions.

Common Mistakes to Avoid When Using Routing Numbers

While routing numbers are relatively simple to use, mistakes can still occur. These errors can lead to transaction failures, delays, or even fraud. Here are some common pitfalls to avoid:

- Using the Wrong Number: Ensure you're using the correct routing number for the specific transaction type.

- Confusing Account Numbers: Double-check that you're entering the routing number and not your account number by mistake.

- Ignoring Location-Specific Numbers: Some banks have different routing numbers for different branches or states.

Major Banks in New Jersey and Their Routing Numbers

New Jersey is home to numerous banks, each with its own unique routing numbers. Below is a list of some major banks operating in the state, along with their routing numbers.

| Bank Name | Routing Number | Location |

|---|---|---|

| Bank of America | 021200339 | Newark, NJ |

| Chase Bank | 021000021 | Jersey City, NJ |

| Wells Fargo | 121000248 | Princeton, NJ |

| TD Bank | 031201360 | Cherry Hill, NJ |

| PNC Bank | 043000096 | Trenton, NJ |

Using NJ Routing Numbers for International Transactions

If you're sending or receiving money internationally, your NJ routing number may still be relevant, depending on the type of transaction. For wire transfers, you'll typically need both the routing number and a SWIFT/BIC code to ensure the funds are routed correctly.

Tips for International Transactions

- Verify the SWIFT Code: Ensure you have the correct SWIFT/BIC code for your bank.

- Check Fees: Be aware of any fees associated with international wire transfers.

- Confirm Recipient Details: Double-check the recipient's account number and bank information.

Security Tips for Protecting Your Routing Number

Your routing number is sensitive information, and safeguarding it is crucial to prevent fraud or unauthorized transactions. Here are some tips to keep your routing number secure:

- Limit Sharing: Only provide your routing number to trusted entities, such as your employer or verified financial institutions.

- Monitor Accounts: Regularly review your bank statements for any suspicious activity.

- Use Secure Connections: Avoid entering your routing number on public Wi-Fi or unsecured websites.

Frequently Asked Questions About Routing Numbers

Here are some common questions and answers about routing numbers in New Jersey:

What happens if I use the wrong routing number?

Using the wrong routing number can result in transaction failures or delays. In some cases, the funds may be sent to the wrong bank, requiring additional steps to retrieve them.

Can I use the same routing number for all transactions?

Not necessarily. Some banks use different routing numbers for specific transaction types, such as wire transfers or ACH payments. Always verify the correct number for your specific needs.

Conclusion and Call to Action

Routing numbers are a fundamental part of the U.S. banking system, and understanding them is essential for managing your finances effectively, especially in New Jersey. Whether you're setting up direct deposits, transferring funds, or verifying your account, having the correct routing number ensures smooth and secure transactions.

We hope this guide has provided you with valuable insights into routing numbers and their importance. If you found this article helpful, please share it with others who might benefit. For more information on banking and financial topics, feel free to explore our other articles or leave a comment below with your questions or feedback.

Open Auditions In Atlanta: Your Gateway To The Entertainment Industry

Famous Hawaiian Singers: Celebrating The Voices Of Paradise

WW84 Cast: A Comprehensive Guide To The Characters And Stars Of Wonder Woman 1984

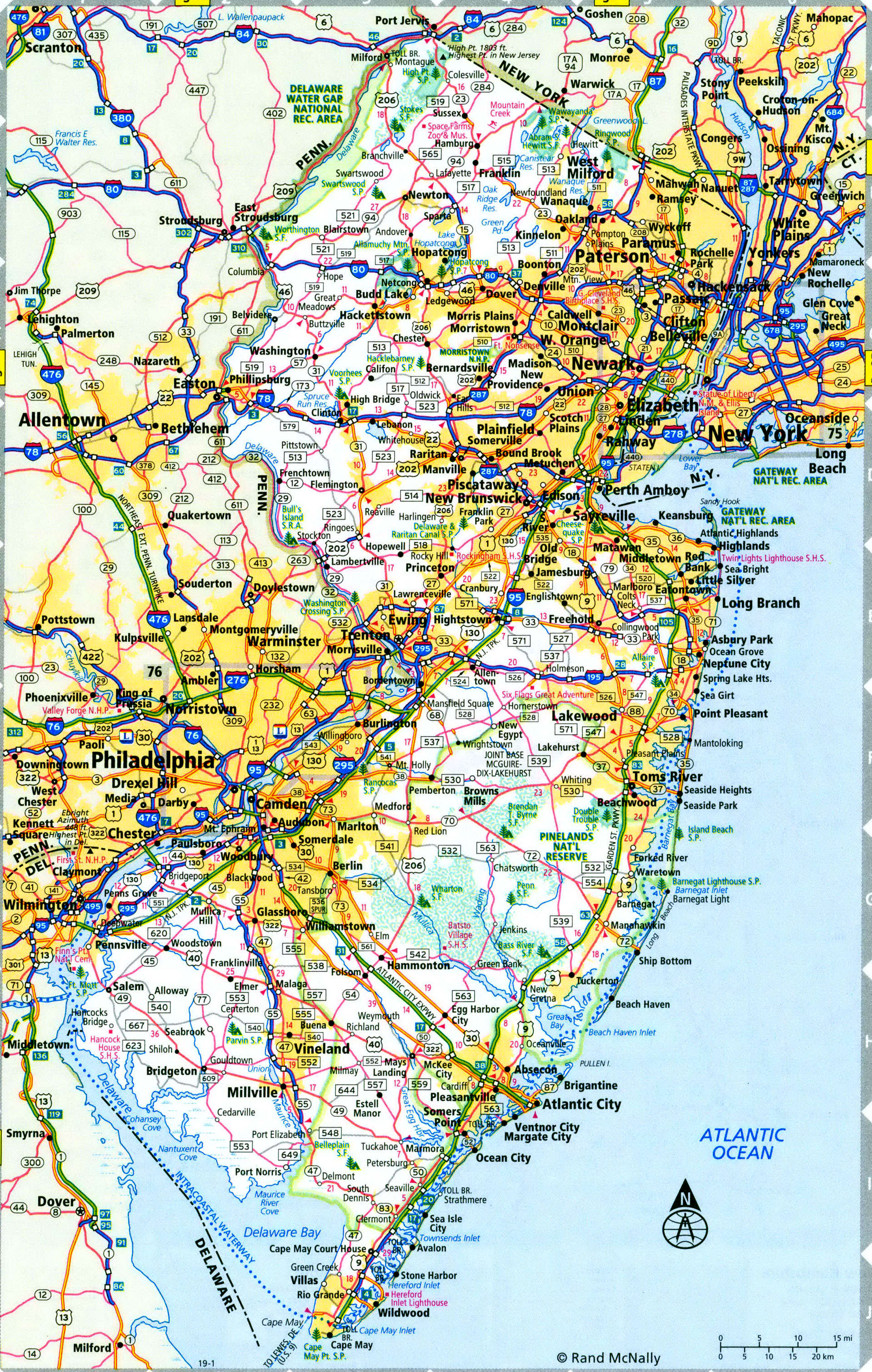

New Jersey interstate highway map I78 I80 I95 I195 road state

Checks Account Number And Routing Number Location Examples and Forms