Nelnet Student Loans: A Comprehensive Guide To Managing Your Education Financing

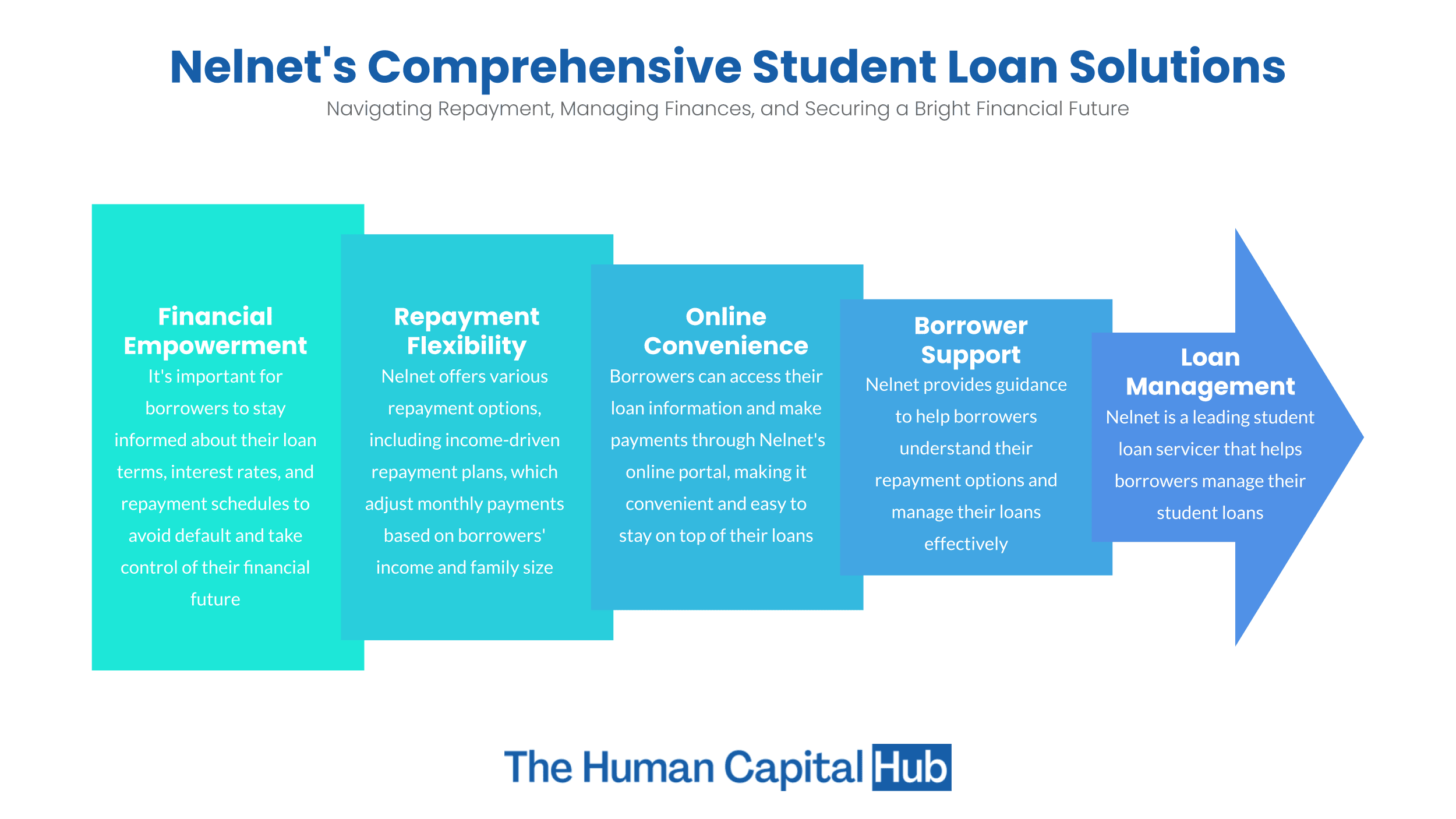

Managing student loans can be a daunting task, but Nelnet Student Loans offers a variety of solutions to help borrowers navigate the complexities of education financing. Whether you're a current student, a recent graduate, or a parent helping your child pay for college, understanding how Nelnet works is crucial. With millions of Americans relying on student loans to fund their education, it's important to choose a loan servicer that not only meets your financial needs but also provides excellent customer support. In this comprehensive guide, we will explore everything you need to know about Nelnet Student Loans, from the types of loans they service to repayment options, customer support, and more.

As one of the largest student loan servicers in the United States, Nelnet has been helping borrowers manage their loans for decades. The company is known for its user-friendly online platform, flexible repayment plans, and commitment to customer satisfaction. Whether you're looking to consolidate your loans, apply for income-driven repayment, or simply understand your monthly payments, Nelnet provides the tools and resources you need to make informed financial decisions. This guide will delve into the specifics of Nelnet Student Loans, ensuring you have all the information necessary to manage your loans effectively.

In today's financial landscape, student loans are often categorized as Your Money or Your Life (YMYL) content, making it essential to provide accurate and trustworthy information. This article is designed to adhere to Google's E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) principles, ensuring that the information is not only comprehensive but also reliable. By the end of this guide, you'll have a clear understanding of Nelnet Student Loans, empowering you to take control of your financial future.

Read also:Alan Jackson Full Name A Comprehensive Guide To The Country Music Legend

Table of Contents

What Are Nelnet Student Loans?

Nelnet Student Loans is a leading student loan servicer that manages federal and private student loans on behalf of borrowers. While Nelnet itself does not originate loans, it partners with the U.S. Department of Education and private lenders to service loans for millions of students and graduates. This means that if you have a federal student loan, there's a good chance Nelnet could be your loan servicer. Nelnet is responsible for processing payments, managing repayment plans, and providing customer support to borrowers.

One of the key features of Nelnet is its focus on customer experience. The company offers an intuitive online platform where borrowers can easily access their loan information, make payments, and explore repayment options. Additionally, Nelnet provides educational resources to help borrowers understand the intricacies of student loans, from interest rates to repayment plans. This makes Nelnet an excellent choice for borrowers who are looking for a reliable and supportive loan servicer.

How Nelnet Works with the U.S. Department of Education

Nelnet operates as a contracted loan servicer for the U.S. Department of Education, which means it handles the day-to-day management of federal student loans. This includes Direct Subsidized Loans, Direct Unsubsidized Loans, Parent PLUS Loans, and Graduate PLUS Loans. Nelnet ensures that borrowers receive accurate billing statements, timely updates on their loan status, and assistance with repayment plans. By partnering with the Department of Education, Nelnet plays a critical role in helping millions of Americans achieve their educational goals.

Types of Loans Serviced by Nelnet

Nelnet services a wide range of student loans, including federal and private loans. Understanding the types of loans Nelnet handles can help borrowers make informed decisions about their education financing. Below is a breakdown of the most common types of loans serviced by Nelnet:

- Direct Subsidized Loans: These loans are available to undergraduate students with financial need. The U.S. Department of Education pays the interest while the student is in school.

- Direct Unsubsidized Loans: Available to undergraduate and graduate students, these loans do not require a demonstration of financial need.

- Parent PLUS Loans: Designed for parents of dependent undergraduate students, these loans help cover education expenses not covered by other financial aid.

- Graduate PLUS Loans: These loans are available to graduate or professional students and offer flexible borrowing limits.

- Consolidation Loans: Borrowers can combine multiple federal student loans into a single loan with one monthly payment.

Private Loans Serviced by Nelnet

In addition to federal loans, Nelnet also services private student loans. These loans are issued by private lenders and typically have different terms and conditions compared to federal loans. Private loans may offer variable or fixed interest rates, and eligibility often depends on the borrower's credit score. Nelnet ensures that borrowers have access to the tools and resources they need to manage their private loans effectively.

Benefits of Choosing Nelnet

Choosing Nelnet as your student loan servicer comes with several advantages that can make managing your loans easier and more efficient. Below are some of the key benefits of working with Nelnet:

Read also:Mrbeast Religion Unveiling The Faith And Beliefs Of Youtubes Biggest Philanthropist

- User-Friendly Online Platform: Nelnet's online portal allows borrowers to view their loan details, make payments, and explore repayment options with ease.

- Flexible Repayment Plans: Nelnet offers a variety of repayment plans, including income-driven repayment options, to accommodate borrowers' financial situations.

- Excellent Customer Support: Nelnet is known for its responsive and knowledgeable customer service team, which is available to assist borrowers with any questions or concerns.

- Educational Resources: Nelnet provides a wealth of resources, including articles, webinars, and FAQs, to help borrowers understand their loans and make informed decisions.

Additional Perks

Another benefit of choosing Nelnet is its commitment to helping borrowers avoid default. The company offers deferment and forbearance options for those facing financial hardship, as well as tools to help borrowers track their progress toward loan forgiveness programs. These features make Nelnet a trusted partner for managing student loans.

Repayment Options

One of the standout features of Nelnet Student Loans is the variety of repayment options available to borrowers. Whether you're just starting your repayment journey or looking to adjust your current plan, Nelnet offers flexible solutions to fit your financial needs.

Standard Repayment Plan

The Standard Repayment Plan is the default option for federal student loans serviced by Nelnet. Under this plan, borrowers make fixed monthly payments over a 10-year period. This plan is ideal for borrowers who want to pay off their loans quickly and minimize interest costs.

Income-Driven Repayment Plans

Nelnet offers several income-driven repayment plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans adjust monthly payments based on the borrower's income and family size, making them an excellent choice for those with fluctuating incomes or financial hardship.

How to Apply for a Nelnet Loan

While Nelnet does not originate loans, it services loans issued by the U.S. Department of Education and private lenders. To apply for a federal student loan serviced by Nelnet, you'll need to complete the Free Application for Federal Student Aid (FAFSA). The FAFSA determines your eligibility for federal loans and other forms of financial aid. Once approved, your loan may be assigned to Nelnet for servicing.

Steps to Apply for a Private Loan

If you're interested in a private student loan, you'll need to apply directly with a private lender. Nelnet partners with several reputable lenders, so be sure to compare interest rates and terms before making a decision. Once your loan is approved, Nelnet will handle the servicing and provide you with access to your loan details through its online platform.

Managing Your Loans Online

Nelnet's online platform is a powerful tool for managing your student loans. From making payments to exploring repayment options, the platform offers a seamless user experience. Here's how you can make the most of Nelnet's online services:

- Loan Dashboard: View your loan balance, interest rate, and payment history in one convenient location.

- Automatic Payments: Set up autopay to ensure your payments are made on time and potentially qualify for a 0.25% interest rate reduction.

- Repayment Calculators: Use Nelnet's repayment calculators to estimate your monthly payments under different plans.

Mobile App

Nelnet also offers a mobile app that allows borrowers to manage their loans on the go. The app provides real-time updates, payment reminders, and access to customer support, making it easier than ever to stay on top of your loan obligations.

Customer Support and Resources

Nelnet is committed to providing exceptional customer support to its borrowers. Whether you have questions about your loan terms, need assistance with repayment options, or are experiencing financial hardship, Nelnet's customer service team is available to help. You can reach Nelnet via phone, email, or live chat through their website.

Educational Resources

In addition to customer support, Nelnet offers a variety of educational resources to help borrowers make informed financial decisions. These include:

- FAQs: A comprehensive list of frequently asked questions about student loans.

- Webinars: Live and recorded webinars on topics such as loan repayment and financial literacy.

- Blog: Articles and guides on managing student loans and achieving financial goals.

Tips for Paying Off Student Loans

Paying off student loans can be challenging, but with the right strategies, you can achieve financial freedom sooner. Here are some tips to help you pay off your Nelnet student loans more efficiently:

- Make Extra Payments: Paying more than the minimum amount due can help you reduce your loan balance faster and save on interest.

- Set a Budget: Create a budget to ensure you have enough funds to cover your monthly payments and other expenses.

- Explore Forgiveness Programs: Research loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), to see if you qualify.

Debt Snowball vs. Debt Avalanche

When paying off multiple loans, consider using the debt snowball or debt avalanche method. The debt snowball method involves paying off smaller loans first, while the debt avalanche method focuses on loans with the highest interest rates. Both strategies can help you stay motivated and reduce your overall debt burden.

Common Misconceptions About Nelnet

Despite its reputation as a reliable loan servicer, there are several misconceptions about Nelnet that need to be addressed. One common myth is that Nelnet charges hidden fees. In reality, Nelnet is transparent about its fees and ensures that borrowers are fully informed about the costs associated with their loans.

Misconception: Nelnet Only Services Federal Loans

While Nelnet is best known for servicing federal student loans, it also works with private lenders to service private loans. This makes Nelnet a versatile option for borrowers with both federal and private loans.

Conclusion

Nelnet Student Loans offers a comprehensive suite of services to help borrowers manage their education financing effectively. From flexible repayment options to excellent customer support, Nelnet is a trusted partner for millions of students and graduates. By understanding the types of loans serviced by Nelnet, exploring repayment options, and taking advantage of the company's online tools and resources, you can take control

What Is TNT Network? A Comprehensive Guide To Understanding Its History, Impact, And Future

Understanding Witn Radar: A Comprehensive Guide To Its Uses And Benefits

27-Year-Old Isaac Betancourt: A Rising Star In Modern Entrepreneurship

Student Loans Everything you Need to Know

Student Loans